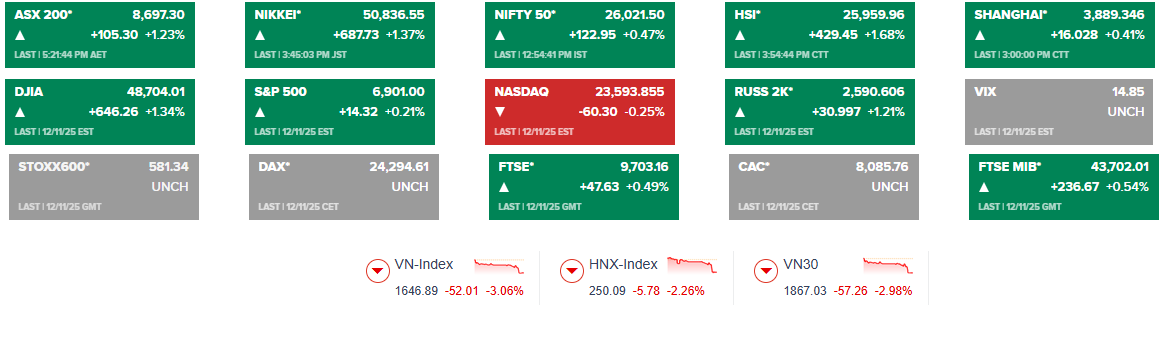

The MSCI All Country World Index, a comprehensive gauge of global equity markets, rose by 0.2% on December 12, extending its record-breaking streak from the previous session. Overnight, the Dow Jones surged nearly 650 points to a new high, while the volatility index VIX plummeted to its lowest level in three months.

Global Stock Market Performance

Source: CNBC and VietstockFinance

|

In Asia, the MSCI Asia stock index climbed 1.3%, poised for its highest close in a month. Japan’s Topix led the regional rally, soaring nearly 2% to a historic high, with banks in focus amid expectations that the Bank of Japan (BOJ) will likely raise rates next week. The Nikkei 225 also jumped nearly 700 points (1.37%) to 50,836.

Hong Kong’s Hang Seng gained 1.68%, while China’s Shanghai Composite edged up 0.41%.

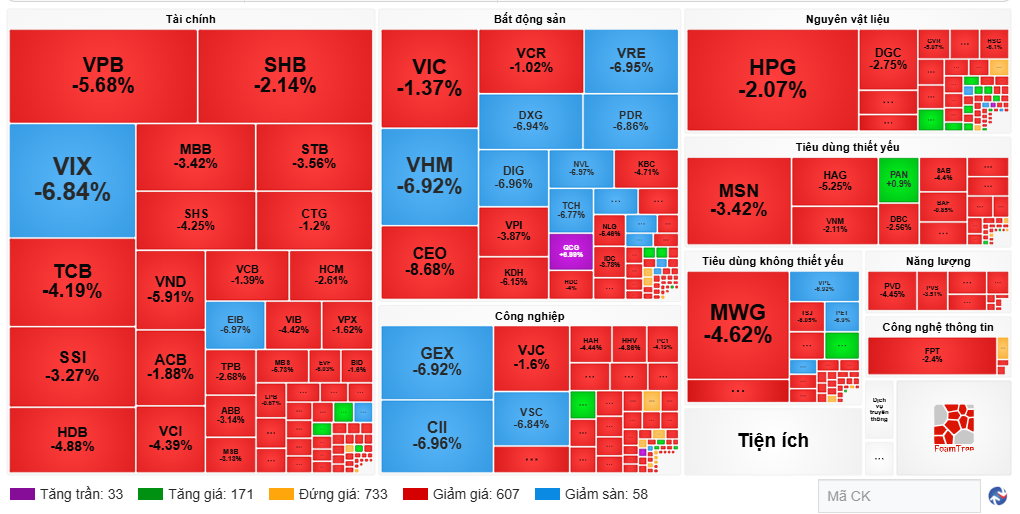

In contrast, Vietnam’s market bucked the trend, with the VN-Index dropping 52 points (3.06%) to 1,647 and the VN30 falling over 57 points (2.98%) to 1,867. Broad-based declines dominated the session, accompanied by a surge in trading volume. According to VietstockFinance, total liquidity across all three exchanges reached nearly VND 28 trillion.

Shifting Market Dynamics

Tech stocks ceded ground to other sectors in both Asia and the U.S., signaling a broadening of the rally that has propelled global equities up nearly 21% in 2025, setting the stage for the best year since 2019.

“This momentum should carry through year-end,” said Gina Bolvin, President of Bolvin Wealth Management Group. “With ongoing rate cuts, a new Fed Chair taking office, and improving corporate earnings, the bull market could extend into 2026.”

“As more companies adopt AI, market participation will widen, and sectors beyond the Magnificent Seven may start to shine,” Bolvin added.

– 15:20 12/12/2025

When Does VIX Opt to Increase Capital?

On December 2nd, the Board of Directors of VIX Securities JSC (HOSE: VIX) passed a resolution to implement a plan to issue nearly 919 million shares, raising over VND 11,026 billion. During the recent extraordinary general meeting, the company’s leadership shared the expected date for finalizing the list of shareholders eligible for the rights issue.

Tracking the Shark Money Flow on November 21: Foreign Investors Net Sell VIX Over 700 Billion VND

Foreign investors resumed net selling in the November 21st session, focusing on VIX, contrasting with the buying pressure from securities companies’ proprietary trading desks.