The Ho Chi Minh City Stock Exchange (HoSE) has announced the results of the share auction for Petrosetco (PET), a subsidiary of the Vietnam National Oil and Gas Group (Petrovietnam, PVN). The auction, held on December 11, 2025, saw six domestic individual investors successfully acquire over 24.9 million PET shares, representing 23.21% of Petrosetco’s charter capital.

The winning bid matched the starting price of VND 36,500 per share. Each investor subscribed to purchase between 3 and 5 million shares. With the successful auction, PVN raised VND 909.4 billion.

The divestment aligns with the restructuring plan for Petrovietnam, approved by the Prime Minister in Decision No. 1243 in October 2023. By the end of 2025, PVN aims to fully withdraw its capital from Petrosetco.

As of September 30, 2025, Petrosetco’s other major shareholder is HDCapital, holding 14.47 million shares (13.48% of PET’s capital). HDCapital became a major shareholder in July 2025.

Petrosetco specializes in wholesale distribution of electronic and telecommunications equipment. Since 2020, as an authorized distributor for Apple, the company has shifted its focus to technology product distribution (ITC), which has become a core business segment.

In the first nine months of the year, PET reported an after-tax profit of VND 187 billion, a 65% increase year-on-year, despite a 2% decline in revenue to VND 14,216 billion. The company achieved 69% of its revenue target but exceeded its profit goal by 1%, surpassing profits from the previous three years.

Billion-Dollar Enterprise Surpassing Hoa Phat, Vinamilk, MB in Market Cap Set to List on HoSE

Listing on HoSE, as assessed by Vietcap, will enable this stock to access substantial capital from investors leveraging margin trading. Additionally, it will unlock opportunities to attract foreign investment through ETFs and actively managed funds.

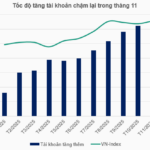

Lowest Number of New Individual Stock Accounts Opened in Four Months

In November 2025, Vietnam’s stock market saw an addition of over 237,000 investor accounts, marking the lowest monthly increase in the past four months. This trend reflects a more subdued liquidity landscape in the market.