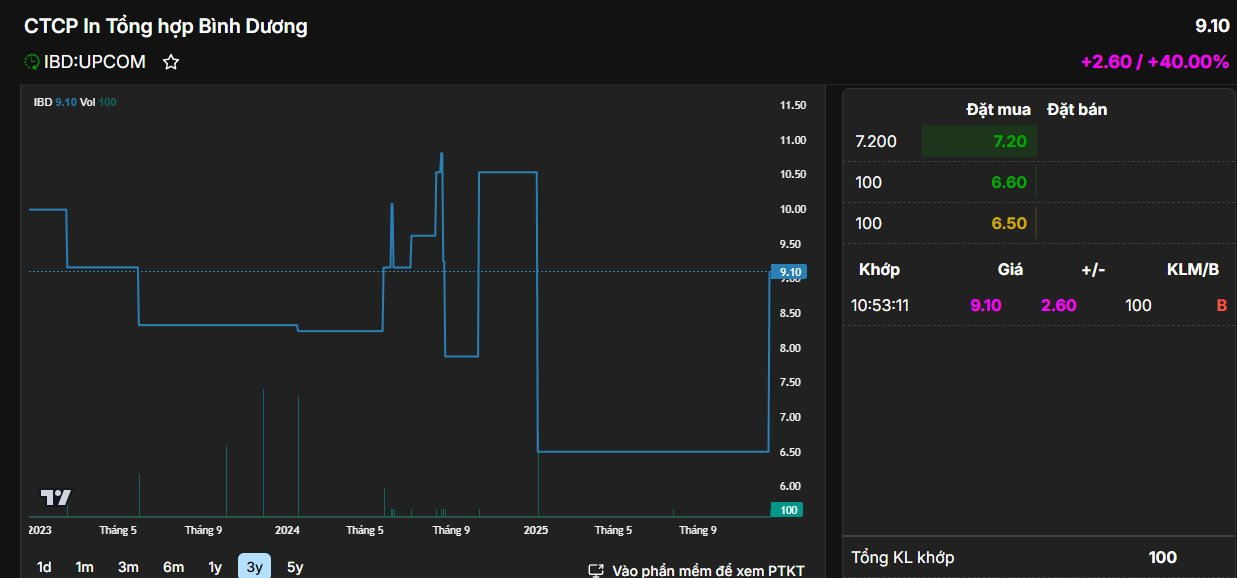

In the Vietnamese stock market, the occasional surge of stocks by dozens of percentage points in a single session is not uncommon. The latest example of this rare phenomenon is the IBD stock of Binh Duong Comprehensive Printing Joint Stock Company. On December 12th, the stock hit its ceiling with a 40% increase, closing at 9,100 VND per share.

This dramatic rise is attributed to the Regulations on the Organization and Management of the Trading Market for Unlisted Public Companies at the Hanoi Stock Exchange (HNX), issued under Decision No. 236 on April 24, 2015, by the General Director of HNX. According to these regulations, if a stock on the UPCoM market has no transactions for 25 consecutive trading sessions, on the first day it resumes trading, the price fluctuation range is set at ± 40% relative to the reference price.

Prior to this sudden surge, IBD had experienced a prolonged period of “liquidity drought.” The last transaction of this stock occurred nearly five months ago, on July 28, 2025, with only 100 shares traded. Even on the day of the ceiling increase, liquidity remained weak, with only 100 units traded by the end of the morning session.

IBD’s origins trace back to the Song Be Printing Enterprise, established in 1988 through the merger of the Printing Enterprise under the Department of Culture and Information and the Printing Enterprise of the Song Be Newspaper.

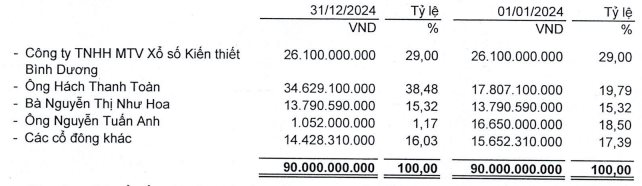

On January 2, 2019, the Department of Planning and Investment of Binh Duong Province issued the Business Registration Certificate Amendment No. 01 to the company, with a charter capital of 90 billion VND. This marked the official establishment of Binh Duong Comprehensive Printing Joint Stock Company. In March of the same year, the company completed the financial settlement procedures and capital handover from a single-member limited liability company to a joint stock company.

The company’s primary business activities include printing and trading in printing materials. IBD was listed on the UPCoM market with 9,000,000 shares.

The current shareholder structure of IBD shows that Binh Duong Lottery One-Member LLC holds 29% of the capital, while Mr. Hach Thanh Toan holds nearly 38.5%.

In terms of business performance, IBD’s net revenue in 2024 reached nearly 82 billion VND, a slight decrease of 3% compared to the previous year. As a result, profit before tax (PBT) and net profit after tax (NPAT) were 21 billion VND and 16.8 billion VND, respectively, representing a 65% increase compared to 2023.

For 2025, the company aims to achieve a total revenue of approximately 100 billion VND and a PBT of over 18 billion VND.

SGI Capital: A Major Opportunity for Value Investors May Emerge in the Coming Months

According to SGI, in the coming months, hot money flows originating from debt-financed investments during the recent era of cheap credit may retreat under the dual pressures of rising interest rates and tightening liquidity.

Earning $1.5 Billion in 6 Hours: Billionaire Pham Nhat Vuong Sets a New Record

The trading session on December 8th marked a historic milestone, not only for Chairman Pham Nhat Vuong’s remarkable asset growth but also for Vingroup, as it became the first Vietnamese enterprise to reach a market capitalization of 1.2 million billion VND.