In a recent article titled “Vietnam’s Stock Market Boom: Just the Beginning?” published by CNBC on December 9, the network highlights Vietnam’s rising prominence in the Asian market. “China, step aside. Vietnam is seizing a share of the spotlight from Asia’s largest economy,” CNBC emphasized.

Driven by robust stock market growth, domestic reforms, and trade developments, Vietnam has captured significant attention in 2025. The VanEck Vietnam ETF (VNM) surged approximately 62%, while the iShares MSCI China ETF (MCHI) lagged, rising only about 31%.

“Vietnam is truly making its own strides,” said Thea Jamison, Managing Director at Change Global, in an interview with CNBC. “Emerging markets offer far greater potential than China,” she added, labeling Vietnam as a “promising rising star.”

The primary driver of this growth is strong domestic retail investor demand. As a result, Vietnam’s stock market, already considered “ultra-cheap” compared to the U.S., has seen liquidity soar, with average daily trading volumes reaching up to $2 billion, according to Jamison.

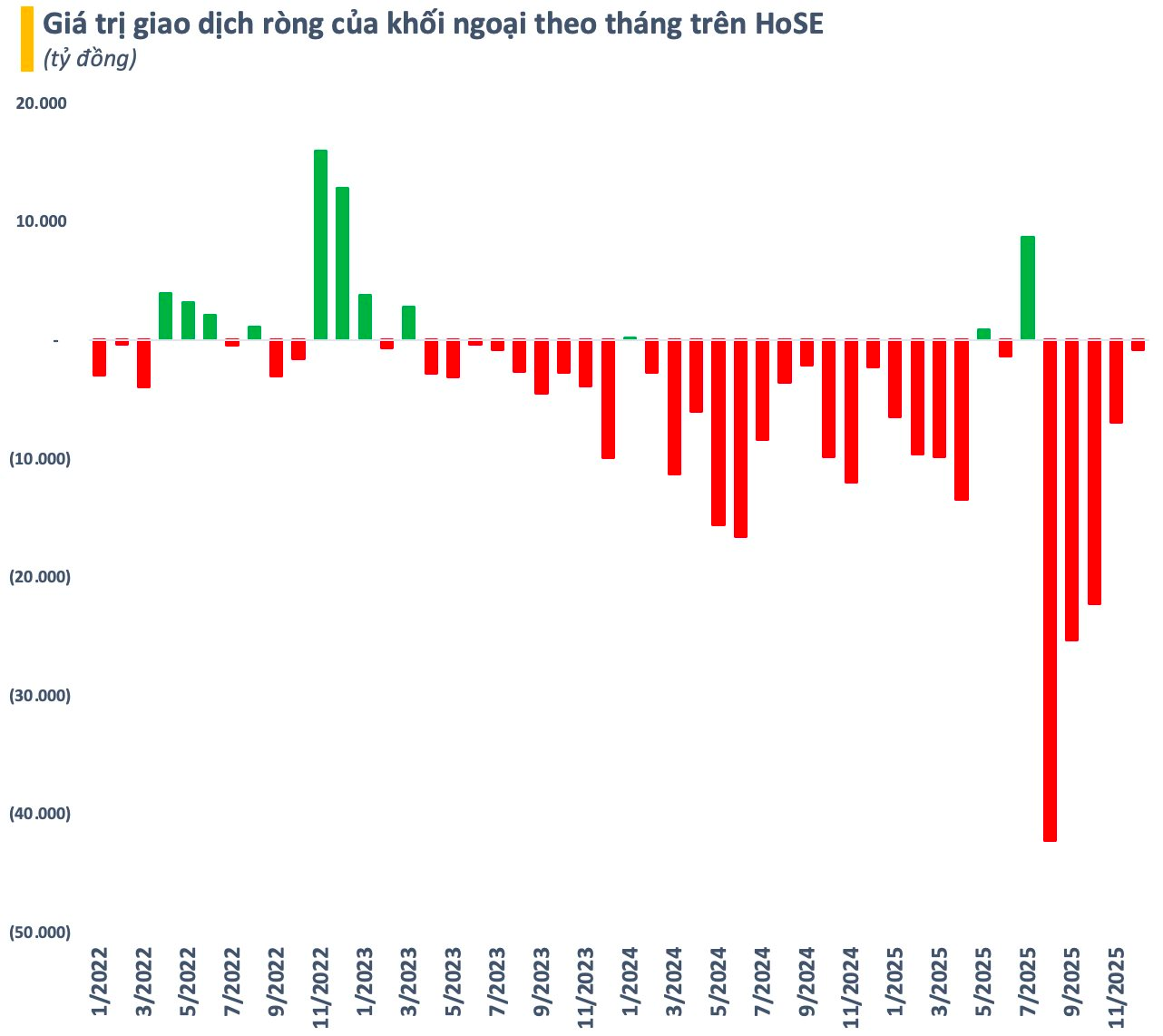

“Foreign investors have completely missed this rally. The market is increasingly independent of volatile foreign capital, relying instead on its own internal strength and domestic investor base,” Jamison noted. Foreign investors have net sold nearly $5 billion on HoSE since the start of 2025.

This trend is expected to shift soon. Market sentiment was further bolstered when FTSE Russell announced in October that Vietnam would be upgraded from frontier to secondary emerging market status, effective September 21, 2026. The decision was based on recent reforms, including the removal of pre-funding requirements for foreign investors.

Nguyễn Hoài Thu, CEO of VinaCapital, estimates the upgrade could attract an additional $5–6 billion in capital. “We are confident regulators will complete the remaining reforms, ensuring the upgrade proceeds as scheduled in September 2026,” she stated.

VinaCapital forecasts a more stable market in 2026, with corporate earnings potentially rising 15%. This aligns with expected stock market gains of 15–20%. “Valuations remain reasonable and continue to reflect profit growth potential,” Thu added.

Vietnam’s momentum extends beyond equities. To foster a more business-friendly environment, the government has implemented structural reforms aimed at driving economic growth.

However, risks persist. According to VinaCapital, geopolitical tensions, particularly U.S.-China relations, capital outflows from emerging markets, and currency pressures could dampen investor sentiment. Despite significant opportunities, U.S. investor engagement with Vietnam remains limited.

How Does Becamex IDC Secure Funding Without Selling Shares?

Becamex IDC sought to publicly offer 150 million BCM shares, but the proposal failed to gain shareholder approval. The company has consistently turned to bond issuance as a means to secure capital.

Unlocking Vietnam’s Vast Capital Market Potential in the New Era

With new equity capital reaching 10% of GDP and KRX infrastructure significantly boosting liquidity, experts believe the capital market is poised for a breakthrough, supported by an increasingly robust policy framework.

Stock Market Outlook for the Week of December 8-12, 2025: Storm Clouds Gather

The VN-Index plummeted relentlessly in the final session of the week, marking its steepest weekly decline since the tariff shock in April 2025. Pessimism is spreading as the market loses all support from blue-chip stocks, while buying power remains insufficient to counter the mounting selling pressure.