Illustrative image

On the morning of December 11th, the auction of 24.9 million shares of Petrosetco (stock code: PET), held by Vietnam Oil and Gas Group (PVN), concluded with all shares sold. According to the announced results, six domestic individual investors won the bid at the starting price of 36,500 VND per share, purchasing between 3 to 5 million shares each. The total transaction value is estimated at a minimum of 910 billion VND.

The stock market on the same day witnessed a notable contrast. During the afternoon trading session on December 11th, PET shares faced significant downward pressure, hitting the floor at 32,600 VND per share. Liquidity remained high, with over 4 million shares traded.

PET Stock Price Movement

The auction winning price of 36,500 VND per share is approximately 12% higher than the current market price, resulting in a temporary loss of about 97 billion VND for the investors.

The investors’ willingness to pay a premium reflects their long-term confidence in the company’s value.

In terms of business operations, the distribution of electronic equipment contributes over 70% of Petrosetco’s total revenue. The company is an authorized distributor for Apple, Xiaomi, Honor, and TCL, maintaining annual revenues between 17,000 and 19,000 billion VND.

Starting January 1, 2025, the company transitioned from a fulfillment model to direct distribution for Samsung products. This model enhances profit margins but requires larger working capital.

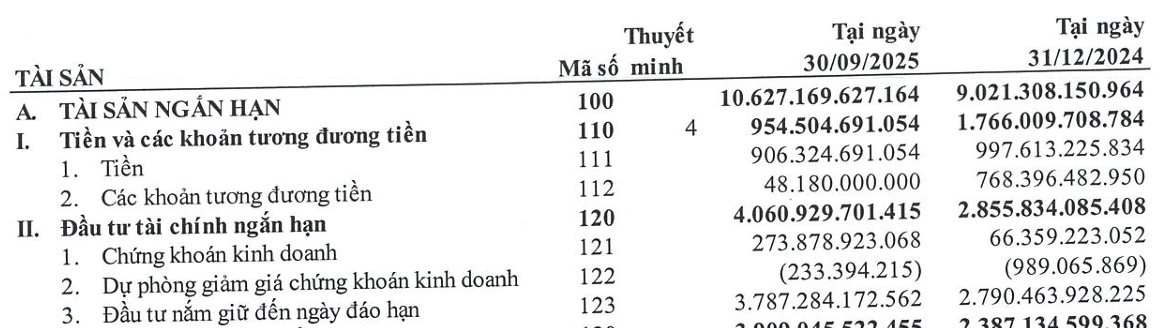

Financially, in the first nine months of 2025, Petrosetco reported revenue of 14,216 billion VND, equivalent to the same period last year. After-tax profit reached 247 billion VND, a 56% increase compared to the first nine months of 2024. Financial activities significantly contributed to profits, with a gain of 326 billion VND.

Source: PET Financial Report

As of September 30, 2025, the company’s total assets reached 11,735 billion VND. Short-term financial investments accounted for 4,061 billion VND, including 274 billion VND in trading securities and 3,787 billion VND in term deposits.

Liabilities totaled 9,200 billion VND, 3.6 times the equity. Short-term financial debt exceeded 6,300 billion VND. Operating cash flow for the first nine months was negative at 1,323 billion VND, primarily due to increased inventory for distribution activities.

Following the auction, PVN’s ownership in Petrosetco decreased to 0%. The six new individual investors now hold over 23% of the company’s charter capital. This significant change in shareholder structure coincides with the company’s restructuring of its distribution model and capital management.

Tianlong (TLG) Announces Dividend Payment Date: Chairman Co Gia Tho’s Family Group Set to Receive 5.15 Million New Shares and VND 51.5 Billion in Cash

Thiên Long Group has officially approved its 2024 dividend plan and an advance dividend for 2025. Given their substantial ownership stake, the shareholder group associated with Chairman Cô Gia Thọ is poised to receive millions of new shares and tens of billions of Vietnamese dong.

Technical Analysis Afternoon Session 02/12: Stochastic Oscillator in Overbought Territory

The VN-Index paused its upward momentum after reaching the psychological threshold of 1,700 points. Meanwhile, the HNX-Index extended its losing streak to a fourth consecutive session, testing its previous November 2025 low around the 255-259 point range.