ACB Securities Company Limited (ACBS) has recently approved the plan to publicly issue its first batch of bonds in 2025.

Accordingly, ACBS plans to issue non-convertible, unsecured public bonds with a total volume of 30 million bonds, valued at 3,000 billion VND.

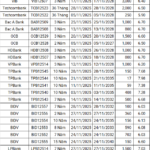

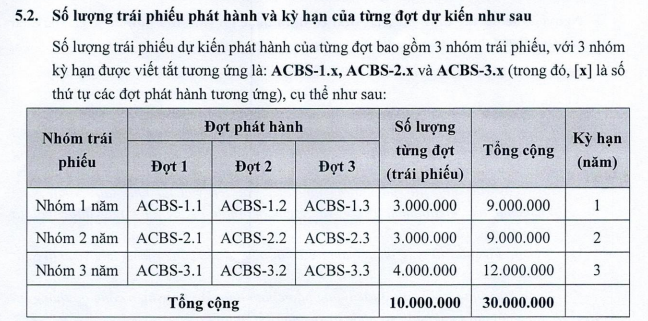

Each bond will have a face value of 100,000 VND. The issuance is expected to occur in three phases, with varying quantities and terms for each phase, as detailed below:

Source: ACBS

The issuance is scheduled to take place from Q4/2025 to Q4/2026. Individual investors can register to purchase a minimum of 100,000 VND, while institutional investors must register for a minimum of 1 million VND.

The bonds will offer a fixed and/or floating interest rate, capped at 7.5% per annum, depending on the issuance phase. The first phase is expected to feature a fixed interest rate.

ACBS reserves the right to repurchase up to 100% of the issued bonds starting from the 12th month after the issuance date. The proceeds from the bond issuance will be entirely allocated to proprietary trading activities, with disbursement scheduled for 2026.

In recent developments, ACBS has relieved Mr. Lê Hoàng Tân of his duties as Deputy General Director and Ms. Đinh Nguyễn Hoài Hương as Director of Business Operations at the Mạc Đĩnh Chi Branch – Sales & Customer Service Department 01, effective from December 12, 2025.

In November 2025, ACBS was fined by the State Securities Commission (SSC) for administrative violations in the securities and stock market sector under Decision No. 410/QĐ-XPHC dated November 12, 2025.

ACBS was fined 275 million VND for failing to ensure that the information in the private bond issuance dossier complied with the required content as stipulated.

Specifically, the Information Disclosure Statements (IDS) issued prior to the bond issuance on July 23, 2024, and August 21, 2024, for the 2024 private bond issuance dossier of Vietnam International Commercial Joint Stock Bank (advised by ACBS) were incomplete:

Section 1.0, Chapter IV, on the plan for using the proceeds from the issuance, did not specify the disbursement timeline as required.

Additionally, ACBS was fined 65 million VND for failing to submit reports within the legally mandated timeframe. Specifically, the company delayed submitting the 2024 Money Laundering Risk Assessment Report, the 2025 Semi-annual Risk Management Report, and the 2024 List of Securities Practitioners.

Consequently, ACBS was fined a total of 340 million VND.

November Bond Issuance Declines

The private bond market recorded approximately VND 35 trillion in November, marking the second-lowest level since April 2025, amid rising deposit interest rates in the final months of the year.

Real Estate Firm Fined for Bond Violations

BNP Global Real Estate Joint Stock Company has been fined VND 92.5 million by the State Securities Commission for violations related to its bond issuance activities.