By 2025, Vietnam’s capital market is poised for transformative milestones: upgrading its stock market, establishing a legal framework for digital assets, and creating an institutional framework for an international financial center. These foundational steps will empower the capital market to become a key driver of medium and long-term capital for the economy. As the nation approaches the 14th National Party Congress in 2026, these initiatives are expected to gain momentum, fostering rapid and sustainable growth while elevating Vietnam’s financial market on the global stage.

To facilitate dialogue, collaboration, and policy recommendations among regulators, financial institutions, investment funds, businesses, and experts, the Vietnam Financial Consulting Association (VFCA) and Vietnam Finance Magazine jointly organized the Vietnam Capital Market Outlook Forum 2026. Under the theme “Breakthrough on a New Foundation,” the event took place on Friday, December 12, 2025, in Hanoi.

The forum served as a platform for in-depth insights and actionable strategies to position the capital market as a cornerstone for double-digit economic growth. Key discussions focused on the impact of stock market upgrades on domestic and foreign investment flows, the potential of digital assets in expanding capital mobilization, and the institutional enhancements needed to develop an international financial center that positions Vietnam on the global capital map.

In his opening remarks, Dr. Lê Minh Nghĩa, Chairman of VFCA and Head of the Organizing Committee, stated: “Today’s forum brings together not only policymakers and regulators but also financial institutions, investment funds, businesses, and experts. My hope is that we leave this gathering not just with a beautifully crafted joint declaration, but with a concrete action plan: who does what, when, and with whom, and how progress will be measured. Only then can we meet the expectations of millions of businesses and investors awaiting Vietnam’s capital market to truly ‘breakthrough on a new foundation.’

Dr. Lê Minh Nghĩa, Chairman of VFCA

Dr. Nguyễn Sơn, Chairman of the Board of Directors of Vietnam Securities Depository and Clearing Corporation (VSDC), shared: “As we step into 2026, the capital market faces significant opportunities with synchronized reforms in market structure, risk management, technology upgrades, and standardized operational processes. This environment enables Vietnam to align more closely with developed market standards, enhancing the financial market’s role in supporting economic growth, business development, and long-term capital attraction. For Vietnam’s stock market, 2026 is pivotal, marking the first year of its official upgrade according to FTSE standards and setting the stage for higher MSCI benchmarks.”

From an investment fund perspective, Mrs. Lương Thị Mỹ Hạnh, Asset Management Director, Domestic Division, Dragon Capital, noted: “Experience from developed nations shows that successful capital market transformations stem from decisive government policies focused on incentivizing the private sector. This is an opportune moment for the fund management industry to mobilize idle capital, provide safe and sustainable access to the capital market for citizens, and enable direct participation in economic growth. Long-term capital from funds will alleviate pressure on bank credit, offering stable support for development. This positions Vietnam closer to a modern, multi-pillar financial system aligned with regional standards.”

With the participation of Party and State leaders, representatives from investment funds, securities firms, businesses, and economic-financial experts, the forum fostered a multidimensional exchange, contributing to a unified market voice on 2026 policy priorities.

Sprint to Disburse Public Investment Funds

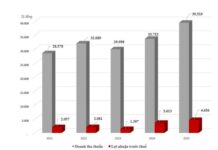

As 2025 draws to a close, numerous public investment projects are racing against time to meet their deadlines. Amidst economic pressures, over 1 million billion VND in public investment capital is seen as a crucial catalyst to drive growth and unlock private sector resources.