Mr. Le Huu Son (right) at the signing ceremony with 1Office in July 2024

|

Mr. Le Huu Son, Deputy General Director of VietCredit Finance Joint Stock Company (VietCredit, UPCoM: TIN), has recently registered to purchase an additional 1 million shares of TIN for personal purposes. Following this transaction, his holdings are expected to increase to over 4.5 million shares, equivalent to approximately 4.94% of the company’s charter capital, still below the threshold for major shareholders.

Currently, the largest shareholder of VietCredit is Vietnam Cement Corporation (Vicem), holding more than 11% of the capital, according to VietstockFinance data.

|

Born in 1977, Mr. Le Huu Son was appointed as Deputy General Director of VietCredit by the Board of Directors on April 1, 2025, with a term until March 31, 2028. Previously, he served as a Senior Director. His responsibilities include managing platforms for lending to small and medium-sized enterprises, overseeing the Human Resources Department, and managing capital mobilization activities. |

This additional purchase by VietCredit’s leadership comes amid a significant correction in TIN shares. In the most recent week, the stock price dropped by over 11%, falling to around VND 49,000 per share. At this price, the transaction to acquire 1 million shares would require approximately VND 49 billion.

Despite the short-term correction, TIN remains one of the strongest performers on UPCoM over a longer period. Over the past year, the stock price has surged by 245%, with average trading volume exceeding 19,000 shares per session.

| Price movement of TIN stock over the past year |

During 2023-2024, TIN shares primarily traded around VND 10,000 per share. By late October 2024, the stock broke out of its accumulation phase, reaching VND 12,000 per share by year-end. The upward momentum accelerated in early 2025, with TIN climbing to nearly VND 54,000 per share by late June and hitting an all-time high of over VND 59,000 per share by late October. Although the stock has since corrected from its peak, the current price remains significantly higher than levels seen in previous years.

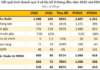

In terms of financial performance, VietCredit reported net interest income of nearly VND 2 trillion in the first nine months of 2025, 3.6 times higher than the same period last year. After-tax profit reached over VND 654 billion, the highest level ever recorded by the financial company.

| VietCredit’s after-tax profit for the first nine months of each year |

– 10:33 13/12/2025

Newcomer in Construction Sector Receives HOSE Approval to List Over 40 Million Shares

After more than seven months of filing, the shares of Truong Son Investment and Construction Joint Stock Company (UPCoM: TSA) have officially been approved for listing on HOSE, marking the addition of another construction industry code to the group of enterprises preparing to join the largest stock exchange in the market.

FT1 Announces Record Dividend Payout: 5,142 VND per Share, Highest Since Listing

Recently, the Board of Directors of Corporation of Mechanical Accessories No. 1 (FUTU 1, UPCoM: FT1) passed a resolution approving the payment of the 2024 dividend in cash at a rate of 51.42% (5,142 VND per share). The ex-dividend date is set for December 18, with the payment expected on January 20, 2026.

How Did Ton Dong A Perform Before Filing for Listing on HoSE?

The Ho Chi Minh City Stock Exchange (HoSE) received the listing application for 149 million GDA shares of Dong A Steel Joint Stock Company on November 27, 2025.