Specifically, by the close of the session on December 11th, QCG shares of Quoc Cuong Gia Lai JSC surged by 6.82%, reaching VND 16,450 per share, with the order-matched trading volume exceeding 2 million units.

This marks the second consecutive session where the stock hit its upper limit, boosting Quoc Cuong Gia Lai’s market capitalization to over VND 4,525 billion.

QCG shares unexpectedly surged in the last two sessions, despite the stock market’s sharp decline and liquidity drought.

Notably, QCG shares soared amidst a steep market downturn and dwindling liquidity.

In related news, the company recently announced a Board of Directors Resolution approving documents for a written shareholder consultation. The consultation period ends before December 16th.

To restructure finances and settle debts arising from a promise-to-purchase contract for the Bac Phuoc Kien Residential Area project with Sunny Island Investment JSC—a company linked to Truong My Lan (valued at VND 2,882 billion)—Quoc Cuong Gia Lai proposes shareholders approve the transfer of capital contributions in subsidiaries and affiliates this year.

Regarding business performance, in the first nine months, Quoc Cuong Gia Lai reported a 46% increase in net revenue to VND 354 billion. Pre-tax profit quadrupled year-on-year to VND 46 billion.

However, these figures fall short of the 2025 business plan approved by the Annual General Meeting, which targeted VND 2,000 billion in revenue and VND 300 billion in pre-tax profit.

Stock Market Continues Sharp Decline

Selling pressure dominated buying interest in the December 11th session, plunging the market into red territory. The VN-Index extended its steep decline for the third consecutive session.

At the close on December 11th, the VN-Index dropped 20.08 points to 1,698.9 points. The HNX-Index fell 0.61 points to 255.97 points. Bucking the trend, the UPCoM-Index rose 1.04 points to 120.15 points.

Market liquidity remained low, with total trading value across all three exchanges reaching just over VND 16,500 billion. On the HoSE alone, liquidity hit VND 15,250 billion, down VND 4,600 billion from the previous session.

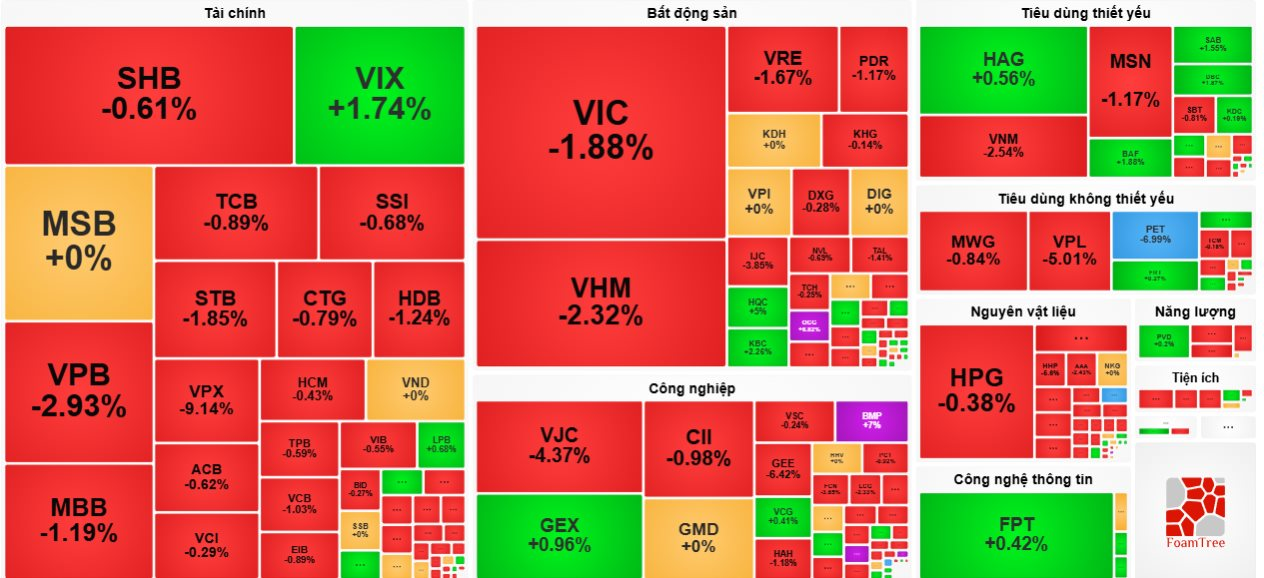

Red dominates the board as the VN-Index plunges for the third straight session.

Real estate stocks remained a market burden, with Vin-related shares leading profit-taking: VIC -1.88%, VHM -2.32%, VRE -1.67%, and VPL -5.01%. Other deep declines included IJC -2.85%, TAL -1.41%, PDR -1.17%, and BCM -1.06%.

Conversely, some real estate stocks surged: QCG +6.82%, KBC +2.26%, HQC +5%, SIP +1.12%, and LDG +1.04%.

Banking stocks remained in the red: VPB -2.93%, STB -1.85%, HDB -1.24%, MBB -1.19%, and VCB -1.03%.

Securities stocks also faced selling pressure: VPX -9.14%, TCX -2.61%, BSI -1.53%, AGR -1.87%, and FTS -1.2%.

Large-cap stocks weighed heavily on the index: VJC -4.37%, GEE -6.42%, VNM -2.54%, MSN -1.17%, BSR -1.04%, POW -1.63%, and GAS -1.42%.

Against the trend, some large-cap stocks in other sectors surged, helping the VN-Index avoid deeper losses. Binh Minh Plastics (BMP) hit its upper limit of 7%, closing at VND 169,700 per share. Other gainers included SAB +1.55%, DBC +1.87%, BAF +1.88%, and VIX +1.74%.

Foreign investors extended their net selling streak to five sessions, offloading over VND 500 billion. VIC led with VND 192 billion in net sales, followed by STB (VND 158.46 billion), VHM (VND 104.89 billion), GMD (VND 102.18 billion), and SHB (VND 63.73 billion).

On the buying side, foreign investors accumulated FPT shares worth over VND 240 billion, followed by MBB (VND 71.32 billion), VIX (VND 51.58 billion), VPL (VND 49.7 billion), and HPG (VND 33.8 billion).