The Hanoi Stock Exchange (HNX) has recently announced the delisting of 1.067 billion shares of MCH, issued by Masan Consumer Corporation (Masan Consumer). The delisting date is set for December 18, 2025, with the final trading day on the UPCoM system being December 17, 2025.

The MCH shares will be delisted from UPCoM following their approval for listing on the Ho Chi Minh City Stock Exchange (HoSE). The effective listing date on HoSE is December 10, 2025. Masan Consumer is expected to commence official trading on HoSE from December 25, 2025. The reference price for the first trading day will be the average reference price of the last 30 trading sessions before the delisting from UPCoM.

Previously, MCH shares began trading on UPCoM on January 5, 2017, with a reference price of 90,000 VND per share.

In other developments, Masan Consumer has adopted a resolution to simultaneously implement a plan to distribute treasury shares to shareholders and issue new shares to increase equity capital from retained earnings (bonus shares).

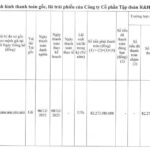

Accordingly, MCH will issue 10.88 million treasury shares to shareholders through a rights offering. The ratio is 10,000:103, meaning shareholders holding 10,000 shares will receive 103 additional shares. These shares are unrestricted and will be sourced from the capital surplus based on the latest audited financial report.

Additionally, MCH shareholders approved the issuance of 226.87 million bonus shares to existing shareholders. The ratio is 10,000:2,147, meaning shareholders holding 10,000 shares will receive 2,147 new shares. These shares are also unrestricted and will be sourced from the capital surplus based on the latest audited financial report.

Both share issuance plans are expected to be implemented in 2026.

In terms of business performance, in Q3 2025, MCH reported net revenue of 7,516 billion VND, a slight decrease of 6% year-over-year. Net profit after tax also declined by 19% to 1,698 billion VND.

For the first nine months of the year, Masan Consumer recorded net revenue of 21,281 billion VND, down 3% year-over-year. Consequently, net profit after tax decreased to 4,660 billion VND, a 16% drop compared to the same period last year.

For 2025, Masan Consumer has set a revenue target of 33,500 – 35,500 billion VND (up 10-15%) and a net profit after tax target of 7,300 – 7,800 billion VND.

SHS Plans to Issue VND 5 Trillion in Public Bonds by 2026

SHS plans to publicly offer up to VND 5,000 billion in bonds, divided into two tranches. The issuance is scheduled to take place between Q1 and Q4 of 2026.

Khải Hoàn Land Launches Second Bond Issuance of the Year

Khải Hoàn Land has recently launched a new bond issuance, KHG12502, valued at 80 billion VND with a 60-month term and an attractive annual interest rate of 13.5%. This marks the company’s second bond offering this year, further solidifying its financial strategy and market presence.