The stock market opened the final trading session of the week on December 12th with a decline, pressured by the downward adjustment of Vingroup-affiliated stocks. The sell-off spread to other sectors, including securities, banking, and real estate. Selling pressure intensified in the afternoon session, particularly in the last 30 minutes and during the ATC period. Broad-based losses resulted in the VN Index closing at 1,646.89 points, down 52.01 points or 3.06%. Foreign investors continued their net selling streak, offloading approximately VND 533 billion across all three exchanges.

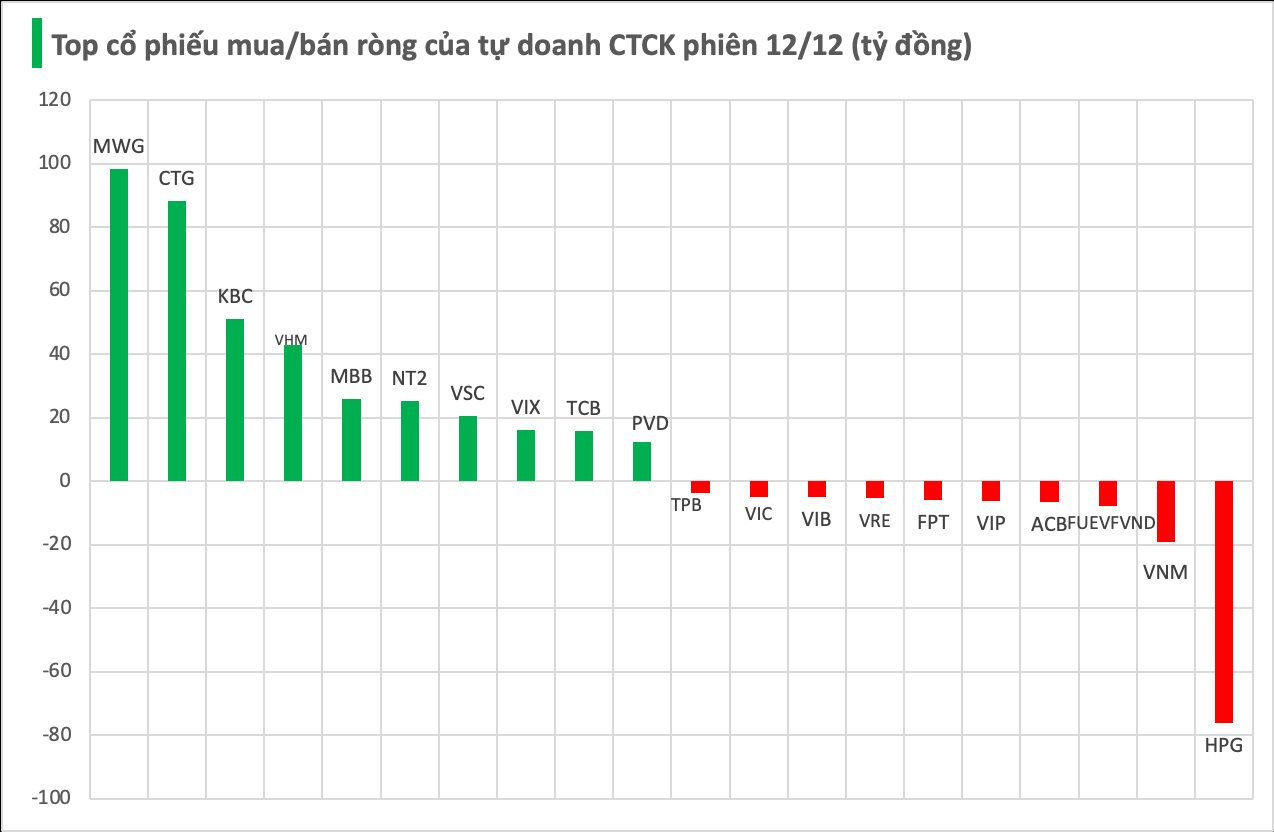

Securities firms’ proprietary trading desks net bought VND 341 billion on HOSE.

Specifically, MWG saw the strongest net buying at VND 99 billion, followed by CTG (VND 88 billion), KBC (VND 51 billion), VHM (VND 43 billion), MBB (VND 26 billion), NT2 (VND 25 billion), VSC (VND 21 billion), VIX (VND 16 billion), TCB (VND 16 billion), and PVD (VND 12 billion) – all actively purchased by securities firms’ trading desks.

Conversely, HPG experienced the heaviest net selling at VND 76 billion, followed by VNM (VND 19 billion), FUEVFVND (VND 8 billion), ACB (VND 6 billion), and VIP (VND 6 billion). Other notable net sells included FPT (VND 6 billion), VRE (VND 5 billion), VIB (VND 5 billion), VIC (VND 5 billion), and TPB (VND 4 billion).

Stock Market Outlook for the Week of December 8-12, 2025: Storm Clouds Gather

The VN-Index plummeted relentlessly in the final session of the week, marking its steepest weekly decline since the tariff shock in April 2025. Pessimism is spreading as the market loses all support from blue-chip stocks, while buying power remains insufficient to counter the mounting selling pressure.

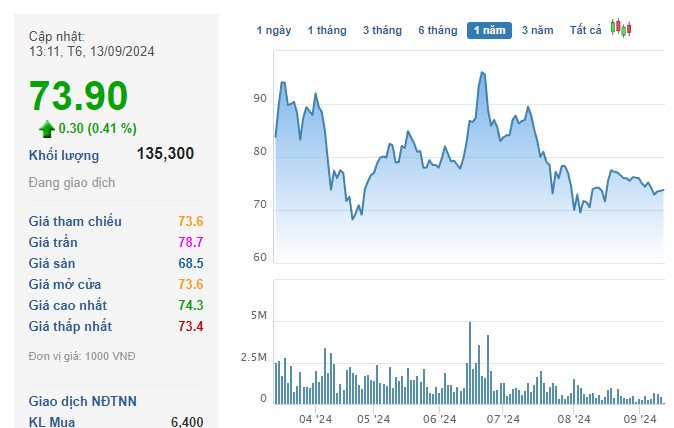

PV GAS D Revises Profit Plan Downward as Year-End Approaches

On December 10th, Vietnam Oil and Gas Low-Pressure Gas Distribution Joint Stock Company (PV GAS D, HOSE: PGD) announced a board resolution adjusting its 2025 business plan.

Vietstock Daily 11/12/2025: Pivot Shift Challenges VN-Index?

The VN-Index plunged, marked by a long red candle signaling heightened risk. The Stochastic Oscillator continues its downward trajectory after issuing a strong sell signal in overbought territory. Should the indicator exit this zone in upcoming sessions, the short-term outlook will grow increasingly pessimistic.

2025 Year-End Performance Test for Banking Stocks

Amid last week’s swift recovery, the banking sector played a pivotal role in propelling the VN-Index back to the 1,700–1,800 point range. However, this upward momentum proved short-lived. A lack of sustained conviction is becoming evident, as 25 out of 27 banking stocks remain entrenched in either correction or bear market territory.