Over 90% of Vietnamese startups fail within their first three years—a stark statistic from the Ministry of Planning and Investment’s 2023 report that serves as a cautionary tale for any aspiring entrepreneur. Amidst this challenging landscape, the survival of a purely Vietnamese tech company for over a decade in an intensely competitive field—dominated by giants willing to spend lavishly for market share—has become a case study worth examining.

MoMo is that case study.

What’s remarkable is that MoMo’s success isn’t solely due to outpacing competitors or securing more funding. Their resilience stems from a simple yet rarely practiced principle: at every stage, they focus relentlessly on the most critical factors for survival and sustainable growth, sidelining everything else, no matter how tempting.

MoMo’s CEO, Nguyễn Mạnh Tường, succinctly encapsulates this philosophy: “MoMo has a three-year vision but acts on three-month plans.”

Steve Jobs, the legendary former CEO of Apple, once proudly stated, “I’m as proud of what we chose not to do as I am of what we did.” This ability to say “no” to thousands of good ideas allowed Apple to focus on creating groundbreaking products like the iPod, iPhone, and iPad.

MoMo, operating in a vastly different market and scale, applies a similar principle—though their rejections aren’t of products but of well-trodden paths, strategies promising rapid growth but risking collapse during crises.

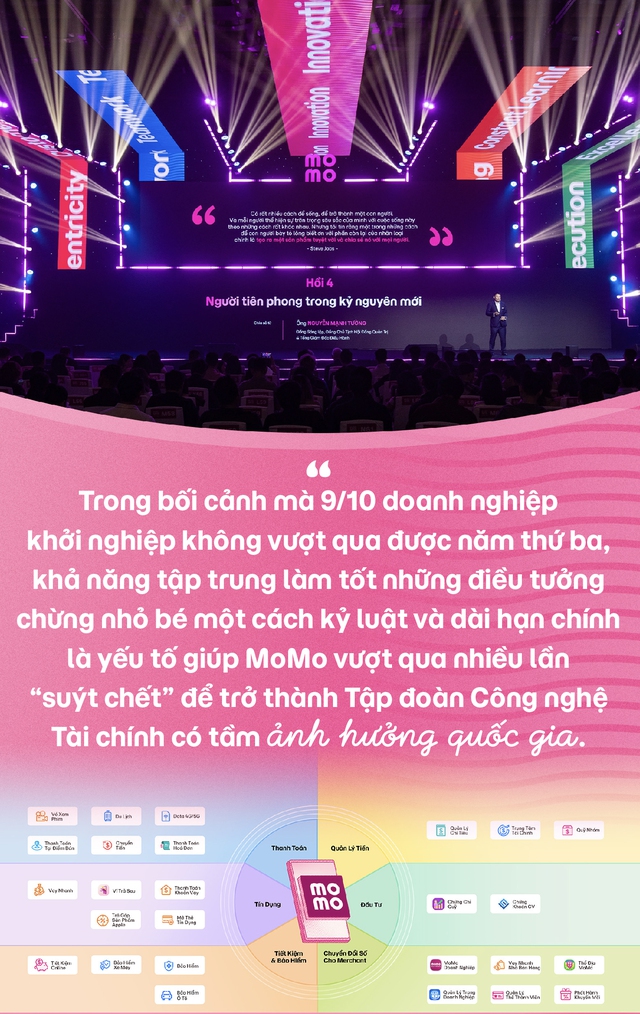

During the Tech in Asia Saigon Summit 2024, CEO Nguyễn Mạnh Tường drew gasps from the audience with his bluntly pragmatic response to MoMo’s success: “To succeed, you must survive.” MoMo’s survival strategy is to channel all efforts into the single path they’ve chosen.

Founded in 2010, MoMo began with a simple dream: enabling Vietnamese to conduct financial transactions using just their phones. A team of young engineers poured their passion into developing a SIM-based digital wallet. They secured licenses, built systems, and established agent networks—leaving no stone unturned. Yet, despite their efforts, the product failed to attract users. The experience was limited, especially as most users relied on basic black-and-white “brick” phones with confusing interfaces. MoMo pivoted to an in-store money transfer model, but results remained lackluster.

It was only after months of fieldwork at bus stations, industrial zones, and boarding houses—and learning from Kenya, Tanzania, and Rwanda’s “send money home” models—that MoMo grasped the core issue: migrant workers needed more than just fast transfers; they needed safety, peace of mind, and trust. MoMo hadn’t met these needs; no amount of advanced technology could compensate for misunderstanding real user needs.

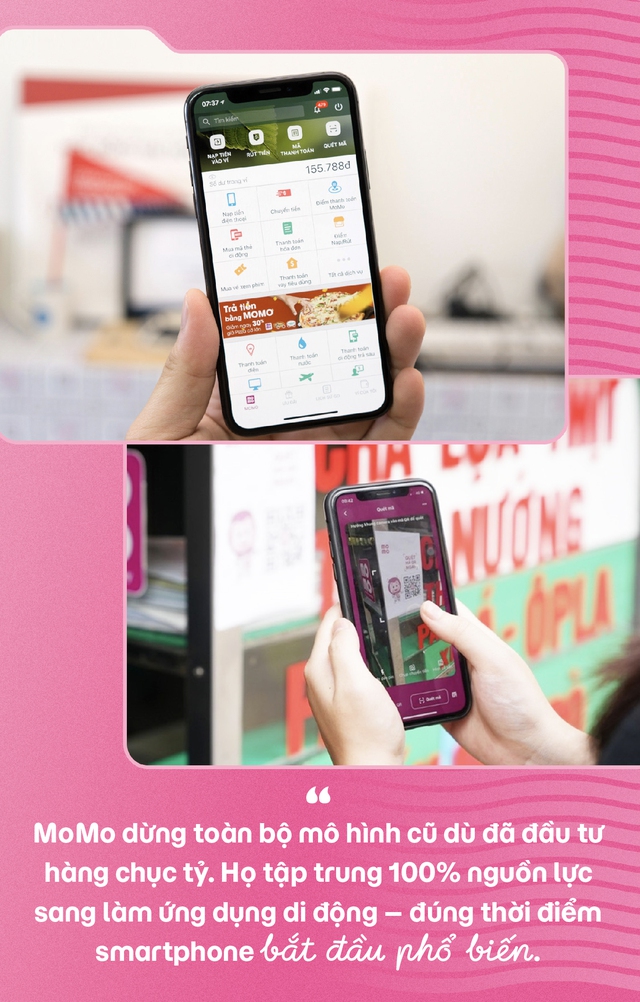

Instead of pouring more money into “perfecting” their technology like many startups would, MoMo halted their entire old model despite investing tens of billions. They redirected 100% of their resources into developing a mobile app—just as smartphones began gaining traction. This decisive move saved the company from premature failure.

Soon after, MoMo faced another existential challenge.

In 2012, when MoMo sought funding, many investors bluntly stated that fintech couldn’t survive in a limited ecosystem. Most digital wallets in Vietnam were backed by additional services like ride-hailing, food delivery, or online shopping. MoMo, as an independent fintech, focused on building its own core banking system, achieving PCI DSS Level 1 compliance, developing large-scale fraud prevention systems, and ensuring the capacity to handle millions of transactions without system crashes.

While this didn’t lead to explosive user growth, when Uber—their largest partner after two years of negotiation and just four months of collaboration—was acquired by Grab, which had its own ecosystem and payment partners, MoMo remained standing. Their independent foundation and capabilities ensured they didn’t rely on any single giant.

Over 15 years, MoMo has said “no” countless times: to seemingly great features users didn’t truly need, to reckless spending for artificial growth, to outdated models, and to chasing trends without the necessary infrastructure.

MoMo only says “yes” to strategies pragmatic enough to ensure survival for another month, quarter, or year—and to long-term paths ensuring their continued existence.

AI is the path MoMo has chosen. Since 2017–2018, MoMo has placed AI at the core of its technology strategy—not as a trend but as a necessity for survival.

With hundreds of millions of monthly transactions, no manual system could ensure safety, speed, and accuracy. Since then, MoMo has invested heavily in enhancing its tech infrastructure and applying AI across all business aspects. This technology not only addresses survival needs but also paves the way for sustainable growth, offering a diverse financial services ecosystem that retains users through value rather than promotions.

Today, MoMo boasts over 1,000 tech engineers, including 200 AI specialists, operating hundreds of machine learning models. Each transaction passes through 6–7 AI models—from real-time fraud detection and personalization to 24/7 customer support, operational optimization, and credit scoring for those without credit histories. Their computational power is backed by advanced GPU systems (16 H100 and 8 A100 GPUs), capable of processing vast real-time data. MoMo also meets the highest security standards, including PCI DSS Level 1, ISO 27001:2022, ISO 27701:2019, and Dynamic Liveness technology in eKYC.

MoMo has become a leading payment channel for online public services—a field demanding high security and stability, traditionally associated with banks or state infrastructure. Since 2019, MoMo has been integrated into the National Public Service Portal, handling 25–35% of all non-cash transactions and nearly 50% of university entrance fees. MoMo supports payments for tuition, hospital fees, taxes, and administrative services in 34 provinces; nearly 9,000 schools and over 200 hospitals have integrated MoMo. Notably, MoMo is one of the first private platforms to partner with the Ministry of Public Security in implementing e-authentication and online payments on VNeID—a significant step in digitizing public services.

This ecosystem comprehensively supports users’ financial needs, from payments to budgeting, risk prevention, savings, and access to small loans. This has fueled MoMo’s growth, deepening their understanding of over 30 million users’ behaviors and leveraging this insight to develop personalized financial products.

Reflecting on MoMo’s 15-year journey, in a landscape where 9 out of 10 startups fail within three years, their disciplined focus on seemingly small but critical tasks has been key to surviving multiple near-death experiences and becoming a nationally influential fintech group.

These lessons remain invaluable for any tech company aiming for long-term survival in Vietnam: focusing on what truly matters and maintaining long-term discipline isn’t just safe—it’s often the only path to success.

RMIT Expert Explores Digital Banking in the New Era: AI Empowers, Enhances, and Personalizes the Banking Experience

Paying for iced tea, parking via QR codes, and settling electricity and water bills through banking apps are becoming the new norms for consumers. This shift not only reflects evolving spending habits among Vietnamese citizens but also marks a significant leap forward for digital banking in Vietnam.

Strategic Partnership Signed Between Funding Societies Vietnam and Nam A Bank

On November 7th, Funding Societies Vietnam, a member of the Funding Societies Group – Southeast Asia’s leading financial platform for small and medium-sized enterprises (SMEs), signed a Memorandum of Understanding (MoU) with Nam A Commercial Joint Stock Bank – An Dong Branch. This partnership aims to pursue foreign currency funding for Vietnamese SMEs.

International Financial Hub: Localizing Innovation, Not Replicating It

Vietnam’s ministries, agencies, and localities are working diligently to finalize the legal framework and infrastructure necessary for the country’s International Financial Center to commence operations in November. Experts emphasize that while Vietnam has the advantage of learning from international experience, it must focus on localization rather than mere replication.

Unveiling Barron Trump’s Assets: A Closer Look at His Wealth and Holdings

Barron Trump, the youngest son of former President Donald Trump, is making headlines as his personal net worth is estimated to have reached a staggering $150 million, surpassing even that of his mother, former First Lady Melania Trump.