Tam Trinh Construction Raises VND 2 Trillion in Bonds Within One Week

According to the Hanoi Stock Exchange (HNX), Tam Trinh Construction Joint Venture Investment Company (Tam Trinh Construction) has announced the results of its private domestic bond issuance.

Specifically, on December 5, 2025, Tam Trinh Construction successfully issued 11,000 TAT32502 bonds with a face value of VND 100 million per bond, totaling VND 1.1 trillion.

With a 72-month term, these bonds are expected to mature on December 5, 2031.

Previously, the company issued 9,000 TAT32501 bonds with a face value of VND 100 million per bond, totaling VND 900 billion. These bonds have a 96-month term and were issued domestically.

The issuance and completion date was November 28, 2025, with an expected maturity date of November 28, 2033.

Detailed information about bond terms, capital usage, bondholders, etc., is not disclosed in this document. However, according to HNX, the TAT32501 bonds have an interest rate of 9.2% per annum.

Thus, within just one week, Tam Trinh Construction successfully raised a total of VND 2 trillion through bond issuance.

Illustrative image

Established in November 2005, Tam Trinh Construction is headquartered at 411 Nguyen Tam Trinh Road, Hoang Mai District, Hanoi.

According to the business registration change announcement in April 2025, the charter capital remains unchanged, but the list of capital contributors now includes: TNR Holdings Vietnam Real Estate Investment and Development JSC (TNR Holdings) with 94.8%; ROX Cons Vietnam Construction Investment JSC (ROX Cons) with 4.96%; and Ms. Phung Thi Nga with 0.239%.

Mr. Ha Dang Sang and Mr. Nguyen Manh Hung are authorized to represent the entire capital contribution of TNR Holdings and ROX Cons at Tam Trinh Construction.

In the most recent registration change in July 2025, Mr. Luu Duy Hung (born in 1988) became the Director and legal representative of the company, replacing Ms. Phan Thi Minh Thuong.

Close Relationship with ROX Group

The aforementioned legal entities and individuals all have close ties to ROX Group, led by businesswoman Nguyen Thi Nguyet Huong.

First, Ms. Phan Thi Minh Thuong is known as the CEO and legal representative of Duc Tri Investment and Development JSC (Duc Tri). She is also authorized to represent Duc Tri’s VND 1.5 trillion capital contribution in Vipico LLC (Vipico), the developer of the TNR The LegendSea Da Nang project. The project’s developer and general contractor is ROX Signature JSC and ROX Cons, both part of the ROX Group ecosystem.

Bim Son A Industrial Park Project. Photo: ROX iPark

Ms. Thuong is also the Chairwoman and legal representative of VID Thanh Hoa Investment and Development JSC, a member of the ROX Group. VID Thanh Hoa is the developer of the Bim Son Bac A Industrial Park (Thanh Hoa) with an area of 163.36 hectares and a total investment of VND 886.5 billion.

Mr. Ha Dang Sang (born in 1985) is associated with TNR Holdings, a key entity in the ROX Group ecosystem and the majority shareholder of Tam Trinh Construction. Mr. Sang is also linked to Da Nang Resort Development JSC, which previously owned Vipico.

Regarding ROX Cons (holding 4.96% of Tam Trinh Construction’s capital), this company was formerly known as TNCONS Vietnam, established in 2015. It is a subsidiary of ROX Group specializing in general contracting for high-rise urban areas, low-rise urban areas, industrial infrastructure, shopping centers, and office buildings.

In March 2025, the company was renamed Gen Cons Vietnam Construction Investment JSC (Gen Cons).

Gen Cons is the general contractor for several projects, including TNR The GoldView, Royal Park (Hai Duong), TNR Stars Dien Chau (Nghe An), and TNR Stars Tan Truong (Hai Duong).

Mr. Nguyen Manh Hung previously served as the CEO and legal representative of ROX Cons. However, as of October 2025, this position is held by Mr. Lam Tuan Duong (born in 1983).

The relationship between Tam Trinh Construction and the ROX Group extends further. According to Resolution No. 26/2024/NQ-HĐQT of ROX Key Holdings JSC (ROX Key Holdings, stock code: TN1), the TN1 Board of Directors approved a loan from Tam Trinh Construction with a maximum amount of VND 495.2 billion. The loan is intended to supplement working capital and production, business, and investment capital. The loan term is 36 months with an interest rate of 9-11% per annum.

On December 27, 2024, TN1 successfully issued VND 200 billion in TN1H2427001 bonds with a 36-month term.

According to TN1’s issuance plan, the company will use 39 million shares of Vietnam Maritime Commercial Joint Stock Bank (stock code: MSB) and other assets owned by TN1 as collateral for all obligations related to this bond issuance.

TN1 will use the entire VND 200 billion raised to repay the principal of the loan from Tam Trinh Construction.

Additionally, in September 2018, Tam Trinh Construction entered into a secured transaction with Vietnam Maritime Commercial Joint Stock Bank (MSB), using the proceeds from the business and exploitation of land use rights and assets attached to the land at 411 Nguyen Tam Trinh Road, Hoang Van Thu Ward, Hoang Mai District (formerly), Hanoi, as collateral. This is based on Investment Certificate No. 01121000931 dated January 20, 2011, issued by the Hanoi People’s Committee.

MSB is not only a familiar credit partner of many companies within the ROX Group but also has a close relationship with the conglomerate.

Specifically, in 2007, VID Group (the predecessor of TNG Holdings, now ROX Group) acquired shares in Maritime Bank (now MSB).

At that time, Mr. Tran Anh Tuan was elected Vice Chairman of the bank’s Board of Directors. In 2008, he became the CEO of Maritime Bank. Since 2012, he has held the position of Chairman of MSB’s Board of Directors. Mr. Tran Anh Tuan is known as the husband of Ms. Nguyen Thi Nguyet Huong, Chairwoman of ROX Group.

Additionally, Ms. Huong previously served as the First Vice Chairwoman of the Board of Directors and Chairwoman of the Founding Council of Maritime Bank, representing VID Group’s capital contribution in the bank.

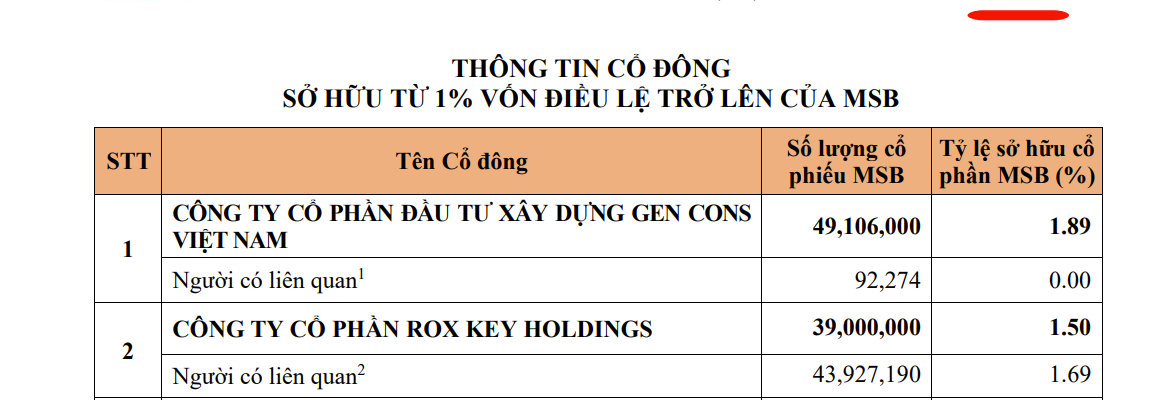

Source: MSB

According to MSB’s disclosure of shareholders owning 1% or more of its charter capital (updated based on VSDC data as of July 31, 2025, provided on August 1, 2025, and information from shareholders as of August 11, 2025), Gen Cons holds over 49.1 million MSB shares, equivalent to 1.89% of the bank’s charter capital.

Additionally, ROX Key Holdings JSC (a subsidiary of ROX Group) holds 39 million MSB shares, equivalent to 1.5%.

Khải Hoàn Land Launches Second Bond Issuance of the Year

Khải Hoàn Land has recently launched a new bond issuance, KHG12502, valued at 80 billion VND with a 60-month term and an attractive annual interest rate of 13.5%. This marks the company’s second bond offering this year, further solidifying its financial strategy and market presence.

Becamex Group Plans to Inject Additional Capital into Two Affiliated Companies

Becamex Group plans to inject additional capital into two of its affiliates, Becamex Bình Phước and Becamex Bình Định, utilizing proceeds from a bond issuance.