|

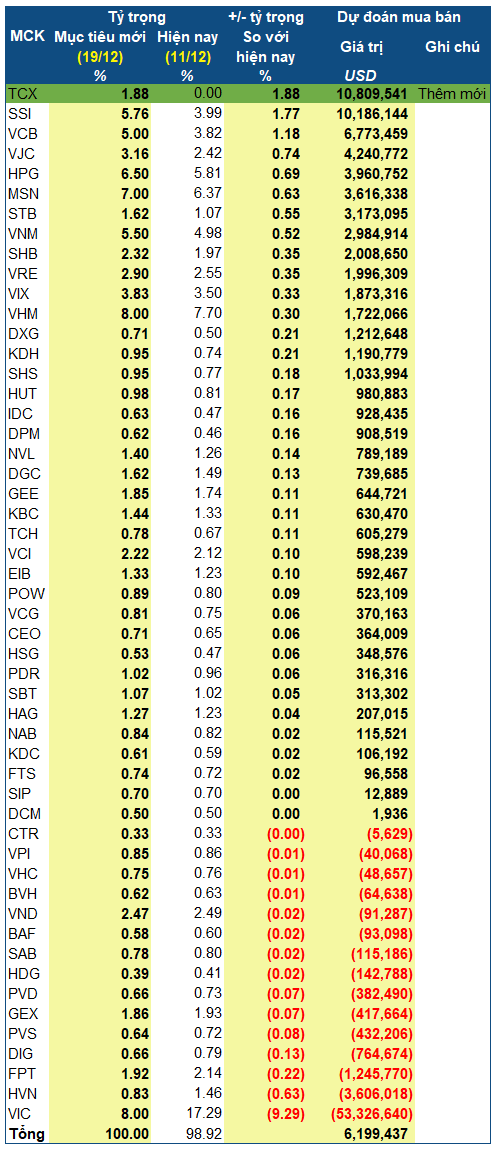

Projected Weighting Adjustments for VNM ETF Post Q4/2025 Review

|

Specifically, the index basket adds TCX, a recently IPO’d stock. The new purchase value is 10.8 million USD, with an estimated 6.5 million shares, accounting for approximately 1.88% of the weighting. This is also the stock with the highest projected purchase value.

In second place is SSI, with an expected additional purchase of nearly 10.2 million USD, or approximately 9.6 million shares. Its weighting is projected to increase from 4% to 5.76%.

Conversely, the index basket does not remove any stocks. The stock forecasted to be sold most heavily by value is VIC, with over 53 million USD, significantly reducing its weighting from 17.29% to 8%. This move was anticipated, as VIC experienced a substantial price surge, inflating its portfolio weighting. At the closing price of 144,000 VND/share on December 13th, the Fund could sell nearly 9.8 million VIC shares.

In terms of sell value, other stocks trail far behind, with HVN projected to be sold for 3.6 million USD and FPT for 1.2 million USD.

Following the Q4/2025 review, the VNM ETF portfolio will consist of 52 stocks, 1 fund certificate, and 2 stock warrants, an increase of 1 stock compared to Q3/2025. All holdings are Vietnamese stocks. The highest weightings remain with VIC and VHM at 8% each. MSN is projected to rank third with 7%, followed by HPG at 6.5%.

Changes to the constituent stocks of the MarketVector Vietnam Local Index will take effect after the market close on Friday, December 19th, and will officially trade from Monday, December 22nd.

– 09:15 13/12/2025

Market Pulse 12/09: Financial Stocks Rebound in Afternoon Session, Yet Fall Short of Driving Momentum

Closing the session on December 9th, the VN-Index settled at 1,747 points, down over 6.5 points, while the HNX-Index ended at 257.1 points, shedding 1.5 points. Despite an afternoon rebound supported by various stock groups, the market failed to reclaim positive territory.