At the Vietnam Finance Market Outlook Forum 2026, held by Vietnamfinance on December 12th, Ms. Le Vu Huong Quynh, Director of Asia-Pacific at Tether, highlighted that despite Vietnam’s Resolution 05 on piloting the cryptocurrency market and Resolution 22 on the International Financial Center, there remain ambiguities in operational frameworks.

“Many businesses and investors we’ve engaged with still face uncertainty regarding fundamental questions, such as the classification, listing, and trading of stablecoins—a significant cryptocurrency asset—on digital asset exchanges,” Ms. Quynh illustrated.

Additional concerns include standards for custodial organizations, cryptocurrency service providers, and licensing mechanisms for tokenization platforms and on-chain infrastructure.

Ms. Quynh cited Japan as an example, where clarifying legal definitions in 2023 led to over 54 financial institutions entering the cryptocurrency market within 12 months. Similarly, Dubai and Abu Dhabi post-pandemic proactively established open frameworks for digital assets, attracting businesses to relocate from Hong Kong and Singapore to the UAE.

Tether’s representative noted that while Vietnam has achieved over 70% cashless payment adoption in urban areas, banking systems and blockchain platforms remain largely disconnected ecosystems.

Leading nations like Singapore and Hong Kong have addressed this by integrating on-ramp/off-ramp partners, enabling seamless conversion between cryptocurrencies and fiat currencies within banking systems. This fosters efficient international payments, trade services, and remittances.

“Cryptocurrency capital is flowing from Latin America and Africa to Hong Kong. Exporters in China and Asia increasingly receive payments in digital assets from importers in these regions. However, businesses in Vietnam and Taiwan lack legal frameworks to accept cryptocurrency payments, hindering accounting and legal compliance. As a result, intermediaries in Hong Kong and Singapore accept digital assets from importers, issue letters of credit, and pay exporters in USD. Without swift action, Vietnam risks losing this value-added opportunity,” Ms. Quynh emphasized.

Furthermore, Tether’s representative stressed that liquidity is critical for a smooth-functioning cryptocurrency market. Under Resolution 05, clearer guidelines are needed on how domestic exchanges can engage with international liquidity, the role of market makers, and risk assessment mechanisms when connecting with foreign exchanges or global liquidity pools.

Tether also advocates for clear regulatory mechanisms governing cross-border cryptocurrency payments to ensure safety and compliance.

Lastly, enhancing investor protection and transparency is essential. By implementing real-time reporting standards, transaction monitoring, and blockchain-based illicit activity tracing, Vietnam can establish a digital asset market that surpasses traditional markets in transparency.

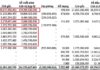

Tether, the world’s largest issuer of the USDT stablecoin with a circulation of approximately $185 billion, serves over 500 million global users. The company collaborates with millions of businesses and more than 50 regulatory and law enforcement agencies worldwide.

In Vietnam, Tether has partnered with Ho Chi Minh City and Da Nang authorities to develop cryptocurrency-related platforms and applications within financial hubs.