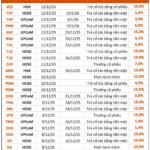

Nam Long Investment Corporation (stock code: NLG, HoSE) has released its report on the public offering of 100.1 million shares. The rights issue ratio is 100:26, meaning shareholders holding 100 shares are entitled to purchase 26 new shares.

During the registration and payment period from October 27 to November 17, 2025, Nam Long shareholders subscribed and paid for 97.1 million shares, equivalent to approximately 97% of the total offered shares.

The remaining 3 million shares, which were not subscribed by existing shareholders, will be further distributed to 282 individuals from December 15 to 18, 2025. These shares will be subject to a one-year trading restriction from the end of the offering period.

Among the 282 individuals, Mr. Trần Thanh Phong intends to purchase 1.1 million shares, Mr. Cao Tấn Thạch plans to buy 225,000 shares, and Ms. Nguyễn Thanh Hương aims to acquire 135,000 shares. Most other individuals are subscribing for a few thousand to tens of thousands of shares.

With an offering price of VND 25,000 per share, NLG expects to raise over VND 2,500 billion from this offering, increasing its charter capital to nearly VND 4,852 billion.

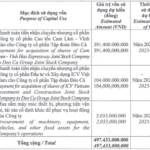

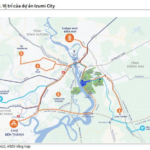

Izumi City Project by Nam Long

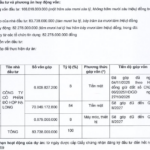

Regarding the use of proceeds, Nam Long will allocate approximately VND 640 billion to settle debts and financial obligations, VND 1,597 billion for investment in projects owned by Nam Long and its subsidiaries, and the remaining VND 265 billion will be invested in two key companies: Nam Long Land Investment LLC and Nam Long Commercial Property LLC.

In terms of business performance, in the first nine months of 2025, Nam Long recorded net revenue of nearly VND 3,941 billion, 4.8 times higher than the same period last year; after-tax profit exceeded VND 441 billion, 8.1 times higher year-on-year. The parent company’s after-tax profit reached VND 354 billion, 23 times higher than the first nine months of the previous year.

For 2025, Nam Long targets net revenue of VND 6,794 billion and after-tax profit of VND 701 billion. As of the end of Q3, the company has achieved 58% of its revenue target and 50.5% of its profit goal.

As of September 30, 2025, Nam Long’s total assets decreased by 6.4% from the beginning of the year to nearly VND 28,387 billion. Inventory accounts for VND 17,852 billion, or 62.9% of total assets.

On the liabilities side, total debt stands at nearly VND 14,020 billion, down 11% from the start of the year. This includes VND 1,442 billion in short-term loans and VND 5,550 billion in long-term loans.

Halong CAN Invests Over 166 Billion VND in New Hai Phong Factory

CAN shareholders have approved the re-leasing of a 20,000 m² (2-hectare) land plot in the Nam Dinh Vu Industrial Zone (Zone 1), Dong Hai Ward, Hai Phong. The lease term extends for 34 years, until 2059, with an estimated total rental value exceeding 68 billion VND.

Real Estate Firm Experiences Explosive Growth in 9 Months, Analysts Predict 2025 Sales Surge Fueled by Infrastructure and Urban Migration Trends

This forecast hinges on the anticipated active launch of the Izumi City project throughout the remainder of 2025, coupled with the market’s capacity to absorb low-rise residential products in provinces such as Long An and Can Tho.