Specifically, the Board of Directors has tasked the Executive Board with developing and ensuring the sale of six projects in 2026. These include a mixed-use tourism apartment complex, multi-functional office space combined with commercial services (Hàn River) in Da Nang, covering 0.8 hectares; an urban redevelopment and residential area in Bắc Hà Thanh, spanning 43.1 hectares in Gia Lai. The remaining four projects are located in Ho Chi Minh City (new), featuring the Thuận An 1 high-rise residential complex with an area of 1.81 hectares in Thuận Giao Ward; a commercial services hub, tourism apartments, luxury villas, and a high-end hotel spanning 5.5 hectares in Phước Hải Commune; the Poulo Condor tourism area covering 12 hectares in Côn Đảo Special Zone; and the redevelopment of an old apartment building at 239 Cách Mạng Tháng Tám, covering 0.3 hectares in Bàn Cờ Ward.

Notably, the Bắc Hà Thanh project (commercially known as Quy Nhơn Iconic) was launched in the first half of 2025. Thanks to Bắc Hà Thanh and the Kỳ Đồng project, PDR’s Q3 net revenue reached nearly 507 billion VND, compared to just 3 billion VND in the same period last year.

For the Thuận An 1 project, in Q4 2025, PDR transferred 79.01% of its capital contribution in Thuận An 1 High-Rise Real Estate Investment LLC, the project owner, reducing its ownership stake to 19.99%.

PDR stated that despite reducing its capital, the company will continue to oversee project development, coordinate construction progress, and ensure quality control. The proceeds from this transaction will enhance liquidity, enabling reinvestment in new strategic projects, including a key project in central Ho Chi Minh City currently undergoing investment procedure finalization.

The central Ho Chi Minh City project mentioned by PDR is likely the one at 239 Cách Mạng Tháng Tám. Shortly after the Thuận An 1 transaction, the company announced acquiring a 50% stake in AKYN Commercial Investment and Services JSC, the project developer, from Dai Quang Minh Real Estate Investment JSC. PDR plans to invest in the 239 project from 2026 to 2030, with an estimated total value of 5,500 billion VND.

According to PDR, the 239 Cách Mạng Tháng Tám transaction marks the company’s re-entry into the central Ho Chi Minh City market. This inner-city project is expected to yield high profit margins due to limited land availability and strong demand in the high-end segment. The capital divestment from Thuận An 1 and Q1 Tower in 2025 enabled PDR to quickly recover capital and secure funds for the 239 transaction.

Targeting nearly 45 trillion VND in revenue over the next 5 years

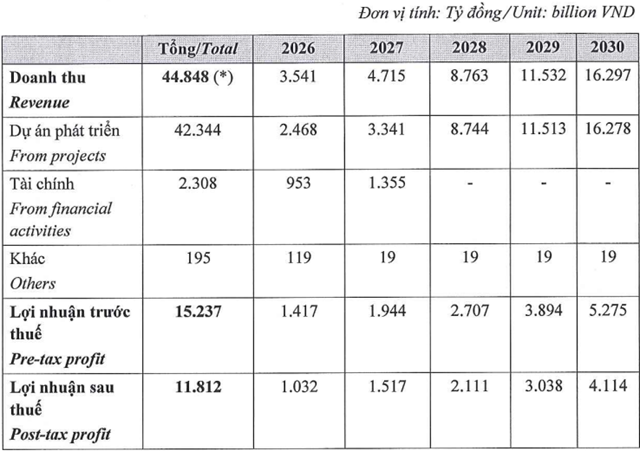

The Board of Directors’ resolution dated December 12 also outlines PDR’s 2026-2030 business goals, aiming for total revenue of over 44.8 trillion VND, with pre-tax and after-tax profits exceeding 15.2 trillion VND and 11.8 trillion VND, respectively.

|

PDR’s 2026-2030 Revenue and Profit Plan

Source: PDR

|

Of the projected 44.8 trillion VND in revenue, development projects will contribute over 42.3 trillion VND, including Hàn River, Bắc Hà Thanh, the high-end resort and hotel project in Phước Hải Commune, Poulo Condor tourism area, the 239 Cách Mạng Tháng Tám project, and the new Tan Binh urban area.

Financial activities are expected to generate 2.3 trillion VND through the transfer of the Thuận An 1 and 2 projects. The remaining 195 billion VND will come from other activities.

– 22:39 13/12/2025

Luxury Real Estate Hotspots

The real estate market is teetering on the brink of a potential bubble, as surging supply and inventory outpace accessible housing options for the population. In Vietnam, the average home price stands at a staggering 20 to 30 times the annual per capita income, a stark contrast to the United States, where this ratio hovers around a more manageable 4 to 5 times.

BGI Group Secures Billions in Loans from Chairman

On December 5th, the Board of Directors of BGI Group Joint Stock Company (HNX: VC7) passed a resolution approving a maximum loan of VND 27 billion from Chairman Hoang Trong Duc. The loan carries an annual interest rate of 5% and will be utilized to support the company’s production, business operations, and investment activities.