Vietcap Invests VND 300 Billion to Acquire 23% Stake in Tran Dinh Long’s Agriculture IPO

According to the announced issuance plan, Hoa Phat Agriculture Development JSC (HPA) is offering 30 million shares to the public at a fixed price of VND 41,900 per share. The total expected capital raised is VND 1,257 billion, which will be used for debt restructuring and enhancing financial capacity.

Recently disclosed information reveals that Vietcap Securities JSC (VCI) is participating as an independent investor following a thorough business evaluation, separate from its role as a distribution agent. By registering to purchase 7 million shares, VCI’s proprietary trading desk is estimated to invest approximately VND 293 billion, securing a 23.3% stake in this IPO.

Preparing a VND 4,000 Billion Capital Reserve

Vietcap has also finalized plans to privately offer 127.5 million shares (17.64% of circulating shares) to 69 strategic investors from December 9–15, 2025.

At an offering price of VND 31,000 per share, Vietcap aims to raise nearly VND 4,000 billion. Of this, 20% will bolster proprietary trading activities, while 80% will support margin lending, positioning the company to capitalize on emerging investment opportunities.

The issuance has attracted prominent financial institutions, including Dragon Capital (VEIL), Manulife Vietnam, Prudential Vietnam, and international funds such as Darasol Investments Limited.

Vietcap’s Multi-Billion Proprietary Portfolio

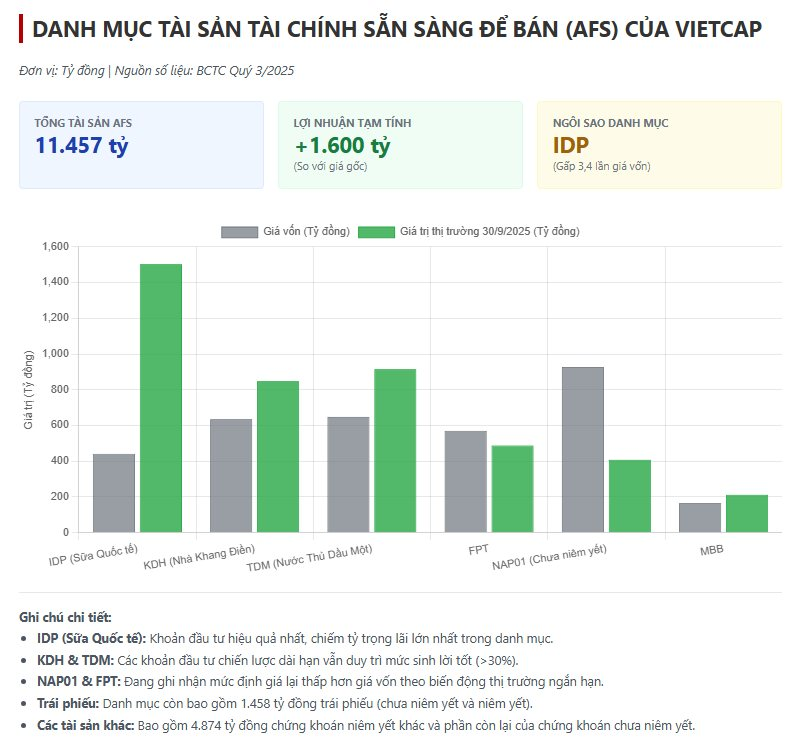

As of September 30, 2025, VCI’s total assets reached VND 29,718 billion, an increase of over VND 3,100 billion since the beginning of the year. The Available-for-Sale (AFS) financial assets portfolio stands at VND 11,457 billion, currently recording an unrealized gain of approximately VND 1,600 billion compared to its cost basis.

VCI’s Available-for-Sale (AFS) Financial Assets Portfolio

Within this portfolio, the investment in International Dairy Products (IDP) stands out as the most profitable, with a cost basis of VND 441 billion and an unrealized gain exceeding VND 1,000 billion. Khang Dien House (KDH) holds the largest proportion in the listed segment, with a cost basis of VND 635 billion and an unrealized gain of VND 213 billion.

During the period, VCI invested an additional VND 150 billion in Military Bank (MBB), increasing its cost basis to VND 165 billion, with an unrealized gain of VND 47 billion. Meanwhile, the investment in FPT, with a cost basis of VND 570 billion (up VND 70 billion from the beginning of the year), is currently recording a temporary loss of over VND 82 billion due to market fluctuations.

Additionally, the AFS portfolio includes VND 1,458 billion in bonds, VND 4,874 billion in other listed securities, and VND 927 billion in unlisted securities (including NAP01).

The first nine months of 2025 saw robust financial performance, with after-tax profit reaching VND 899 billion, a 30% increase year-over-year, achieving 76% of the annual target.

The Allure of Hoa Phat Agriculture as a New Market Entrant

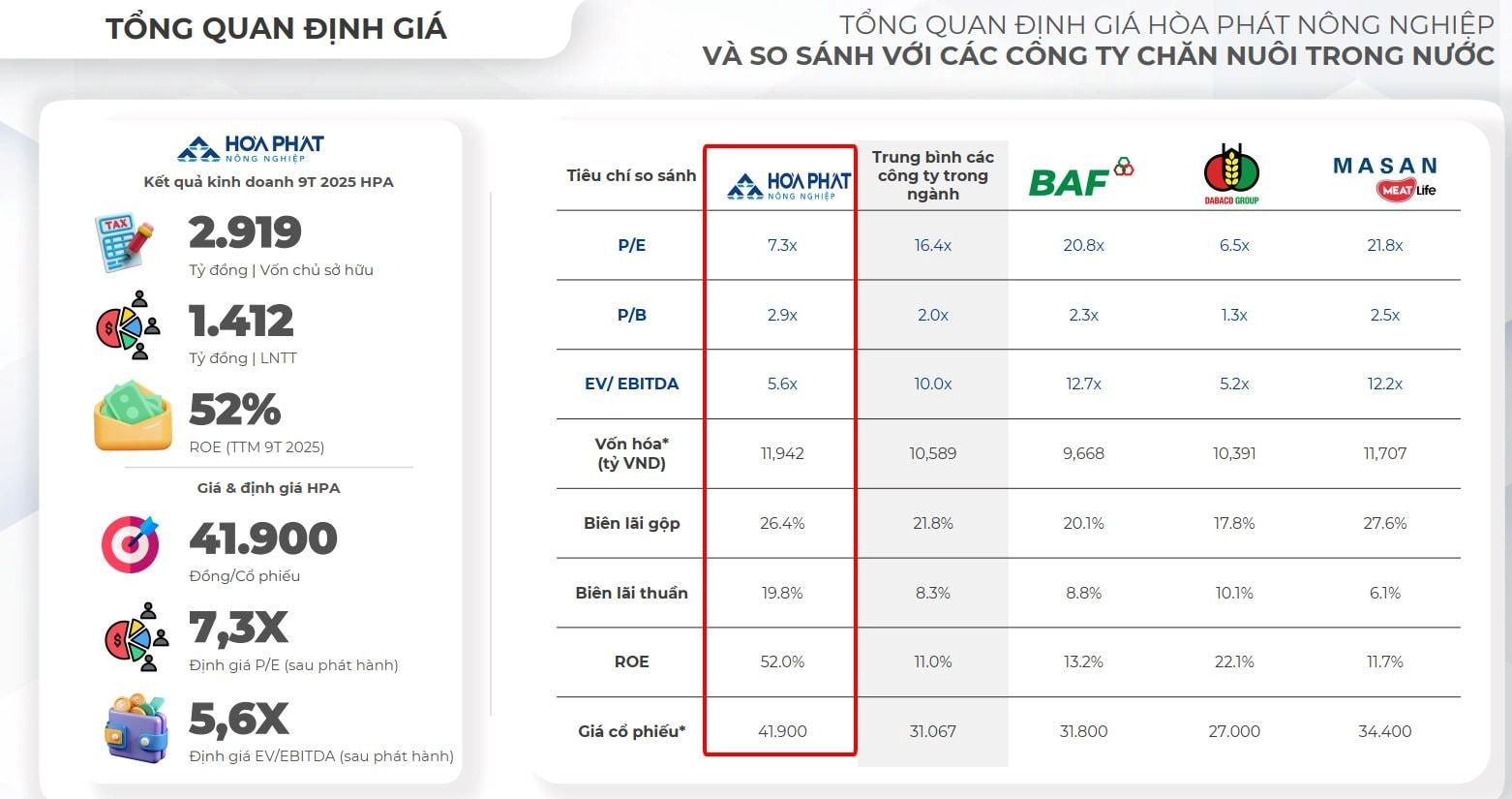

At the IPO price of VND 41,900 per share, HPA’s post-issuance P/E ratio is 7.3 times, significantly lower than the industry average of approximately 14 times.

HPA’s Valuation Overview

HPA’s appeal is further enhanced by its commitment to a substantial cash dividend. The company’s leadership plans to distribute a cash dividend of approximately VND 3,850 per share over the next 12 months, equivalent to 38.5% of par value. At the current offering price, the dividend yield is around 9.2%.

Operational efficiency is evident in HPA’s cumulative after-tax profit of VND 1,295 billion for the first nine months of 2025, with a net profit margin of 21%, return on equity (ROE) of 56.4%, and return on assets (ROA) of 31.7%.

These results are underpinned by the company’s low-cost industrial management model. In pig farming, the DanBred breeding program achieves 33–34 piglets per sow per year, 1.5 times the industry average. HPA maintains an average production cost of VND 42,000 per kg of liveweight pork, lower than the market price range of VND 59,000–61,000 per kg.

HPA’s Integrated Farm System

This efficiency is supported by a fully integrated Feed-Farm model (Full Ownership). Unlike many industry peers, HPA avoids contract farming to maintain strict control over disease risks.

The company currently operates 7 pig farm clusters, 3 Australian cattle farms, 2 feed mills, and 2 poultry farms. This scale positions HPA among the top 10 pig farming companies in Vietnam, with a leading market share in Australian cattle supply and northern egg production.

MWG Finalizes Plan for Điện Máy Xanh’s IPO in 2026

World Mobile Group Joint Stock Company (HOSE: MWG) has confirmed its strategy to take Dien May Xanh public with an initial public offering (IPO) and listing planned for 2026. This move is expected to drive double-digit profit growth and expand the retail ecosystem.

Unlocking Growth: IPOs, Post-Upgrade Capital Raises, and Investor Concerns

Elevating capital and pursuing an IPO are pivotal strategies for businesses seeking robust growth, especially as Vietnam’s stock market ascends to secondary emerging market status. However, short-term market fluctuations have left many investors hesitant to engage in additional share purchases or participate in IPOs, despite the long-term potential.

Why Asahi Life Chooses MVI Life as Its Trusted Partner in Vietnam?

Asahi Life, a 137-year-old Japanese insurance powerhouse, has made a bold move into Vietnam’s life insurance market. In a deal valued at nearly ¥30 billion (approximately $192 million USD), Asahi Life is acquiring Manulife’s entire stake in MVI Life, marking a significant milestone in their international expansion strategy. This strategic acquisition signals Asahi Life’s commitment to establishing a strong presence in Vietnam’s thriving insurance sector.