Three years ago, when Ms. Thao (43) completed her two-bedroom apartment in Cau Giay district, she was confident in her rental investment strategy. Initially, she leased the property to a foreign family for 25 million VND per month, a stable and attractive figure compared to her initial investment. This rental income comfortably covered her monthly bank interest payments, leaving her with a surplus as profit.

She believed that within a few years, the apartment would not only appreciate in value but also generate a steady cash flow, aligning perfectly with her “buy-to-rent” strategy.

However, the situation shifted after a year when the tenant family ended their lease and returned to their home country. Despite being in an area popular with expatriates, Ms. Thao’s apartment remained vacant for nearly six months. During this period, she had to cover all loan and service fees without any rental income to offset these costs. What was once considered a “hands-off” investment began to reveal its inherent risks.

When she finally secured a new tenant, the rental price had dropped significantly to 17-18 million VND per month. Although this was a slight increase compared to three years prior, it failed to keep pace with the rising property values. The apartment’s value had soared, service fees had increased, and the interior had depreciated, yet the rental price couldn’t be raised due to a saturated market and ample tenant options.

Upon recalculating, Ms. Thao realized that the actual return on her rental investment had sharply declined. Renting now merely sustains a basic cash flow, far from the lucrative venture she had initially envisioned.

Rental profits plummet, leaving many landlords disheartened. Photo: Hoàng Hà |

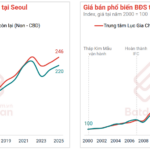

A survey of inner-city condominiums reveals that rental properties are entering a phase of diminished returns. Two-bedroom apartments in Cau Giay and Thanh Xuan districts typically rent for 15-25 million VND per month, but these increases lag behind the surge in property prices.

Meanwhile, many urban projects are priced between 95-150 million VND per square meter, with rental rates remaining stagnant. This results in rental yields of approximately 3-4% per year, or even lower when accounting for loan interest, furniture depreciation, service fees, and vacancy periods.

For instance, at the D’Capitale Tran Duy Hung project, two-bedroom units rent for around 19 million VND per month, while three-bedroom units fetch approximately 24 million VND per month. Fully furnished studio apartments range from 13.5 to 15 million VND per month, and one to one-and-a-half-bedroom units are priced between 16-18 million VND per month.

Sale prices at this project range from 95 to 140 million VND per square meter, depending on the building and interior condition. A 68-square-meter two-bedroom apartment typically lists for 8.5-9 billion VND, while three-bedroom units can reach 10-12 billion VND.

Renting a two-bedroom unit at 18 million VND per month generates an annual revenue of approximately 216 million VND, while the purchase price is 8.8 billion VND. This equates to a pre-expense yield of about 2.4% per year. Even larger units yield only 2.5-3.5% per year, significantly lower than the cost of capital and other secure investment channels.

Some newly handed-over condominiums offer competitive rental rates and incentives. For example, at a new project on Lang Street, 33-38 square meter studio apartments rent for 11-12 million VND per month with basic furnishings and from 13 million VND per month when fully furnished. Two-bedroom units of 48 square meters rent for around 14 million VND per month with basic interiors and 16-17 million VND per month when fully furnished. Three-bedroom units of 93 square meters range from 20-25 million VND per month, depending on the furnishings.

Beyond rental pressures, landlords face numerous additional costs, from repairs and upgrades to replacing interiors to meet the market’s growing demands.

According to financial consultant Nguyen Manh Cuong, landlords should now set competitive and flexible rental prices based on actual rates in their buildings and surrounding areas to minimize vacancy periods.

Selective interior upgrades, focusing on appliances, lighting, and bathrooms, can enhance a property’s appeal without excessive spending. Collaborating with professional real estate agents can also help landlords target the right tenant groups and rent more effectively.

Duy Anh

– 05:45 13/12/2025

Will Rising Interest Rates Plunge the Real Estate Market Back into the 2022 Crisis?

Experts predict that while 2022 saw market turbulence due to rising interest rates, 2025 presents a more optimistic outlook. Despite a slight uptick in rates by year-end, capital continues to flow into tangible asset segments.

Real Estate 2026 Amid Rising Interest Rates: How Does It Differ from the 2022 Freeze?

As the year-end interest rates creep upward, the real estate market in 2026 faces a pivotal moment. Will history repeat itself, echoing the tense scenarios of four years prior, where investors were forced into distress sales and cut their losses? The question looms large, leaving stakeholders to ponder the potential trajectory of the market in the coming months.

Lê Hoàng Châu Elected as HoREA Chairman for the 2025-2030 Term

On the afternoon of December 9, 2025, the Ho Chi Minh City Real Estate Association (HoREA) convened its 1st Congress for the 2025-2030 term. The primary objective of this assembly was to merge the Binh Duong Province Real Estate Association with HoREA, thereby establishing the newly unified Ho Chi Minh City Real Estate Association.

Why the Luxury Segment Dominates the Real Estate Market?

Experts suggest that some previously planned projects were initially designed to cater to the mid-range housing market. However, prolonged delays, rising interest costs, and increased land-use fees have forced developers to reposition these projects as luxury offerings to offset escalating expenses.

Unprecedented Price Surge for Once-Overlooked Condos in Ho Chi Minh City’s Urban Area

Nestled just a stone’s throw from Ho Chi Minh City’s bustling center, the Cát Lái Urban Area was once overlooked by homebuyers due to its dusty streets and heavy container traffic. However, in a remarkable turnaround, property prices in this neighborhood have skyrocketed to unprecedented levels, nearly doubling over the past three years.