Technical Signals of VN-Index

During the morning trading session on December 12, 2025, the VN-Index continued its decline for the fourth consecutive session, testing the 50-day SMA support level.

The Stochastic Oscillator has further decreased, exiting the overbought zone after issuing a strong sell signal. Simultaneously, the MACD indicator has reconfirmed a sell signal, amplifying the short-term bearish sentiment.

Technical Signals of HNX-Index

In the morning session on December 12, 2025, the HNX-Index extended its decline into the sixth consecutive correction session.

The MACD indicator has reissued a sell signal and remains below the zero line, while the Stochastic Oscillator has deepened into the oversold territory. This reinforces the prevailing short-term bearish outlook.

The previous March 2025 high (244-250 range) now acts as potential support for the HNX-Index should the downward trend persist in upcoming sessions.

PDR – Phat Dat Real Estate Development Corporation

On December 12, 2025, PDR shares extended losses for the third session, forming a Three Black Crows candlestick pattern. The price hovers near the Lower Band of Bollinger Bands, reflecting persistent investor pessimism.

Currently, PDR tests the November 2025 low (20,500-21,400 range), coinciding with the 50% Fibonacci Retracement level.

Additionally, a Death Cross between the 50-day SMA and 100-day SMA has formed, accompanied by a bearish MACD below zero. This signals continued medium-term weakness.

SSI – SSI Securities Corporation

SSI shares edged higher in the December 12, 2025 morning session, forming a small-bodied candlestick with reduced volume, indicating cautious investor sentiment.

The price currently trades below the Middle Band of Bollinger Bands, while a Death Cross between the 50-day SMA and 100-day SMA suggests muted medium-term prospects.

Should short-term weakness persist, the 61.8% Fibonacci Retracement (25,900-26,100 range) will serve as critical support for SSI.

Note: This analysis is based on real-time data as of the morning session close. Signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:04 December 12, 2025

Foreign ETFs Continue Net Selling as VN-Index Surpasses 1,700, VIC Weighting Rises to Nearly 17%

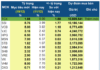

During the period from November 28 to December 5, 2025, as the VN-Index officially surpassed the 1,700-point milestone, the VanEck Vectors Vietnam ETF (VNM ETF) continued its net selling activity across all stocks within its portfolio.

Market Pulse 12/12: Over 660 Stocks Decline, VN-Index Plunges Another 52 Points

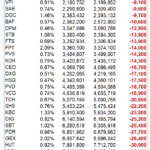

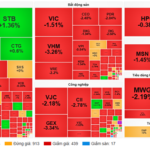

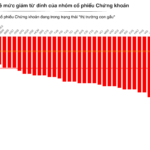

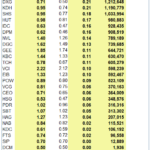

At the close of trading, the VN-Index dropped 52.01 points (-3.06%), settling at 1,646.89 points, while the HNX-Index fell 5.78 points (-2.26%), closing at 250.09 points. Market breadth was overwhelmingly negative, with over 660 decliners and only 200 advancers. Similarly, the VN30 basket saw a sea of red, with 29 decliners and just 1 advancer.

Stock Market Outlook for the Week of December 8-12, 2025: Storm Clouds Gather

The VN-Index plummeted relentlessly in the final session of the week, marking its steepest weekly decline since the tariff shock in April 2025. Pessimism is spreading as the market loses all support from blue-chip stocks, while buying power remains insufficient to counter the mounting selling pressure.

Unlocking Growth: IPOs, Post-Upgrade Capital Raises, and Investor Concerns

Elevating capital and pursuing an IPO are pivotal strategies for businesses seeking robust growth, especially as Vietnam’s stock market ascends to secondary emerging market status. However, short-term market fluctuations have left many investors hesitant to engage in additional share purchases or participate in IPOs, despite the long-term potential.