Sai Gon – Ha Noi Stock Holding Company (ticker: SHS, HNX) has recently approved a public bond issuance plan for 2025.

SHS plans to issue up to 50 million bonds, with a face value of VND 100,000 per bond, aiming to raise VND 5,000 billion. These bonds are non-convertible, unsecured, and do not include warrants.

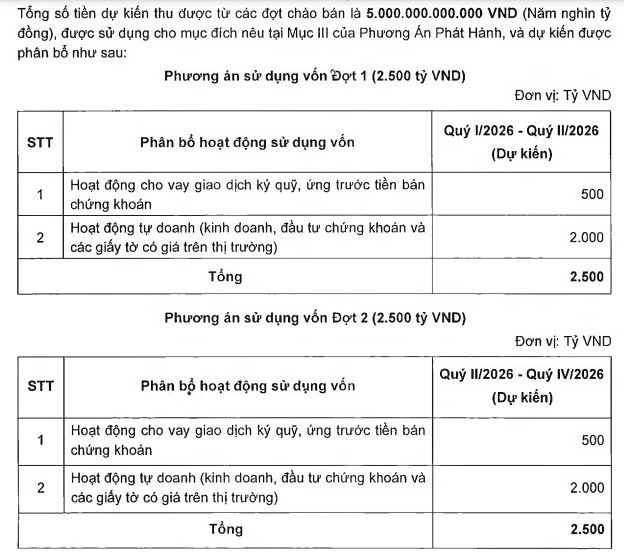

The issuance will be conducted in two phases. Phase 1 includes 25 million bonds under the code SHS2Y202501, with a maximum issuance value of VND 2,500 billion, scheduled for Q1-Q2/2026.

Phase 2 comprises 25 million bonds under the code SHS2Y202502, with a maximum issuance value of VND 2,500 billion, planned for Q2-Q4/2026.

The bonds have a 2-year term, with interest paid semi-annually. The interest rate combines fixed and floating components. The first two interest periods will apply a floating rate of 7.8% per annum, while subsequent periods will use a floating rate equal to the reference rate plus a 0.3% margin.

The issuer reserves the right to repurchase all or part of the bonds on the 12-month anniversary of the issuance date.

Individual investors must purchase a minimum of 100 bonds, equivalent to VND 10 million. Institutional investors must buy at least 10,000 bonds, worth VND 1 billion. VNDirect Securities Corporation will act as the initial bondholder representative.

The proceeds from this bond issuance will be allocated as follows:

In related news, the Hanoi Stock Exchange (HNX) announced that on October 9, 2025, SHS issued 3,600 bonds under the code SHS12502, with a face value of VND 100 million per bond, raising VND 360 billion. These bonds have a 1-year term and a fixed interest rate of 8% per annum.

This issuance is part of the second private bond issuance plan for 2025, with a maximum face value of VND 1,800 billion.

SHS will issue non-convertible, unsecured bonds without warrants. The plan includes up to 5 issuance phases, all scheduled for Q4/2025, with each phase offering between 300 and 500 bonds.

The bonds have a 1-year term, a maximum fixed interest rate of 8% per annum, and semi-annual interest payments. The purpose of this issuance is to restructure the issuer’s debt.

Tam Trinh Construction Raises VND 2 Trillion via Bond Issuance in One Week

With the issuance of VND 1,100 billion in bonds under the code TAT32502, Tam Trinh Construction has successfully mobilized a total of VND 2,000 billion through the bond channel in just one week.

Coteccons Plans Bond Issuance to Fund VND 250 Billion in Employee Bonuses and Debt Repayments, Offering Fixed 9% Interest Rate

Coteccons Construction Joint Stock Company (stock code: CTD) has announced a resolution to issue VND 1,400 billion in bonds, allocating nearly 18% of the total proceeds to employee bonuses and salaries.