According to Dinh Minh Tuan, Director of the Southern Region at Batdongsan.com.vn, infrastructure projects such as the metro, the Ben Luc – Long Thanh expressway, and the bridge system connecting to Dong Nai are significantly boosting satellite cities like Thuan An, Di An, and Vung Tau. As a result, interest in real estate has rebounded, particularly in the eastern part of Ho Chi Minh City and areas bordering Binh Duong.

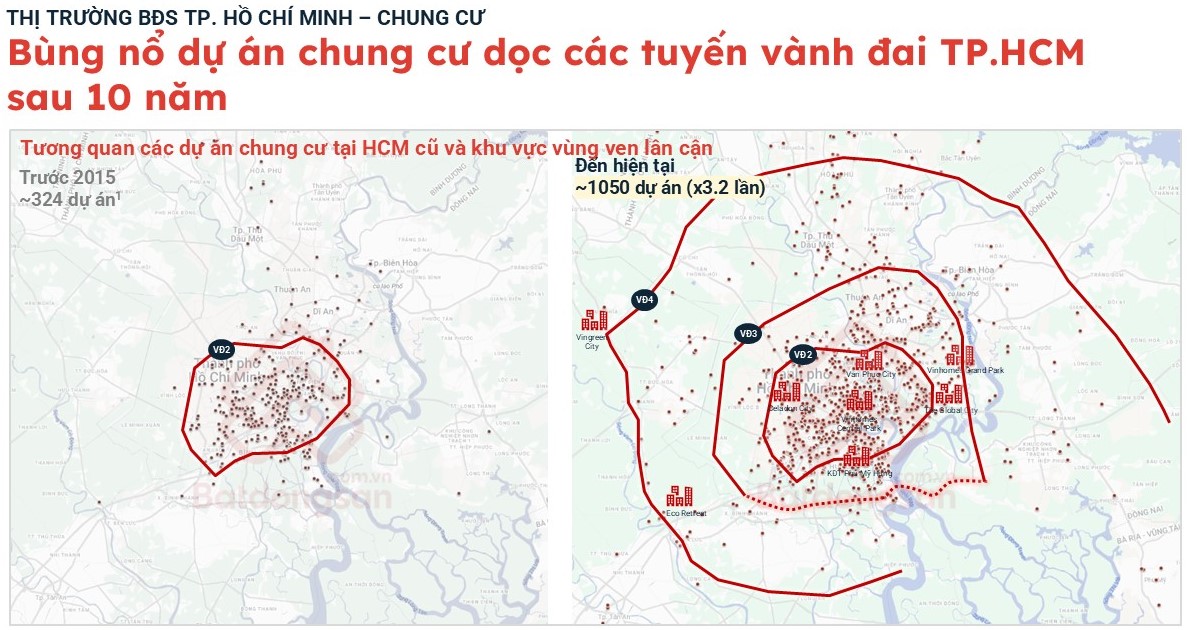

The apartment segment continues to lead the market with a substantial increase in supply. Before 2015, apartment projects were primarily concentrated within the inner ring road of the city center, totaling 324 projects. With the development of the third and fourth ring roads, urban expansion has accelerated, allowing developers to move to suburban areas. This has led to a surge in projects, reaching approximately 1,050 today—a 3.2-fold increase in just a decade, primarily shifting to the northeastern part of Ho Chi Minh City.

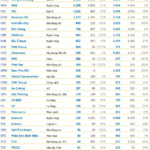

In Q4 2025, apartment listing prices saw a notable increase. Former Nha Be (up 64%), former District 7 (up 63%), Binh Thanh (up 57%), and Thu Duc City (Districts 2, 9, and former Thu Duc) recorded increases of 32-48% compared to Q1 2023. This upward trend has also extended to the expanded central districts of Ho Chi Minh City.

Alongside price increases, apartment search demand in Binh Duong, bordering Ho Chi Minh City, surged in 2025. Over the first 11 months of 2025, interest in Thuan An rose by 129%, Di An by 103%, and Thu Dau Mot by 65% year-on-year, highlighting the appeal of satellite cities adjacent to Ho Chi Minh City.

“The city center is no longer the sole focal point. The ring roads are creating new development hubs in Thu Duc, Di An, Thuan An, Thu Dau Mot, and Nha Be, marking the most significant urban expansion phase to date,” Mr. Tuan commented.

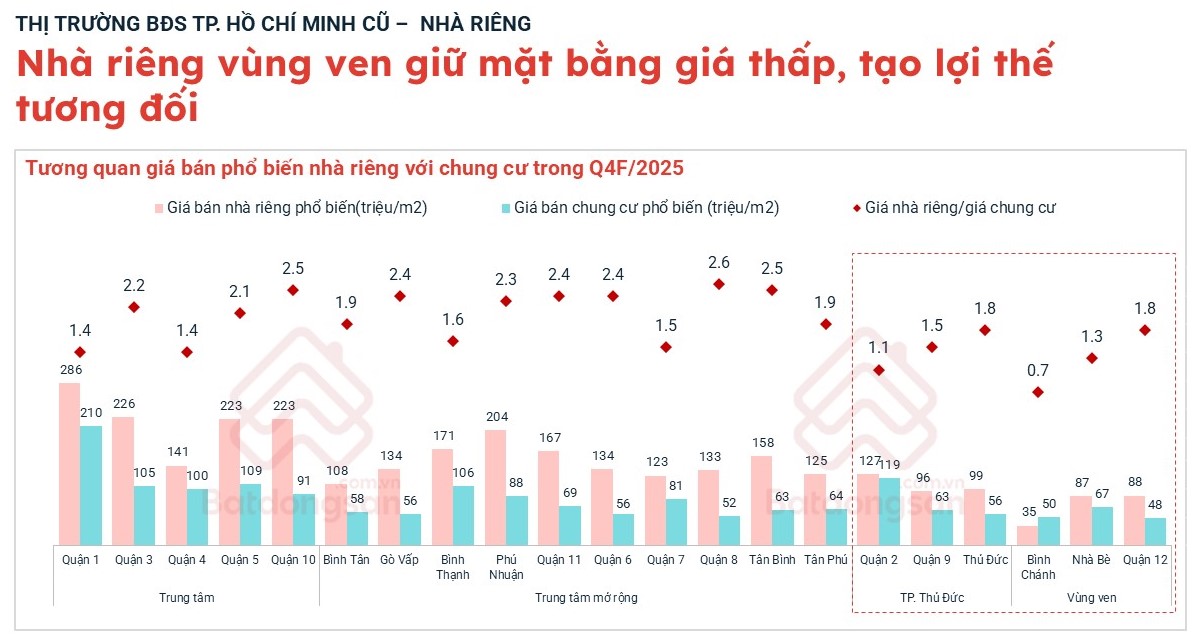

In the private house segment, transactions remain stable despite modest interest growth. According to Batdongsan.com.vn, in the central areas of Ho Chi Minh City, private house listing prices in Q4 2025 averaged between VND 210-286 million per square meter, 1.4-2.2 times higher than apartment prices. In districts like Binh Thanh, Phu Nhuan, District 11, and District 7, prices dropped to VND 125-204 million per square meter, indicating easing price pressure.

Notably, in suburban districts and Thu Duc City, private houses are only 1.1-1.8 times more expensive than apartments. In areas like Binh Chanh, Nha Be, and District 12, the price gap has significantly narrowed, offering better potential for price increases in this segment.

Meanwhile, storefront properties in Ho Chi Minh City have seen a slight recovery, though interest has dipped by 5% compared to the previous quarter. The rental market remains sluggish due to a supply-demand mismatch, with demand concentrated in the inner suburbs while supply is primarily in the city center. Storefront properties in former District 2 have gained attention due to competitive pricing and better rental yields compared to traditional central districts.

Mr. Dinh Minh Tuan advises investors to rely on data to identify regions with genuine growth potential, where infrastructure, quality supply, and real demand converge, rather than chasing speculative trends in a still-fragmented market.

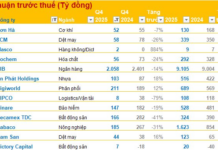

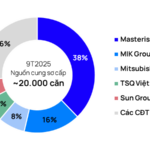

Ho Chi Minh City: Premium Property Supply Concentrates in the Hands of Industry Giants Masterise Homes, Gamuda Land, and Dat Xanh Group

The Ho Chi Minh City market has witnessed a stark polarization in the high-end and luxury segments, with over 80% of new supply being spearheaded by Đất Xanh Group, Gamuda Land, and Masterise Homes.

Da Nang Land Prices Skyrocket: Representative Calls for Temporary Halt on Increases

During the Da Nang City People’s Council session, numerous delegates urged against raising land prices, arguing that the current rates are already excessively high.