|

The pilot phase, extended until the end of 2025, has largely achieved its goal of validating the technical feasibility and market acceptance of mobile money payment models. Mobile money is now entering a new phase with a fresh legal framework proposed by the State Bank of Vietnam (SBV).

The Numbers Speak

The pilot phase has generated a significant dataset, providing policymakers with a basis to assess the effectiveness and risks of the mobile money model.

As of Q1-2025, Vietnam recorded over 10.38 million registered and active mobile money accounts, according to the SBV. This is a notable figure, considering the service has only been operational for about 3-4 years. More significantly, over 71% of users (approximately 7.4 million accounts) are from rural, mountainous, remote, and border areas.

This indicates that mobile money is effectively targeting the intended demographic: individuals without bank accounts or limited access to banking services. These areas are often underserved by traditional commercial banks due to the high costs of establishing branches, transaction offices, and ATMs relative to potential revenue. In this context, mobile money services, operating as a “branchless bank,” have filled this gap.

The ecosystem of acceptance points has also expanded, with 11,884 merchant locations and over 276,239 payment acceptance units. These points, located in villages and hamlets, allow residents to conveniently deposit and withdraw cash, acting as “rice-powered ATMs” that solve a critical issue in financial inclusion.

However, compared to the 120 million active mobile subscriptions and the adult population, the penetration rate of mobile money remains modest and has not yet achieved the expected network effect.

|

In a hypothetical risk scenario, if a criminal group controls 100 fraudulent SIM cards with fake identities, they could transfer up to 10 billion VND monthly outside the formal banking system—a significant threat to financial security. |

The pilot framework still faces several challenges. Firstly, the monthly transaction limit of 10 million VND confines mobile money to a “small wallet” role, primarily used for purchasing phone cards and paying small bills, rather than becoming a primary account for monthly expenses. This limit is a major barrier, making mobile money less competitive compared to e-wallets or QR code payments.

Additionally, the requirement that SIM cards must be activated and used continuously for at least three months to qualify for a mobile money account is a significant hurdle. This condition inadvertently excludes many potential customers, such as industrial zone workers, new students, and migrant workers, who frequently change SIM cards. This technical barrier has slowed user growth during the pilot phase.

The Draft Decree: A New Framework for Mobile Money

The challenges of the pilot phase, coupled with current economic demands, have made the issuance of a formal decree replacing the pilot mechanism urgent. The SBV’s draft decree aims to both refine the legal framework and stimulate market growth, shifting from a tightly controlled pilot approach to a more development-oriented, regulated model, and from ex-ante to ex-post supervision.

Adjusting Transaction Limits

The draft decree (Article 15) proposes increasing the total transaction limit (withdrawals, transfers, payments) to a maximum of 100 million VND per month per customer with a single service provider. Notably, this limit does not apply to essential services and public utilities such as electricity, water, telecommunications, tuition, medical fees, social insurance, health insurance, insurance premiums, and bank loan repayments.

This tenfold increase is expected to have a dual economic and social impact. Functionally, a 100 million VND monthly limit is essential for mobile money to evolve from a utility payment channel into a genuine consumer financial tool. It enables rural residents to accumulate savings, transfer funds for agricultural product purchases, and acquire high-value agricultural supplies without handling cash.

Excluding essential services from the limit also promotes the cashless payment initiative in public services, fostering digital payment habits for basic social welfare needs.

However, expanding transaction volumes increases the risk of money laundering and terrorism financing. Higher limits could enable criminals to fragment large transactions into smaller ones, evading detection.

In a hypothetical risk scenario, if a criminal group controls 100 fraudulent SIM cards with fake identities, they could transfer up to 10 billion VND monthly outside the formal banking system—a significant threat to financial security. This places considerable pressure on telecom operators to enhance their suspicious transaction detection mechanisms, requiring upgrades in both technology and processes to build an effective risk filter commensurate with the expanded transaction scale.

Enhancing Customer Identification Processes

The draft decree eliminates the requirement for SIM cards to be activated and used continuously for at least three months. Removing this barrier allows customers to register and use services almost instantly, a strategic move to attract younger and migrant workers who value flexibility.

To replace the passive risk screening based on SIM card age, the new legal framework introduces a more proactive and rigorous identification process. According to Articles 8, 11, and 12, service providers must collect biometric data and verify customer information against chip-embedded citizen ID cards.

However, removing the “three-month protection” while fraudulent SIM cards remain prevalent could increase security risks. If telecom operators’ eKYC systems are not robust enough to detect sophisticated fraud like deepfakes or identity theft, criminals could exploit this to activate numerous fake accounts for scams or online gambling.

To mitigate risks, the draft decree mandates real-time verification or direct authentication via chip-embedded citizen ID cards for all financial feature activations. This serves as a critical security checkpoint, ensuring account holder legitimacy and preventing illicit funds from entering the system.

Advancing Cross-Border Payments

A groundbreaking aspect of the draft decree is the expansion of mobile money’s geographic scope. Service providers will be permitted to facilitate payments for goods and services abroad, bringing mobile money closer to international payment tools like credit cards (Visa/Mastercard) and major e-wallets. This opens opportunities for rural residents—often underserved by traditional banking—to participate in global e-commerce, pay tuition online, and purchase digital products without payment method restrictions.

However, this expansion requires stringent macro-risk management. To ensure compliance with the Foreign Exchange Ordinance and prevent illegal capital outflows, all international payment and settlement activities must be routed through licensed foreign exchange banks. In this model, banks act as “gatekeepers,” verifying transaction documents and purposes before funds leave the country.

Addressing Technological Challenges

While the legal framework clearly defines roles, operational challenges remain significant, particularly in technology. The core issue is integrating systems between telecom operators and banks to monitor the true purposes of millions of daily small-value transactions, identify suspicious activities without system congestion, and maintain user experience.

The formalization of mobile money through the decree is both inevitable and a vital component of Vietnam’s inclusive finance strategy. However, expanded transaction limits and capabilities must be accompanied by proportional risk management, with a flexible governance mechanism acting as a “safety brake” alongside a transparent legal framework. Rigorous identification processes and decisive action against fraudulent SIM cards are prerequisites. If executed effectively, mobile money can drive the cashless society agenda and ensure inclusive development, leaving no one behind in the digital era.

Luu Minh Sang (University of Economics and Law, Vietnam National University – Ho Chi Minh City)

– 07:00 13/12/2025

Top 100 Global Chinese Conglomerate Eyes Investment Opportunities in Quang Tri

Mr. Yan Jiehe, the visionary founder of Pacific Construction Group—a leading Chinese private enterprise ranked among the world’s top 100 corporations—recently visited Quang Tri. During his visit, he expressed a strong interest in establishing a regional representative office and committing significant investments to urban infrastructure, transportation, and seaport projects in the province.

Unlocking Innovation: The Imperative of Local Technology Development

At TECHFEST Vietnam 2025 on the evening of December 13th, Prime Minister Pham Minh Chinh emphasized that developing domestic technological capabilities is an imperative choice to build an independent, self-reliant economy while deeply integrating with the global community.

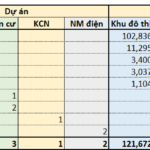

Exclusive Investment Opportunity: December 6-12, 2025 – 5 Mega Urban Projects, Nearly $5.3 Billion in Capital

During the week of December 6–12, 2025, nine provinces and cities attracted investment for 11 projects, totaling over 132 trillion VND. Notably, the Phu Tho Eco-Complex Urban Area project stands out with an investment of more than 102.8 trillion VND. Additionally, one industrial zone and two biomass power plants were also part of the investment calls.