I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

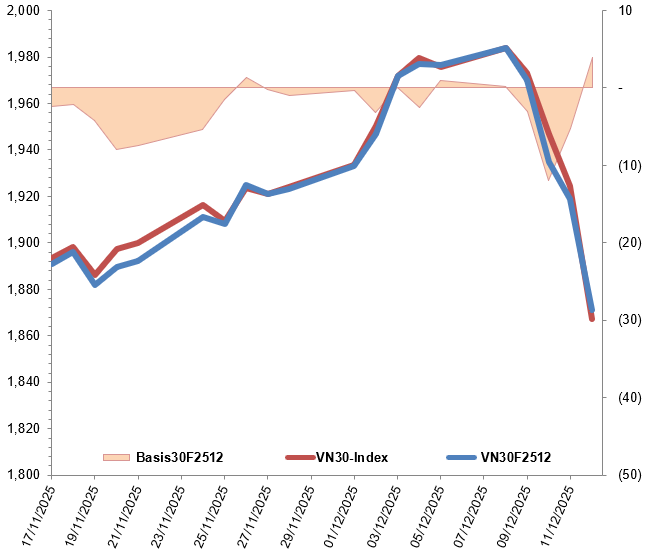

On December 12, 2025, all VN30 futures contracts experienced a decline. Specifically, VN30F2512 (F2512) dropped by 2.51% to 1,871 points; 41I1G1000 (I1G1000) fell by 2.4% to 1,870 points; 41I1G3000 (I1G3000) decreased by 2.3% to 1,871.9 points; and 41I1G6000 (I1G6000) declined by 2.15% to 1,870 points. The underlying index, VN30-Index, closed at 1,867.03 points.

Additionally, all VN100 futures contracts also saw a downturn on the same day. Notably, 41I2FC000 (I2FC000) decreased by 2.83% to 1,776 points; 41I2G1000 (I2G1000) dropped by 1.77% to 1,779.9 points; 41I2G3000 (I2G3000) fell by 2.5% to 1,779.9 points; and 41I2G6000 (I2G6000) declined by 2.26% to 1,762.5 points. The underlying index, VN100-Index, closed at 1,767.08 points.

During the trading week from December 8 to 12, 2025, VN30F2512 generally followed a downward trend. The week began with a bullish session as the Long side initially dominated. However, in subsequent sessions, the upward momentum of F2512 was short-lived as sellers regained control, causing the contract to reverse and plummet throughout the week. Consequently, VN30F2512 closed the week in the red, with a significant loss of 105.5 points.

Intraday Chart of VN30F2512 from December 8 to 12, 2025

Source: https://stockchart.vietstock.vn/

At the close, the basis of the F2512 contract reversed from the previous session, reaching 3.97 points. This indicates a resurgence of optimism among investors.

Fluctuations of VN30F2512 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated using the formula: Basis = Futures Contract Price – VN30-Index

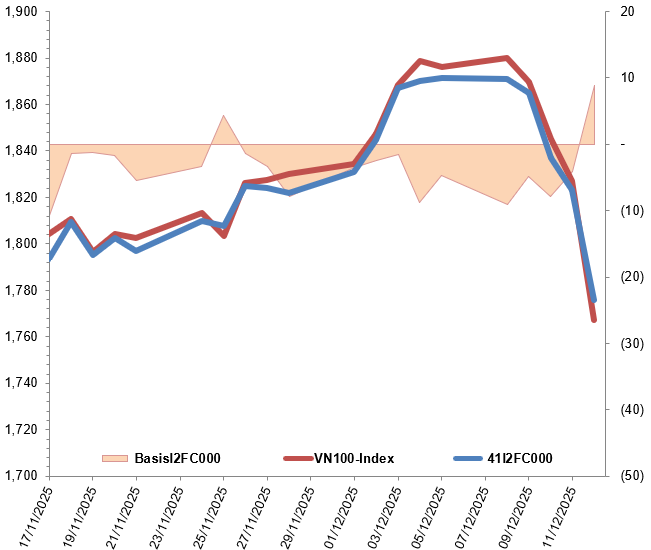

Meanwhile, the basis of the I2FC000 contract also reversed from the previous session, reaching 8.92 points. This reflects renewed investor optimism.

Fluctuations of 41I2FC000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated using the formula: Basis = Futures Contract Price – VN100-Index

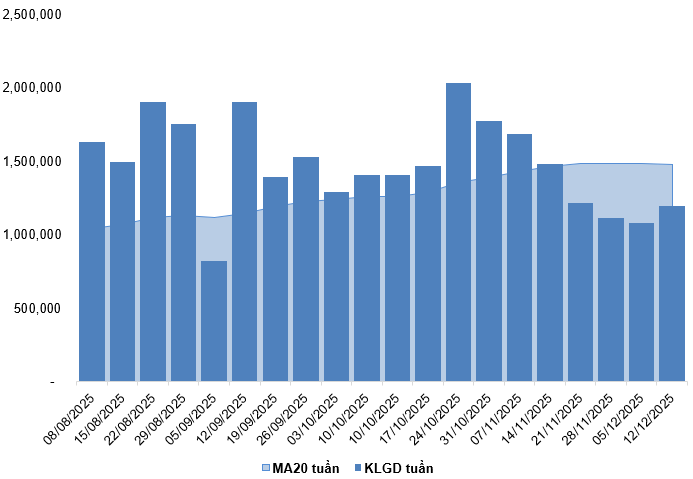

The trading volume and value of the derivatives market decreased by 7.42% and 9.13%, respectively, compared to the session on December 11, 2025. For the entire week, trading volume and value increased by 32.66% and 32.17%, respectively, compared to the previous week.

Foreign investors continued to sell off, with a total net selling volume of 1,512 contracts on December 12, 2025. For the entire week, foreign investors net sold a total of 3,894 contracts.

Weekly Trading Volume Fluctuations of the Derivatives Market. Unit: Contracts

Source: VietstockFinance

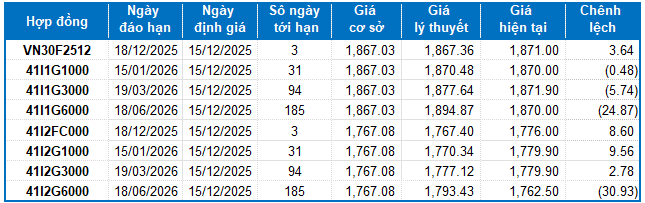

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of December 15, 2025, the fair price range for futures contracts currently trading in the market is as follows:

Summary Table of Valuation for Derivatives Contracts of VN30-Index and VN100-Index

Source: VietstockFinance

Note: The opportunity cost in the valuation model has been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each type of futures contract.

I.3. Technical Analysis of VN30-Index

On December 12, 2025, the VN30-Index continued its fourth consecutive session of decline, accompanied by a Black Marubozu candlestick pattern and increased trading volume above the 20-session average, indicating investor pessimism.

Currently, the index has fallen below the Middle line of the Bollinger Bands, while the MACD indicator has reissued a sell signal. This suggests a continued negative short-term outlook.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

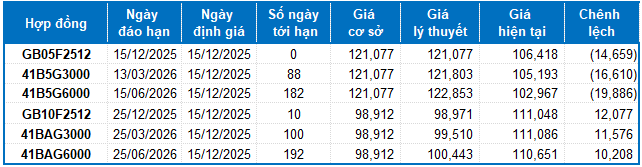

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of December 15, 2025, the fair price range for futures contracts currently trading in the market is as follows:

Summary Table of Valuation for Government Bond Futures Contracts

Source: VietstockFinance

Note: The opportunity cost in the valuation model has been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each type of futures contract.

According to the above valuation, the contracts GB05F2512, 41B5G3000, and 41B5G6000 are currently attractively priced. Investors may focus on and consider buying these futures contracts in the near future, as they present a favorable opportunity in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 18:58 13/12/2025

Technical Analysis Afternoon Session 10/12: Short-Term Risks Continue to Rise

The VN-Index persists in its corrective phase after retesting the October 2025 peak (aligning with the 1,760-1,795 point range). Meanwhile, the HNX-Index continues its decline, marking its fourth consecutive session of adjustment.