The MVIS Vietnam Local Index, the benchmark for the VanEck Vectors Vietnam ETF (VNM ETF), has announced its quarterly rebalancing for Q4 2025. In this update, the index has added only one new stock, TCX from TCBS, while retaining all existing constituents. This brings the total number of stocks in the index to 52.

As of December 11, the VNM ETF’s portfolio size exceeds $574 million (~15 trillion VND). The fund is expected to purchase approximately $10.8 million worth of TCX (6.4 million shares). Additionally, it will increase holdings in several key stocks, including SSI (7.3 million shares), HPG (3.9 million shares), VCB (3.1 million shares), SHB (3.2 million shares), and VIX (2.1 million shares), among others.

Conversely, the VNM ETF will reduce its exposure to certain stocks. VIC is anticipated to see the largest reduction, with sales totaling over $53 million (approximately 9.6 million shares). HVN is also expected to be trimmed by around 3.4 million shares. Other stocks will experience minor reductions in weighting.

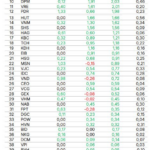

Detailed estimates of the VNM ETF’s Q4 2025 rebalancing:

These changes to the MarketVector Vietnam Local Index will take effect after the market closes on Friday, September 19, and will be implemented starting Monday, September 22.

Earlier, FTSE Russell announced that no new Vietnamese stocks would be added to the FTSE Vietnam Index, while FTS and HSG were removed. Meanwhile, GEE was included in the FTSE Vietnam All-Share Index, and PC1, SAB, and SIP were excluded.

However, these adjustments hold limited significance, as no funds currently track the FTSE Vietnam Index. This follows the rebranding of the Xtrackers FTSE Vietnam Swap UCITS ETF to the Xtrackers Vietnam Swap UCITS ETF in September, which also transitioned its benchmark to the STOXX Vietnam Total Market Liquid Index.

As of early December, the Xtrackers Vietnam Swap UCITS ETF manages over £270 million, equivalent to nearly 9.5 trillion VND. The STOXX Vietnam Total Market Liquid Index is designed to track the performance of highly liquid stocks on the Vietnamese stock market, with reviews conducted biannually in March and September.

Unveiling September’s Top Stock Picks: Three Market Titans Eyeing $1.6 Billion in Investments

In addition to the VNM ETF and Xtrackers Vietnam Swap UCITS ETF, the Fubon ETF will also conduct a portfolio review this September.