An Binh Securities JSC (ABS, Stock Code: ABW, UPCoM) has announced a written shareholder vote on two capital increase proposals, totaling up to VND 2,073 billion. The voting period ends at 5 PM on December 25, 2025.

First, ABS plans to issue 202.3 million shares to existing shareholders at a 1:2 ratio, allowing each shareholder to purchase two new shares for every one held. These shares will be unrestricted for transfer.

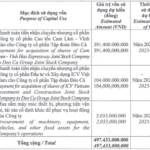

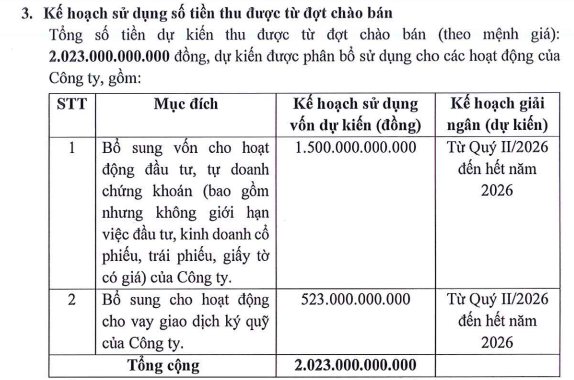

The offering price is set at VND 10,000 per share, aiming to raise VND 2,023 billion. ABS intends to allocate VND 1,500 billion for proprietary trading and the remaining VND 523 billion for margin lending. Disbursement is scheduled from Q2 2026 through year-end.

Source: ABS

Second, An Binh Securities aims to issue 5 million shares under an Employee Stock Ownership Plan (ESOP). These shares will have a one-year transfer restriction.

Scheduled for Q2 2026 following the completion of the existing shareholder offering, the ESOP is expected to raise VND 50 billion, which will be allocated for margin lending and disbursed from Q2 2026 through year-end.

If both issuance plans are successful, An Binh Securities’ chartered capital will increase from VND 1,011.5 billion to VND 3,084.5 billion.

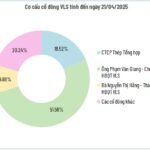

Established in 2006, An Binh Securities has Geleximco Group as its largest shareholder, holding 45.85% of the company’s capital as of September 30, 2025.

In Q3 2025, the company reported a 59% year-on-year increase in operating revenue to nearly VND 141 billion. Operating expenses rose by 72%, resulting in a 72% surge in after-tax profit to over VND 46 billion.

For the first nine months of the year, operating revenue reached nearly VND 341 billion, with after-tax profit at VND 105 billion, reflecting 26% and 27% growth, respectively, compared to the same period last year.

Upcoming IPO: Deo Ca Transport Infrastructure to Offer 49.7 Million Shares for Sale

Đèo Cả Transportation Infrastructure is set to offer over 49.7 million shares to existing shareholders through a rights issue in January 2026.

Tracking the Whale Money Flow on 11/12: VN-Index Drops Below 1,700, Foreign and Proprietary Trading Capital Shift Directions

The 11th/12th session witnessed a negative turn as the VN-Index fell below the 1,700-point mark, closing at 1,698.9 points—a decline of over 20 points from the previous session. Foreign investors continued their net selling streak, offloading more than 514 billion VND, contrasting sharply with the net buying activity of proprietary trading firms, which accumulated nearly 192 billion VND on the HOSE.

CIC Group Appoints New Chairman

Following a comprehensive organizational restructuring, the position of Chairman of the Board of Directors at CIC Group Joint Stock Company (CIC Group, HOSE: CKG) has transitioned from Mr. Trần Thọ Thắng to Mr. Nguyễn Xuân Dũng.