|

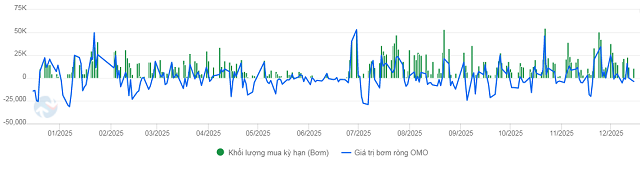

OMO Operations Net Pumping Trends Over the Past Year. Unit: Billion VND

Source: VietstockFinance

|

Specifically, the State Bank of Vietnam (SBV) injected 90,502 billion VND into the market through the repo channel, with terms ranging from 7 to 91 days at an interest rate of 4.5%/year. Conversely, the maturing capital in the week reached 85,058 billion VND, reducing the net injection into the system to 5,444 billion VND. As of December 15, the outstanding volume on the repo channel reached 407,720 billion VND.

|

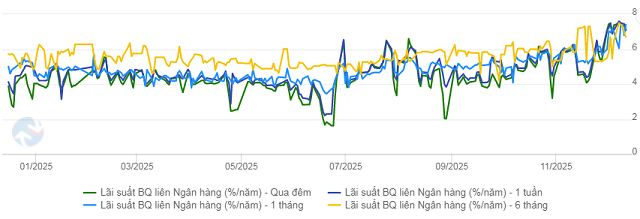

Interbank Overnight Interest Rate Trends Over the Past Year

Source: VietstockFinance

|

The interbank interest rate floor generally remained high last week. The overnight rate decreased slightly by 29 basis points compared to the previous week, dropping to 7.08% on December 12, while the average transaction value for this term gradually increased towards the end of the week, reaching over 798 trillion VND/day. The one-week rate stood at 7.1%, up just 1 basis point; the one-month rate rose sharply by 42 basis points to 7.4%. Notably, the six-month rate increased by 22 basis points from the previous week, reaching 6.7%.

|

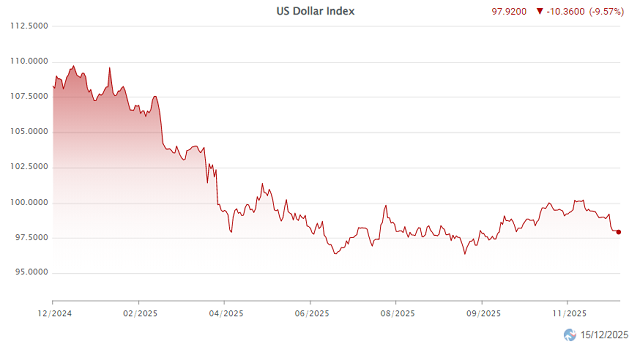

DXY Trends from the Beginning of 2025 to December 15

Source: VietstockFinance

|

In the international market, the USD Index (DXY) continued its downward trend, falling to 98.42 points on December 12, down 0.55 points from the previous week and marking the third consecutive week of decline.

This movement reflects the U.S. Federal Reserve’s (Fed) decision to cut interest rates by another 25 basis points, bringing the policy rate to the 3.5-3.75% range, while signaling only one more rate cut next year. Additionally, the tighter stance of major central banks such as those in Australia, Canada, and Europe has diminished the relative attractiveness of the USD.

Domestically, Vietcombank listed the USD/VND exchange rate at the end of the week at 26,095 – 26,405 VND/USD (buy – sell), a decrease of 43 VND on the buying side and 3 VND on the selling side compared to the previous week.

– 11:00 16/12/2025

USD Price Continues to Hit New Lows

During the week of December 8–12, 2025, the US dollar extended its decline in the international market following the Federal Reserve’s decision to cut interest rates by an additional 25 basis points.

Central Bank’s Move Signals Potential Start of Interest Rate Hike Cycle, Experts Say

According to Mr. Trần Ngọc Báu, the State Bank of Vietnam’s (SBV) decision to raise the OMO interest rate by 0.5 percentage points could be seen as the first signal foreshadowing a policy rate hike cycle.