Deo Ca Transport Infrastructure Investment Joint Stock Company (stock code: HHV, listed on HoSE) has announced a public offering of shares under the Certificate of Registration for Public Offering of Shares No. 463/GCN-UBCK, issued by the Chairman of the State Securities Commission on January 11, 2025.

Accordingly, HHV is offering over 49.7 million shares to existing shareholders through a rights issue. The rights ratio is 10:1, meaning shareholders holding 10 shares can purchase 1 new share. The shares are unrestricted for transfer.

The registration and payment period for the share purchase is from January 6 to 27, 2026. The transfer period for share purchase rights is from January 6 to 23, 2026.

If the issuance is successful, Deo Ca Transport Infrastructure will increase its charter capital from VND 4,974.3 billion to nearly VND 5,472 billion.

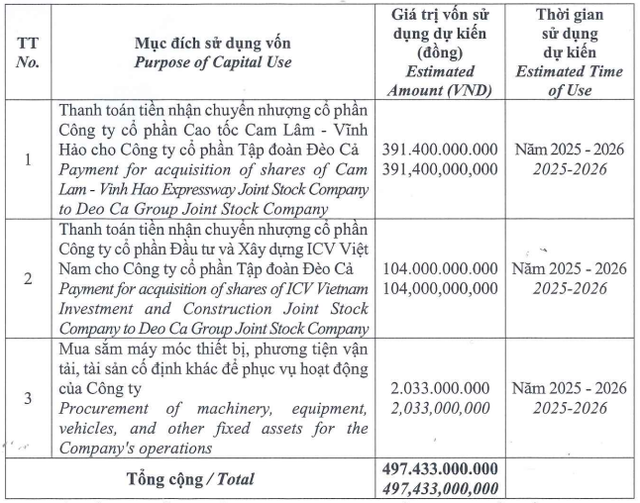

With an offering price of VND 10,000 per share, Deo Ca Transport Infrastructure expects to raise over VND 497.4 billion, which will be allocated for the following purposes:

Source: HHV

Cam Lam – Vinh Hao Expressway Joint Stock Company is the entity executing the project for the construction of the Cam Lam – Vinh Hao section, part of the North-South Eastern Expressway project phase 2017-2020 under a BOT contract.

Prior to this offering, HHV did not own any shares in Cam Lam – Vinh Hao Expressway. According to the transfer agreement dated December 26, 2024, HHV acquired 39.14 million shares, equivalent to a 38% stake in Cam Lam – Vinh Hao Expressway. The transferor is HHV’s parent company, Deo Ca Group Joint Stock Company.

Meanwhile, ICV Vietnam Investment and Construction Joint Stock Company (ICV) has a charter capital of VND 829.8 billion. Before the transaction, HHV owned 2.11% of ICV’s charter capital.

On June 28, 2024, HHV and Deo Ca Group signed the Share Transfer Agreement No. 2806/2024/CNCP-ICV, along with Addendum No. 01-PLHD/2806/2024/CNCP-ICV dated December 25, 2024, and Addendum No. 02-PLHD/2806/2024/CNCP-ICV dated April 30, 2025. Under this agreement, HHV acquired 11.4 million shares, increasing its ownership to 15.37% of ICV’s capital.

In recent developments, HHV announced a Board of Directors resolution approving the plan to contribute additional capital to Deo Ca Urban Infrastructure LLC.

Deo Ca Transport Infrastructure will increase its ownership stake in Deo Ca Urban Infrastructure from 8% to 17.8% (based on the total charter capital after the company completes its capital increase plan).

The value of the additional capital contribution in this phase is expected to be VND 790 billion. Subsequent capital contributions will be determined according to the approved capital increase plan.

HHV stated that it will increase its ownership through legal capital contribution methods in compliance with the law and in line with Deo Ca Urban Infrastructure’s capital increase plan. The sources of additional capital include: equity, loans, and other legally mobilized funds.

Upcoming Steel Industry Newcomer Set to Join UPCoM

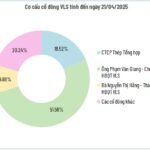

The Hanoi Stock Exchange (HNX) has approved the listing of 24.5 million shares of VLS, issued by Viet Long Steel Production JSC, on the UPCoM market starting December 15th. The reference price is set at 10,100 VND per share, valuing the company at approximately 247.5 billion VND.

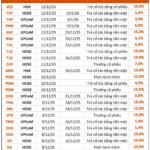

Dividend Ex-Date Schedule December 8–12: Stationery Giant Thiên Long and SSI Gear Up for Payouts

This week, 16 companies are distributing cash dividends, with rates ranging from a high of 15% to a low of 1%.