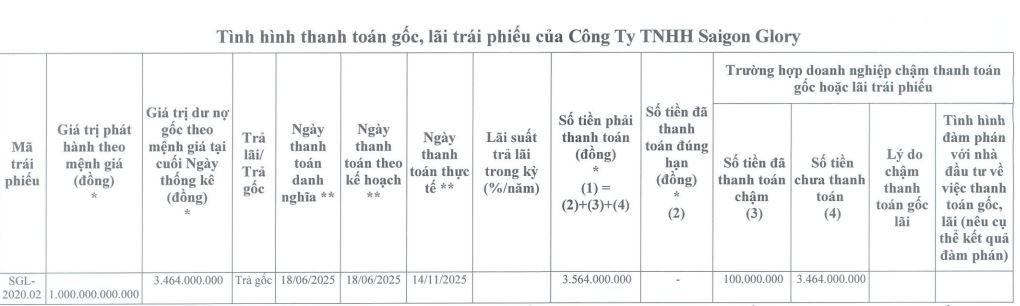

According to a report submitted to the Hanoi Stock Exchange (HNX) on November 14, 2025, Saigon Glory failed to make a timely interest payment of approximately VND 3.5 billion due on June 18, 2025, for its CGL-2020.02 bond issuance.

CEO Nguyen Vu Hai did not provide a reason for the delayed payment.

Source: HNX

|

In an August report on bond repayment for the first half of 2025, the company attributed its non-compliance to staffing shortages during the pre-ownership transition period (before October 2024). During this time, the company prioritized financial planning and seeking bondholder approval for extensions on principal and interest repayments. Following the change in ownership, the company has complied with disclosure requirements regarding buybacks, swaps, conversions, and other material information.

However, the company has yet to disclose its 2024 and first-half 2025 financial statements on HNX. Additionally, a report dated August 26 revealed that the company has not provided financial statements or bond utilization reports for the first half of 2023, full year 2023, and first half of 2024 for all ten bond issuances from SGL-2020.01 to SGL-2020.10, as required by the respective bond documents.

Saigon Glory’s new owner is in the process of rebranding One Central Saigon (also known as The Spirit of Saigon). Market rumors suggest the new owner plans to bring the legendary six-star Ritz-Carlton brand from the United States to develop this controversial project, which has changed hands multiple times.

During a press conference on November 20, the Ho Chi Minh City Department of Construction confirmed that The Spirit of Saigon megaproject received a construction commencement notice from the developer on November 11, 2025. The project’s timeline has been extended by 48 months, effective October 16, 2025.

How UOB Quietly Entered Vietnam’s Real Estate Market

The Spirit of Saigon Megaproject Resumes Construction in Ben Thanh Quadrilateral

– 2:10 PM, December 15, 2025

Real Estate 2026 Amid Rising Interest Rates: How Does It Differ from the 2022 Freeze?

As the year-end interest rates creep upward, the real estate market in 2026 faces a pivotal moment. Will history repeat itself, echoing the tense scenarios of four years prior, where investors were forced into distress sales and cut their losses? The question looms large, leaving stakeholders to ponder the potential trajectory of the market in the coming months.