According to Vietnam Customs statistics, cotton imports in November reached over 106,000 tons, valued at more than $173 million, marking a decline in both volume and value.

Since the beginning of the year, Vietnam has imported over 1.5 million tons of cotton, worth over $2.6 billion, reflecting a 13% increase in volume but a 1% decrease in value compared to the same period last year.

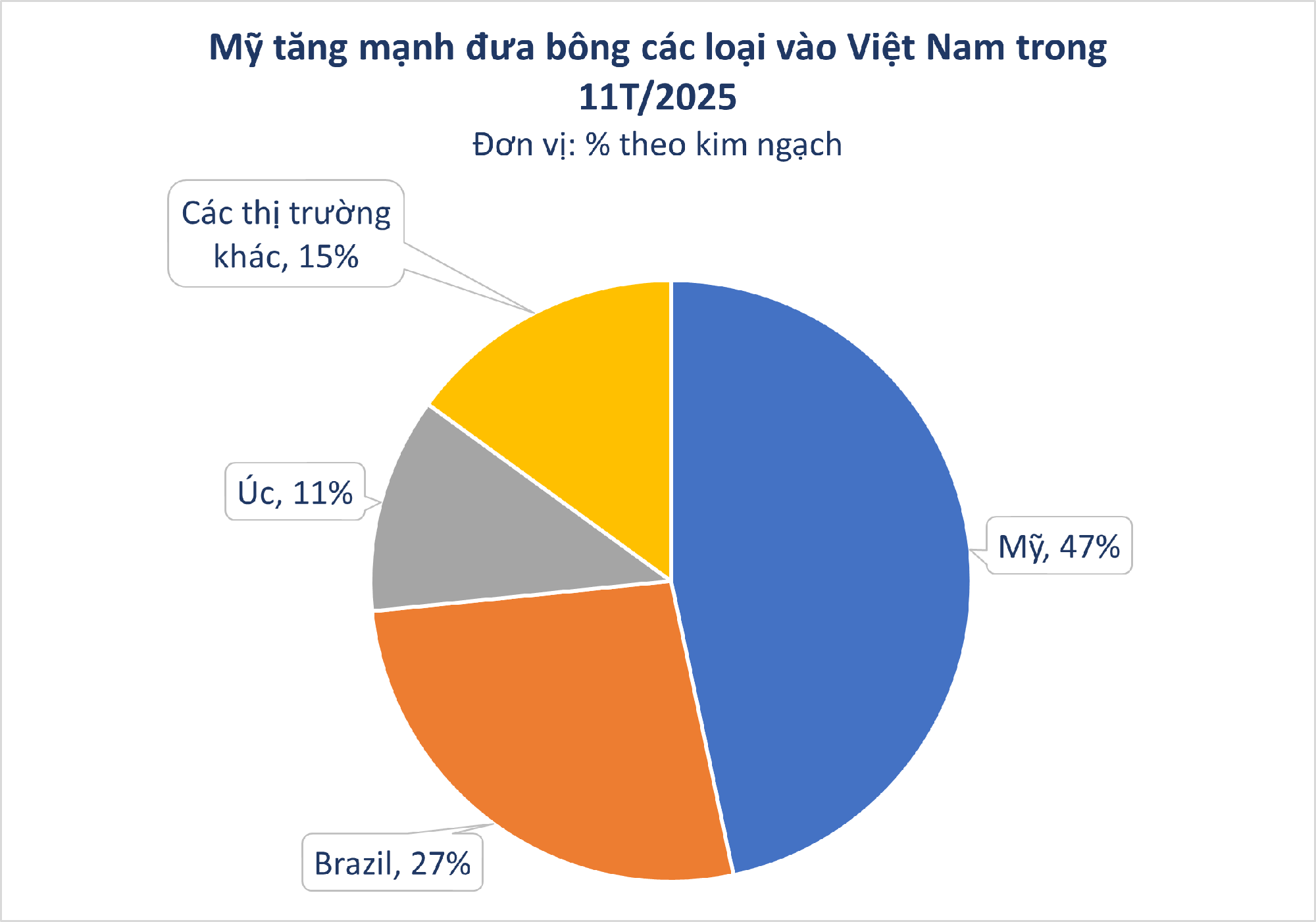

In the first 11 months, the United States was Vietnam’s largest cotton supplier, accounting for nearly 47% of imports, with 723,000 tons valued at $1.27 billion. This represents a significant surge of nearly 130% in volume and 94% in value compared to the same period in 2024. In October alone, the increase reached 141% in volume and 135% in value.

The substantial growth in imports is attributed to a 15% decrease in average prices compared to the same period. The U.S. has consistently maintained its position as Vietnam’s top cotton supplier over the past year.

Brazil ranks second, with 414,000 tons imported in the first 11 months, equivalent to $714 million, showing an increase in volume but a decrease in value. Imports from Australia continued to decline sharply in both volume and value.

Vietnam is the world’s third-largest cotton importer, consuming 1.5 million tons annually. It also ranks as the sixth-largest exporter of yarn and the third-largest exporter of textiles and apparel globally, following China and Bangladesh.

The acceleration in Vietnam’s cotton imports from the U.S. coincides with a sharp decline in U.S. cotton exports to China during the first half of 2025, as reported by the London Stock Exchange Group (LSEG). U.S. cotton exports to China plummeted by 90% in the first six months of 2025, while exports to other Asian countries like Pakistan, Turkey, and Vietnam nearly tripled.

This shift reflects the relocation of textile production due to U.S. tariffs on China. The apparel industry has been moving production from China to South and Southeast Asia for years, driven by lower labor costs. In the 2025/26 fiscal year, U.S. cotton exports are projected to reach approximately 12 million bales, continuing a steady growth trend.

The robust growth of Vietnam’s textile and apparel industry has directly fueled the rapid increase in raw cotton import demand. In the first 11 months of 2025, Vietnam’s textile and apparel exports rebounded impressively after a period of decline, reaching nearly $40 billion, a 6% increase year-on-year. Yarn and textile enterprises, particularly those exporting to the U.S., EU, and Japan, are expanding capacity, leading to a growing demand for raw cotton.

According to the Vietnam Textile and Apparel Association (VITAS), domestic spinning mills are operating at high capacity, especially in key production hubs such as Binh Duong, Dong Nai, Nam Dinh, and Thai Binh. The expansion of export orders in Q3 and Q4/2025, coupled with the shift of orders from China and Bangladesh to Vietnam, has made imported cotton a strategic raw material for ensuring continuous production.

The combination of increased textile orders and high-quality cotton supply is creating a sustainable value chain, solidifying Vietnam’s role as a global textile production and export hub.

Vietnam’s Exports to China Plummet 90% as U.S. Surges in Critical Commodity Shipments, Positioning Vietnam as World’s 3rd Largest Importer

Vietnam consumes 1.5 million tons of this commodity annually, primarily to support its domestic textile industry.