CII Service (a subsidiary of CII Invest) has announced plans to acquire an additional 9.9 million shares of NBB, issued by Nam Bay Bay Investment Corporation, between December 18, 2025, and January 16, 2026. This strategic move, aimed at investment purposes, will be executed through a negotiated agreement on the HoSE platform.

Upon successful completion, CII Service’s holdings in NBB will increase to 12.8 million shares, representing 12.78% of Nam Bay Bay’s charter capital. Conversely, CII Invest’s stake will decrease to 45.13 million shares, or 45.06%.

CII Service operates as a subsidiary of CII Invest, which itself is an indirect subsidiary of Ho Chi Minh City Infrastructure Investment Joint Stock Company (CII, listed on HoSE).

Previously, CII Service acquired 2.9 million NBB shares between December 2 and 4, 2025, increasing its ownership from 0% to 2.9% of Nam Bay Bay’s charter capital.

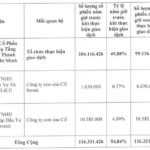

Collectively, the CII group’s holdings in Nam Bay Bay will rise to 79.93 million shares, equivalent to 79.81% of the company’s charter capital. This includes CII’s direct ownership of 21.98 million shares (21.95%) and CII Invest’s direct holdings of 55.03 million shares (54.95%). Additionally, Ms. Nguyen Quynh Huong, Deputy CEO of CII and a board member of Nam Bay Bay, holds 19,200 NBB shares (0.02%).

Notably, prior to transferring shares to CII Service, CII Invest received NBB shares from its parent company, CII. Most recently, from November 19 to 21, 2025, CII Invest successfully acquired 4.49 million NBB shares from CII.

Following this transaction, CII’s holdings decreased from approximately 26.5 million shares (26.43%) to nearly 22 million shares (21.95%), while CII Invest’s stake increased from over 50.5 million shares (50.47%) to more than 55 million shares (54.95%).

In terms of financial performance, Nam Bay Bay reported a net revenue of VND 29.8 billion for the first nine months of 2025, a 44.7% decline compared to the same period in 2024. However, its post-tax profit surged by 90.5% to VND 802.1 billion.

As of September 30, 2025, Nam Bay Bay’s total assets slightly decreased by VND 87.4 billion to VND 7,666.2 billion, while its total liabilities dropped by VND 88.2 billion to VND 5,847.4 billion.

For CII, the first nine months of 2025 saw a 6% decline in net revenue to VND 2,141 billion. Its core business, transportation fees, remained stable at approximately 88% of total revenue. Revenue from real estate, construction, and infrastructure maintenance decreased by 67% and 21%, respectively.

Financial revenue also dropped by 38% to VND 583 billion, primarily due to a VND 430 billion gain from the revaluation of its investment in Nam Bay Bay recorded in the same period last year.

Additionally, CII incurred VND 84 billion in other losses, including penalties for contract violations and VND 13 billion in expenses related to suspended projects.

Despite cost-cutting measures, CII’s post-tax profit plummeted by 55% to VND 241 billion. Profit attributable to the parent company’s shareholders fell by 78% to nearly VND 58 billion compared to the first nine months of 2024.

CII Prepares to Transfer 5 Million LGC Shares to Subsidiary Company

Ho Chi Minh City Infrastructure Investment Joint Stock Company (HOSE: CII) has announced the transfer of 5 million shares in Bridge and Road Investment Joint Stock Company (HOSE: LGC) to its subsidiary, CII Service and Investment One Member Limited Liability Company (CII Service).

Newcomer in Construction Sector Receives HOSE Approval to List Over 40 Million Shares

After more than seven months of filing, the shares of Truong Son Investment and Construction Joint Stock Company (UPCoM: TSA) have officially been approved for listing on HOSE, marking the addition of another construction industry code to the group of enterprises preparing to join the largest stock exchange in the market.

“Stock Market Titan Faces Mandatory Delisting Order”

Previously, this renowned brand had its public company status revoked by the State Securities Commission of Vietnam (SSC) due to an overly concentrated shareholder structure.