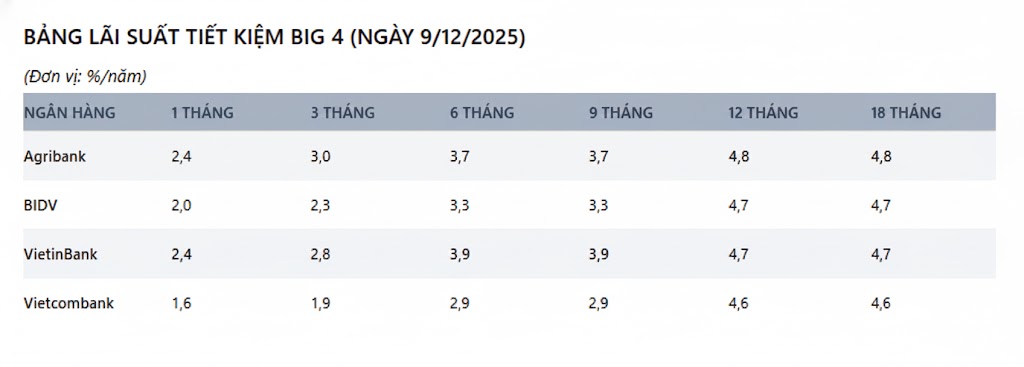

As of now, the online deposit interest rates of the Big 4 banking group, including Agribank, BIDV, VietinBank, and Vietcombank, remain lower compared to private banks.

For the 1-month term, the Big 4’s interest rates range from 1.6% to 2.4% per annum. Agribank and VietinBank offer the highest rate at 2.4% per annum. BIDV provides a 2% per annum rate, while Vietcombank maintains the lowest at 1.6% per annum.

Moving to the 3-month term, rates slightly increase, ranging from 1.9% to 3% per annum. Agribank leads with 3% per annum, followed by VietinBank at 2.8%, BIDV at 2.3%, and Vietcombank at the lowest with 1.9% per annum.

For the 6-month term, a popular choice among depositors, VietinBank leads the Big 4 with a 3.9% per annum rate. Agribank offers 3.7%, BIDV 3.3%, and Vietcombank remains the lowest at 2.9% per annum.

In the 9-month term, rates remain almost unchanged from the 6-month term. VietinBank continues to lead with 3.9% per annum, followed by Agribank at 3.7%, BIDV at 3.3%, and Vietcombank at 2.9% per annum.

For longer terms, Agribank leads with a 4.8% per annum rate for both 12 and 18-month terms. BIDV and VietinBank offer 4.7% per annum, while Vietcombank is slightly lower at 4.6% per annum.

Latest savings interest rates at the Big 4 banks.

To attract deposits, many Big 4 banks have launched promotional programs.

For instance, Vietcombank has introduced a program where, until December 31, 2025, customers depositing a minimum of 30 million VND for 6, 9, 12, or 13-month terms will receive a lottery code. The grand prize is 1 billion VND, with other prizes ranging from 20 to 100 million VND.

Additionally, customers earn VCB Loyalty points based on their deposit amount, redeemable via VCB Digibank for gifts, e-vouchers, and more.

Agribank offers a promotion from November 10, 2025, to March 31, 2026, where individual customers depositing a minimum of 8 million VND (6-month term), 10 million VND (9-month term), or 15 million VND (12-month term) receive a lottery code. Prizes range from 1 to 100 million VND, with a grand prize of 1 billion VND.

VietinBank’s promotion runs from December 3, 2025, to March 31, 2026, offering attractive incentives. New customers opening a savings account and using a payment account receive a cash gift of up to 10 million VND. New deposits of 200 million VND or more for 6-month terms or longer receive a premium account number worth 5 million VND.

For customers with deposits of 9 months or longer, VietinBank offers 10 million VND for an additional 20 billion VND, 5 million VND for 10 billion VND, 3 million VND for 5 billion VND, 1.5 million VND for 3 billion VND, and 1 million VND for 1 billion VND.

Furthermore, deposits made through the VietinBank iPay app earn 20 Loyalty points per 1 million VND, instead of the usual 10 points.

Recently, many banks have increased savings interest rates. In November alone, 21 banks raised rates, with some adjusting rates 2-3 times, while no bank decreased rates.

In early December, six more banks increased deposit rates: Techcombank, MB, NCB, BVBank, VPBank, and Saigonbank. Techcombank adjusted its rates twice in a short period.

Maintaining Interest Rate Stability: Strategies and Challenges

Deputy Governor of the State Bank of Vietnam, Pham Thanh Ha, has affirmed that the lending interest rate landscape remains stable to date.

How Will the Stock Market React as Interest Rates Begin to Rise?

Interest rates on deposits across numerous banks have risen across various terms, sparking concern among many investors.