Another significant decline in Vietnam’s stock market, yet several bright spots emerged. Notably, BMP shares of Binh Minh Plastics JSC continued their upward trajectory, turning “purple” and reaching VND 169,700 per share by the close of the December 11, 2025 session. This price is just 1% shy of its historical peak of VND 172,000 per share set in early November 2025.

Since the beginning of the year, BMP has surged by over 40%, outperforming the VN-Index. Consequently, its market capitalization has risen to nearly VND 13.9 trillion.

Recognized as Vietnam’s leading plastics company, BMP has maintained a steady rise on the stock exchange, driven by consistent business growth. Additionally, the stock has gained investor favor due to its regular cash dividend policy and high payout ratio.

Most recently, in early December, the company distributed an interim cash dividend of VND 532 billion to shareholders, at a rate of 65%. This means each shareholder holding one share received VND 6,500.

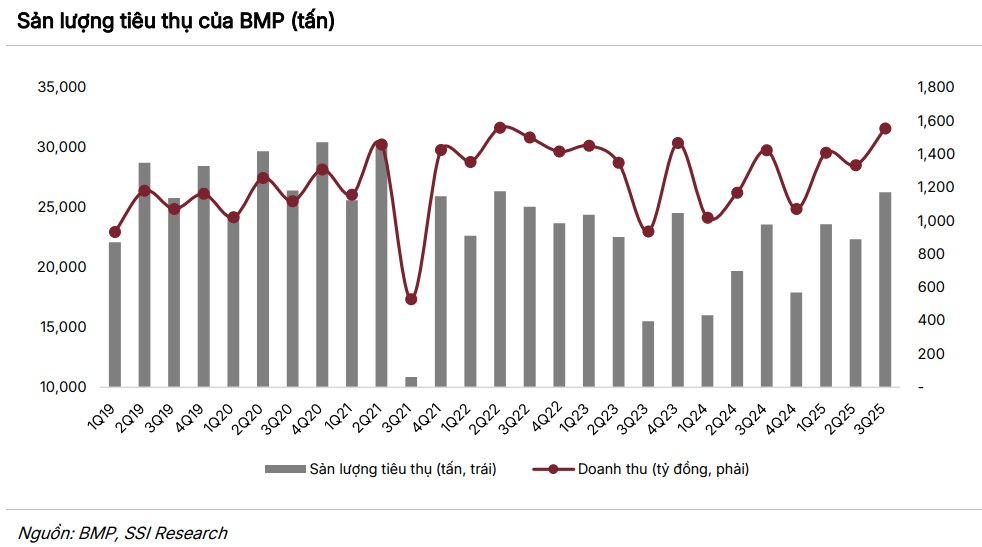

In Q3 2025, Binh Minh Plastics reported net revenue of VND 1,532 billion, a 9% increase compared to Q3 2024. The company’s gross profit margin improved from 43% in Q3 2024 to 48% in Q3 2025.

As a result, its after-tax profit reached nearly VND 351 billion, a 21% year-on-year increase.

This marks a new quarterly profit record since Binh Minh Plastics became a subsidiary of Nawaplastic Industries, a member of Thailand’s SCG Group, in early 2018. This result surpasses the previous record of VND 330 billion set in the prior quarter.

For the first nine months of 2025, Binh Minh Plastics’ net revenue totaled VND 4,224 billion, a 19% increase compared to the same period in 2024. After-tax profit reached VND 967 billion, a 27% year-on-year growth.

BMP’s Competitive Advantages

According to an update from SSI Securities (SSI Research), BMP’s competitive edge stems from its superior product quality compared to competitors. The “Product-Market Fit” approach and stringent supplier standards ensure BMP’s products meet certification requirements for the Australian market and other specific quality standards.

Binh Minh Plastics’ operational capabilities and quality advantages are further strengthened by: (i) increasing automation through collaboration between NPI Thailand, BMP, and AI Tech; (ii) improved operational efficiency, including the restructuring of the Long An factory and warehouse expansion (from 7,000 to 12,000 tons by 2026); (iii) diversified supply sources, with 80% from domestic suppliers—a benefit amid rising exchange rates; and (iv) optimized production processes.

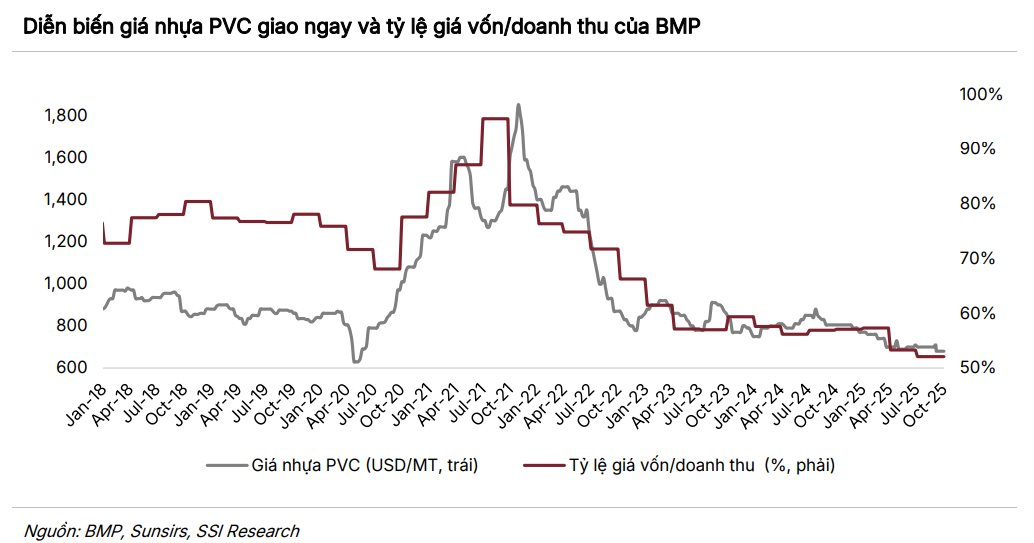

Furthermore, Vietnam’s plastics industry is projected to grow at a CAGR of 8.44–10% from 2026 to 2030. BMP aims to capitalize on this trend by expanding its regional market presence, enhancing product value, and maintaining cost competitiveness through operational efficiency. The company’s management targets a minimum annual growth of 10% in volume and revenue, though profit growth remains dependent on PVC input cost fluctuations.

Meanwhile, SSI anticipates PVC prices to remain low in Q4 2025 and the first half of 2026, barring any unexpected strong recovery in China’s industry. Lower oil prices (down 19% year-to-date), weakened downstream demand in China, and increased PVC capacity continue to pressure plastic resin prices.

“BMP is not concerned about supply disruptions, even if domestic producers shift to exports, thanks to its diversified supplier model. This provides the company with an added advantage, especially in a volatile market,” the report highlights.

Based on these analyses, SSI Research forecasts BMP’s Q4 2025 revenue at VND 1,253 billion and net profit at over VND 285 billion, representing 17% and 24% year-on-year growth, respectively. For the full year 2025, BMP’s net revenue is projected to reach VND 5,480 billion, with net profit at VND 1,270 billion, reflecting 19% and 28% growth compared to 2024, respectively.

Vietnam Stock Market Plunges 52 Points on December 12: Experts Explain the Reasons Behind the Sell-Off

The VN-Index plunged sharply in late trading, shedding over 50 points as numerous stocks hit their lower limits, despite the absence of any specific catalyst.

VPX Debuts on HOSE with a $2.4 Billion Valuation on December 11th

On December 11th, 1.875 billion VPX shares will commence trading on the HOSE at a reference price of VND 33,900 per share, propelling the company’s market capitalization to nearly VND 64 trillion and introducing a valuable addition of high-quality securities to the market.