The VN-Index experienced a sharp decline, dragging steel stocks down by 3-6%. Notably, Pomina Steel’s POM shares defied the trend, surging impressively.

Closing the December 12th session, POM hit its upper limit, even reaching a “zero sell” status at VND 4,200 per share, marking its 6th consecutive ceiling session. The buying demand at the ceiling price was substantial, with nearly 16 million shares, equivalent to 5.6% of the total outstanding shares.

This rally propelled POM’s price to its highest level in nearly two years (since April 2024). Remarkably, this resurgence occurred while the stock was under trading restrictions, only allowed to trade on Fridays.

Recently, Pomina’s Board of Directors called for an extraordinary meeting in December to approve the 2025 Q3 financial report and a restructuring plan. Details of the restructuring remain undisclosed. This isn’t Pomina’s first attempt at revival.

In 2024, Pomina partnered with Japan’s Nansei Steel to restructure by selling a 51% stake. However, legal restrictions on foreign ownership prevented the deal. Domestic partnerships with Thaco Industries also failed.

This restructuring effort gains attention due to Pomina’s ties with VinMetal, a Vingroup subsidiary. VinMetal, established in October, recently increased its charter capital to VND 15 trillion.

Notably, before the capital increase, VinMetal appointed Mr. Do Tien Si as CEO and legal representative. Mr. Si (born 1967), currently Pomina’s CEO and Vice Chairman, is a veteran in Vietnam’s steel industry with over 30 years of experience.

In a related development, Vingroup, through VinMetal, announced a 0% interest working capital loan to Pomina for up to 2 years. This preferential funding will help Pomina improve cash flow, restore supply chains, stabilize production, and gradually recover financial performance.

Additionally, Vingroup will prioritize Pomina as a steel supplier for its subsidiaries like VinFast, Vinhomes, and VinSpeed, ensuring sustainable demand. This aligns with Vingroup’s plan to increase local material usage in its Vietnamese projects.

A Glorious Past: Once a Rival to Hoa Phat

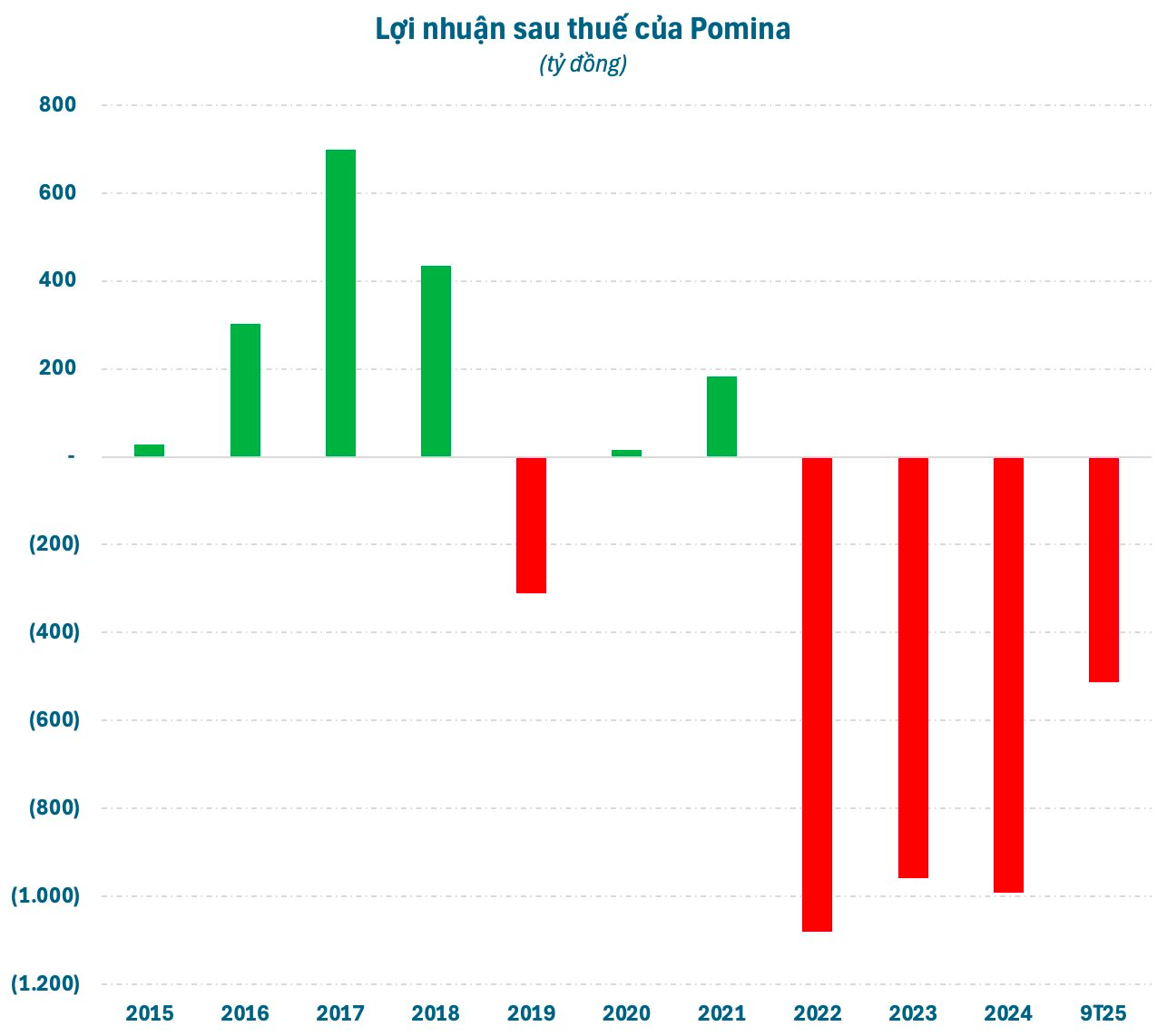

Financially, Pomina reported losses exceeding VND 1 trillion annually from 2022-2024. In 2025 Q3, losses surpassed VND 500 billion, pushing accumulated losses past VND 3 trillion, resulting in negative equity.

Historically, Pomina Steel enjoyed profitable years with earnings between VND 400-700 billion. However, post-boom, profits declined sharply, leading to significant losses.

Due to losses and information disclosure violations, Pomina was delisted from HoSE in May 2024. POM shares now trade on UPCoM, a setback for this once-leading steel producer, reflecting ongoing challenges.

Founded in 1999, Pomina operated three steel mills with a combined capacity of 1.1 million tons of construction steel and 1.5 million tons of billets annually. It was once Vietnam’s largest steel producer with a 30% market share, later overtaken by Hoa Phat.

Expert Insight: Equilibrium Point Imminent as Two Stock Groups Enter “Oversold” Territory

Anticipating next week’s market trends, most experts agree that prices have entered an attractive range following a significant correction. However, investors should remain cautious, closely monitoring developments and only committing funds once the index establishes a new equilibrium zone.

Vietstock Weekly: December 15-19, 2025 – Rising Risks Ahead?

The VN-Index plunged dramatically, marked by the emergence of a Big Black Candle pattern, while slicing below the Middle line of the Bollinger Bands. Trading volume persistently remained below the 20-week average, indicating investors are still gripped by caution. With the MACD indicator widening its gap from the Signal line following a sell signal since late October 2025, market volatility is likely to persist in the near term.

Billionaire Pham Nhat Vuong’s Stocks Witness Surging Accumulation by Brokerage Proprietary Trading Desks on December 11th Session

Proprietary trading desks at securities companies executed a net buy of VND 192 billion on the Ho Chi Minh Stock Exchange (HOSE).

QCG Stock Plunges for the Second Consecutive Session as VN-Index Takes a Sharp Dive

Amidst a declining market, Quốc Cường Gia Lai’s QCG stock defied the trend, surging to its upper limit for the second consecutive session on December 11th. This remarkable performance stands in stark contrast to the benchmark VN-Index, which continued its downward spiral, shedding over 20 points during the same trading day.