Mobile World Investment Corporation (stock code: MWG) has recently announced a summary of material information disclosure for the Board of Directors’ Resolution No. 13/NQ/HĐ QT-2025 dated December 12, 2025.

According to this resolution, Mobile World has approved the plan for its subsidiary, Dien May Xanh Joint Stock Company, to conduct an initial public offering (IPO) and list its shares on the stock exchange. This decision aligns with the company’s restructuring and business specialization strategy.

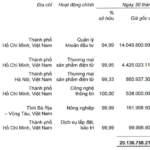

In November 2025, the Board of Directors of Mobile World Investment Corporation approved the restructuring of its subsidiaries to enhance business specialization. As a result, the retail segments of mobile phones, electronics, and home appliances (thegioididong, TopZone), Dien May Xanh, Erablue joint venture, pharmaceuticals (An Khang), and mother & baby products (AVAKids) will operate as independent legal entities. This restructuring aims to improve focus, autonomy, and operational efficiency.

The retailer stated that the strategic significance of Dien May Xanh’s IPO and listing has been thoroughly studied and considered by the Board of Directors, with plans for implementation in 2026.

Dien May Xanh stores are present across various provinces and cities.

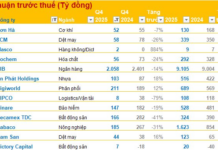

The Board of Directors of Mobile World views the IPO as a strategic shift, marking the beginning of a new growth phase. The company aims to sustain double-digit profit growth through quality-driven expansion.

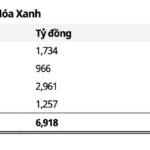

Strategic Roadmap to Eliminate Accumulated Losses, Paving the Way for Bach Hoa Xanh’s IPO

The MWG leadership believes now is the time for BHX to accelerate its vision for 2030. However, a recent report by Mirae Asset suggests that BHX’s potential IPO in the near future warrants close monitoring.

MWG Set to Execute Two Subsidiary Transfers Valued at Over 2.1 Trillion VND

MWG has recently approved the transfer of all shares in Thợ Điện Máy Xanh and Dược Phẩm An Khang Pharm, along with a strategic restructuring plan for its subsidiaries to focus on specialized business operations.