The Vietnamese stock market witnessed a volatile week of trading from December 8th to 12th. The benchmark index closed lower in 4 out of 5 sessions, notably plunging over 50 points in the final session and ending the week below 1,650 points.

Selling pressure intensified across the market, overwhelming buying demand, particularly for large-cap stocks. This resulted in the VN-Index recording four consecutive losing sessions. Conversely, mid- and small-cap stocks saw more active trading, notably in sectors like agriculture and food production that hadn’t experienced significant rallies previously. By week’s end, the VN-Index had shed over 94 points (-5.42%) to close at 1,646.89.

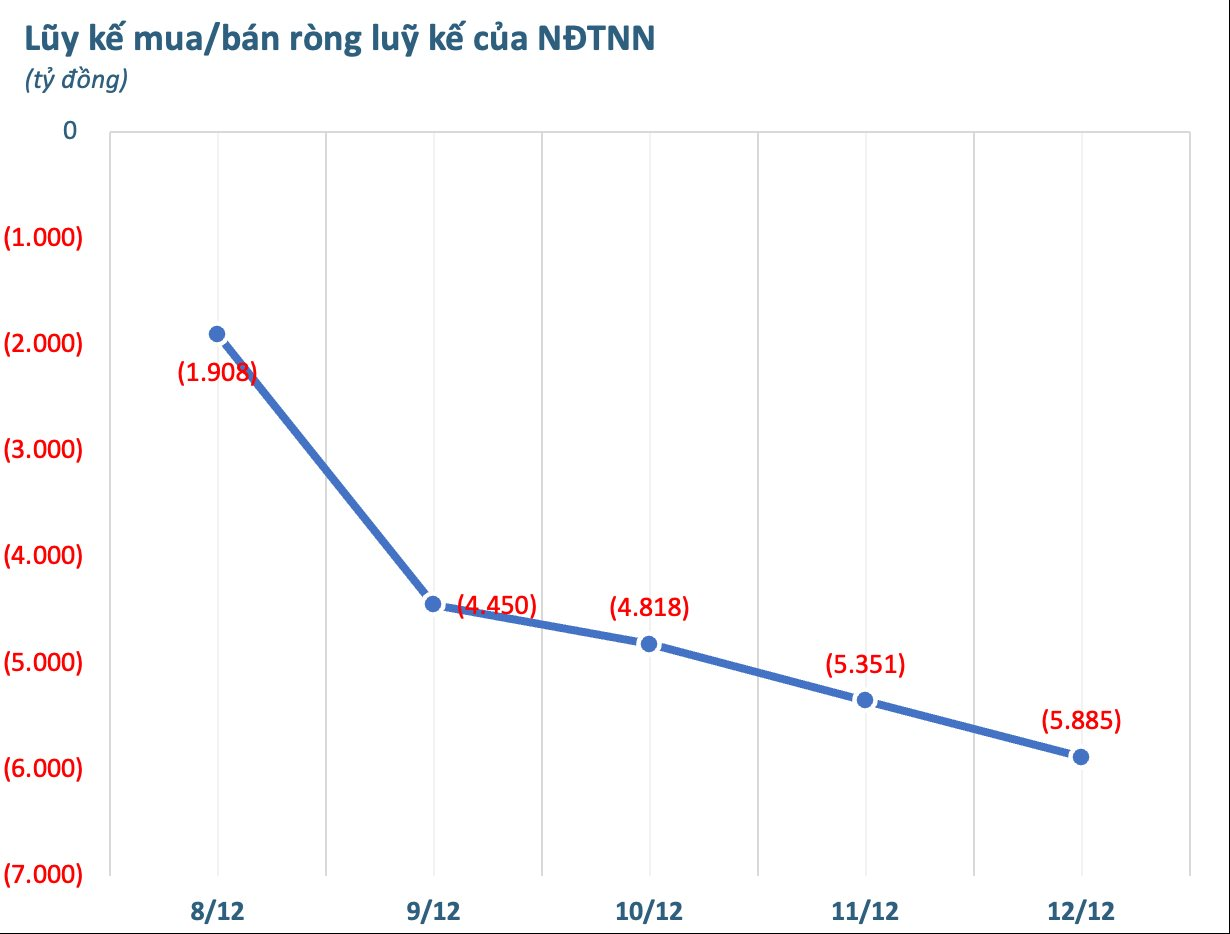

Foreign investors, after being net buyers the previous week, turned net sellers throughout the week. Over the five sessions, they offloaded a total of VND 5,885 billion across the market.

On individual exchanges, foreign investors were net sellers of VND 5,697 billion on HoSE, VND 116 billion on HNX, and VND 72 billion on UPCoM.

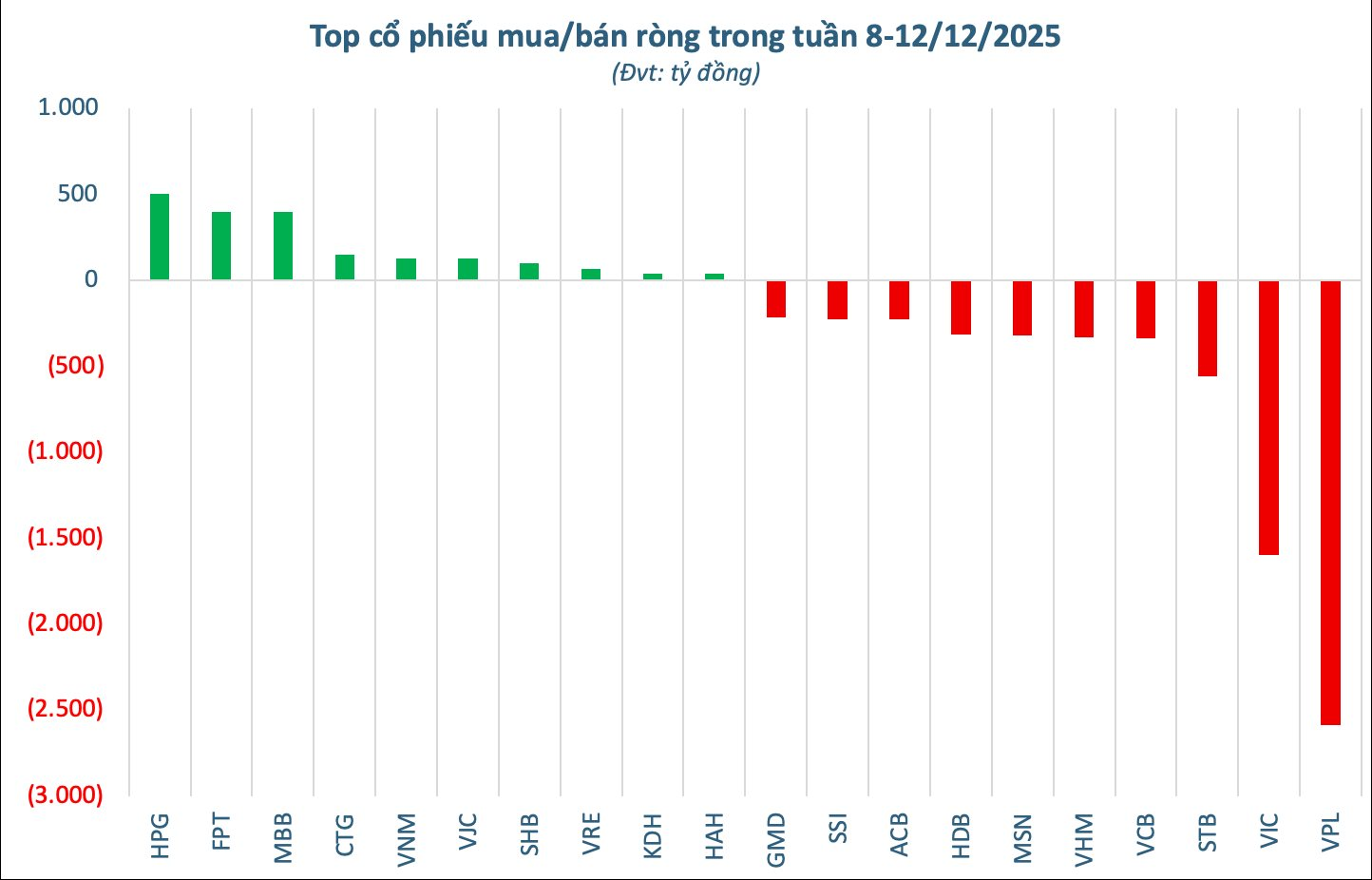

In terms of individual stocks, VPL was the most heavily sold, with net outflows of VND 2,588 billion, far exceeding other stocks. VIC followed with VND 1,597 billion in net selling, followed by STB (VND 557 billion) and VCB (VND 338 billion). Other large-cap stocks facing significant outflows included VHM (VND 330 billion), MSN (VND 320 billion), HDB (VND 314 billion), ACB (VND 230 billion), SSI (VND 227 billion), and GMD (VND 217 billion).

On the buying side, HPG led with net inflows of VND 501 billion, followed by FPT (VND 400 billion), MBB (VND 396 billion), CTG (VND 150 billion), and VNM (VND 126 billion). Other stocks attracting foreign buying included VJC (VND 124 billion), SHB (VND 101 billion), VRE (VND 65 billion), KDH (VND 37 billion), and HAH (VND 37 billion).

Why Did the VN-Index Plunge 52 Points in the Final Session of the Week?

The selling pressure from this group swiftly spread to real estate, stocks, and banking sectors, causing a sharp decline in many blue-chip stocks and fostering a negative sentiment that dragged the market downward.

How Does Becamex IDC Secure Funding Without Selling Shares?

Becamex IDC sought to publicly offer 150 million BCM shares, but the proposal failed to gain shareholder approval. The company has consistently turned to bond issuance as a means to secure capital.