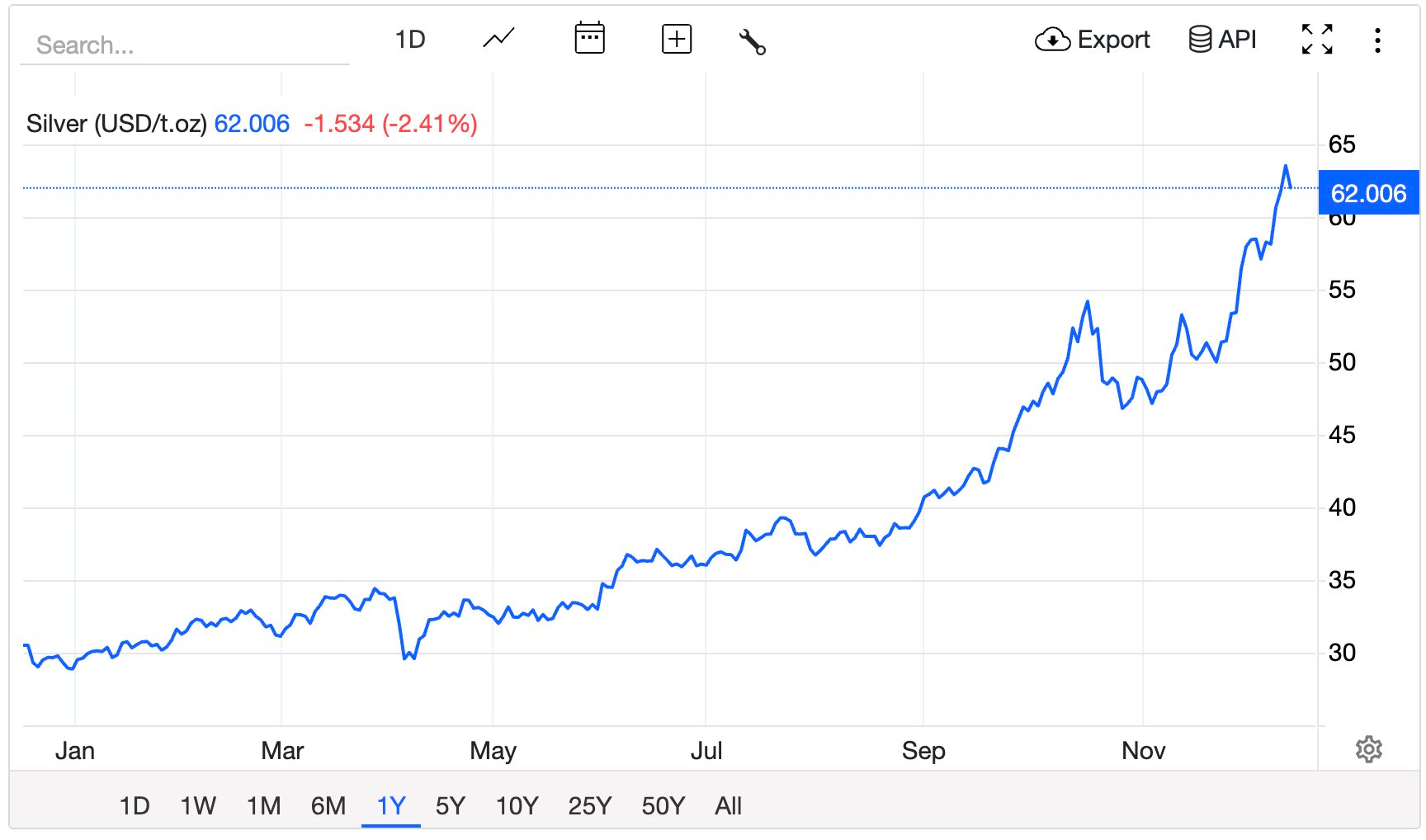

On December 12th, silver prices surged to a record high of nearly $64 per ounce, only to quickly retreat to $62. Despite this dip, silver has skyrocketed by approximately 100% since the beginning of the year.

Drivers of Silver’s Rally

Three key factors are propelling this precious metal’s ascent: a tightening supply, investors seeking safe havens amidst market volatility, and a surge in industrial demand as manufacturers require more silver for technological products. This combination has propelled silver’s rise even faster than gold in 2025.

Paul Williams, CEO of Solomon Global, a gold and silver trading firm, told CNBC that silver currently serves two crucial roles. It’s both an essential industrial material and a store of value during turbulent market conditions.

“Silver’s dual role – as a vital industrial metal and a value-preserving asset – continues to attract both individual and institutional investors,” Williams stated.

“For those who find gold increasingly inaccessible but still want to participate in the precious metals boom, silver presents an attractive alternative. All the factors supporting silver’s rally remain firmly in place; however, we should expect heightened volatility.”

Companies utilize silver in the production of electrical switches, solar panels, and mobile phones. This metal is also crucial in powering artificial intelligence systems. The Silver Institute’s December 10th report highlights the rapidly growing industrial demand.

“Silver’s exceptional electrical and thermal conductivity is becoming increasingly vital in the technological transformation shaping the global economy,” the Institute stated.

“Consequently, global industrial silver demand is projected to rise as key technology sectors accelerate over the next five years. Fields like solar energy, electric vehicles and their infrastructure, data centers, and AI will drive significant industrial demand growth until 2030.”

Experts Predict $100 Silver as Rally Gains Momentum

Williams first predicted silver reaching $100 in October when prices were near $50. He believes the metal will more than double by the end of 2026.

“With silver trading above $60, up roughly 25% in just one month, the trajectory remains on course,” he said.

“The supply-demand imbalance continues to drive silver prices higher, and the long-term fundamentals supporting this ‘Devil’s Metal’ are strengthening. Any pullbacks will likely be temporary rather than a trend reversal, due to the market’s structurally tight conditions. Silver’s outlook for 2026 is bright.”

Philippe Gijsels, Chief Strategist at BNP Paribas Fortis, also anticipates silver’s continued ascent.

“When undervaluation, prolonged supply deficits, and a new industrial revolution converge, the market creates ‘magic’,” Gijsels remarked. “That’s the story of silver in 2025.”

Gijsels believes silver could reach triple digits (surpassing $100 per ounce) in 2026, although he cautions that prices may experience volatility as some investors take profits.

He also referenced his joint research with economist Koen De Leus in the 2023 book “The New World Economy in 5 Trends.”

“We’re clearly in a long-term bull market that could easily propel silver to triple digits in 2026. This isn’t the end, but the beginning of a very exciting story.”

Silver Prices Surge Following Fed’s Interest Rate Decision

Today’s silver prices, both domestically and globally, have surged to unprecedented new highs, marking a significant milestone in the precious metals market.

The World’s Largest Silver Fund Sets Unprecedented Record Amid Price Surge

Since the beginning of the year, the world’s largest silver fund has seen a record net inflow of nearly $2.3 billion, acquiring almost 50 million ounces of silver (1,600 metric tons). This surge has propelled the fund’s assets under management past the $30 billion mark for the first time in history.

Today’s Crypto Market, December 6: Unusual Bitcoin Activity Spotted on Binance

Bitcoin inflows to Binance have surged over the past 30 days, with money flow tracking data showing volumes nearing their highest levels of the year.