According to the latest data from the Vietnam Automobile Manufacturers’ Association (VAMA), November 2025 saw a total of 39,338 vehicle sales across the market. This figure represents a 4% increase compared to October, marking the third consecutive month of positive growth in Vietnam’s automotive sector.

However, when compared to the same period last year, November 2025 sales dropped by 11%. This decline is not entirely unexpected, as November 2024 benefited from the final month of reduced registration fees for domestically produced and assembled vehicles, coinciding with the year-end shopping peak, which significantly boosted car purchases.

Vietnam’s domestic car market in November continued its growth trajectory, achieving the highest sales volume since the beginning of 2025.

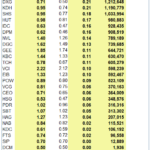

In November, passenger car sales reached 28,557 units, a 5% increase from October. Commercial vehicle sales also saw a slight 1% rise to 10,273 units, while specialized vehicle sales dipped by 3% to 488 units.

In terms of origin, domestically assembled vehicles sold 18,370 units, up 7%, while completely built-up (CBU) imported vehicles saw a modest 1% increase to 20,968 units compared to October.

Segment-wise, SUVs/Crossovers remained the top-selling category in November with 13,135 units sold, a nearly 13% increase from the previous month. Other notable segments experiencing growth were sedans (4,802 units, up 16%) and pickup trucks (2,960 units, up 1%). Conversely, MPVs (6,032 units) and hybrid vehicles (1,340 units) saw slight declines of 3-4%.

VAMA’s report highlights that November’s strong sales contributed to a year-to-date total of nearly 330,000 vehicles. Specifically, the first 11 months of 2025 saw 328,669 vehicles sold, a 6.5% increase compared to the same period in 2024.

VAMA notes that these figures include retail sales from its members and CBU imports by non-VAMA entities in October 2025. Two major players, VinFast and Hyundai, reported their sales separately.

VinFast delivered 23,186 electric vehicles in November 2025, a 14% increase. Hyundai, the South Korean automaker, recorded 5,463 sales in the same month, a 3.8% rise from October.

Combining data from VAMA, VinFast, and Hyundai Thanh Cong, the Vietnamese market is estimated to have sold nearly 68,000 new vehicles in November. This equates to an average of over 2,200 new vehicles delivered daily to domestic customers.

These numbers indicate robust demand and consumption of new vehicles in Vietnam during 2025. However, this growth is largely driven by promotional programs from manufacturers and dealers.

The Honda Civic hybrid is among the models offering significant discounts in the year-end period.

Without government support for reduced registration fees as seen last year, manufacturers have launched their own programs with equivalent incentives to attract customers. As a result, nearly all vehicle segments, from economy to luxury, are offering discounts, with promotional values increasing towards the year-end.

As consumers increasingly wait for discounts to purchase vehicles at the lowest cost, manufacturers are compelled to offer promotions to drive sales. This trend underscores the growing dependence of Vietnam’s automotive market on incentives.

Nevertheless, from a positive perspective, these promotions are significantly boosting market sales. As 2025 draws to a close, manufacturers are not only maintaining but also enhancing their promotional efforts to finalize their business year and set new targets for 2026.

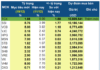

Vietnam’s November Auto Sales: Japanese Brand Stumbles, Multiple Segments See Sharp Declines

November 2025 sales figures from VAMA reveal an 11% year-over-year decline compared to the same period in 2024. The passenger car (PC) segment is experiencing significant polarization, notably marked by the downturn of several major brands.

Top 10 Best-Selling Cars in November 2025: VinFast’s First Electric MPV Sets Unprecedented Sales Record

VinFast Limo Green has achieved remarkable sales success, with 9,642 units sold—surpassing Toyota’s entire November sales of nearly 8,000 vehicles.