This morning (December 15), the Finance and Investment Newspaper hosted a seminar titled “Diverse Capital for Sustainable Development.” The event aimed to provide a comprehensive overview of capital needs, resource mobilization trends, and upcoming policy solutions.

Speaking at the seminar, Deputy Governor of the State Bank of Vietnam (SBV), Nguyen Ngoc Canh, cited data from the Ministry of Finance. He noted that Vietnam’s long-term investment needs for green and sustainable economic development by 2050 are estimated at approximately $670–700 billion. Of this, climate change adaptation requires around $368 billion, or about 6.8% of annual GDP. This underscores the need to mobilize all resources for national green growth goals, particularly from green bond markets, green credit, carbon markets, and international funding, alongside state budget capital.

Deputy Governor of the State Bank of Vietnam (SBV), Nguyen Ngoc Canh. (Photo: Investment Newspaper)

Recognizing the importance of “green credit” and “sustainable finance,” the SBV has continuously improved legal frameworks, policies, and synchronized solutions to promote green credit activities. These efforts include identifying, assessing, and managing environmental and social risks in credit operations, thereby enhancing the banking sector’s role in supporting the nation’s green growth objectives.

Credit institutions and banks have proactively developed green capital mobilization products and green credit to fund projects benefiting the environment, climate change adaptation, and sustainable circular production models. As a result, green credit activities have expanded in both scale and growth rate in recent years.

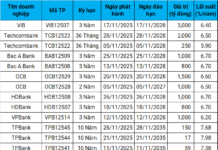

As of November 30, 2025, green credit outstanding balance reached approximately 750 trillion VND, averaging a 21% annual growth rate from 2017 to 9/2025. This outpaces the overall credit growth of the economy, demonstrating banks’ and credit institutions’ commitment to green growth and sustainable development.

Despite the banking sector’s efforts, Deputy Governor Canh emphasized the need to diversify financial resources. This requires participation from domestic and international channels, particularly the private sector and capital markets (stock markets), to collaborate with the banking system in meeting green transition and sustainable development demands.

“Expanding green financial investment channels from various sectors and markets not only reduces pressure on the banking system but also enables more flexible, secure, and efficient medium- to long-term capital mobilization for national goals, aligning with global green finance trends,” affirmed Deputy Governor Canh.

Pham Thi Thanh Tung, Deputy Director of the Credit Department for Economic Sectors (SBV)

At the seminar, Pham Thi Thanh Tung, Deputy Director of the Credit Department for Economic Sectors (SBV), noted that the SBV has long encouraged green lending.

Over the past five years, green credit outstanding balance has grown at an average annual rate of 21%, surpassing the national credit growth rate. In 2017, only 15 credit institutions reported green credit balances; today, that number has risen to 58.

Initially, commercial banks used their own resources to offer preferential loans in this sector. However, Resolution 68-NQ/TW dated May 4, 2025, by the Politburo, and Resolution 198/2025/QH15 by the National Assembly, established a 2% annual interest rate subsidy for private enterprises, business households, and individuals borrowing for green, circular, or ESG (Environmental, Social, Governance) projects. This subsidy is provided through the Small and Medium Enterprise Development Fund and commercial banks. This means additional state budget resources will soon support this sector, creating opportunities for accessing preferential capital and enabling more sustainable business model transitions.

The Prime Minister has directed the SBV and Ministry of Finance to submit a decree to the Government outlining the 2% annual interest rate subsidy policy for enterprises, business households, and individuals borrowing for green, circular, or ESG projects.

“We are actively finalizing the draft Government Decree on interest rate subsidies from the state budget for private sector enterprises, households, and individuals borrowing from commercial banks for green, circular, or ESG projects. The draft has been reviewed by the Ministry of Justice and will be submitted to the Government this week, with expected implementation early next year,” said Ms. Tung.

Meanwhile, Pham Thi Thanh Tam, Deputy Director of the Financial Institutions Department (Ministry of Finance), confirmed that the draft Decree on the 2% annual interest rate subsidy for private sector enterprises through the Small and Medium Enterprise Development Fund will be submitted to the Government in December.

Central Bank Officially Launches 32 Fully Digital Public Services

On December 15th, the State Bank of Vietnam (SBV) launched its centralized Administrative Procedure Resolution Information System. This system now offers 32 fully online public services (DVCTT) for businesses, with certain application components replaced by data from the National Public Service Portal (https://dichvucong.gov.vn).

Green Credit Debt Reaches 750 Trillion VND, with Anticipated 2% Annual Interest Rate Support for Green Projects

The State Bank of Vietnam (SBV) is collaborating with the Ministry of Finance to propose a government decree offering a 2% annual interest rate subsidy from the state budget. This initiative aims to support private enterprises and business households borrowing from banks to implement green projects and circular economy initiatives.

CapitaLand Development Sweeps Top Honors at PropertyGuru Asia Property Awards 2025

CapitaLand Development (CLD) Vietnam has been honored with the prestigious “Outstanding Sustainable Real Estate Developer” award, alongside five other distinguished accolades at the PropertyGuru Asia Property Awards (APA) 2025 Grand Final. This marks the fourth consecutive year CLD Vietnam has been recognized at APA, a platform celebrating the region’s most exceptional real estate enterprises and projects.

Phú Quốc Pearl Island Hosts “Phú Quốc Special Economic Zone – Soaring with APEC” Seminar

On December 12, 2023, the “Phu Quoc Special Economic Zone – Taking Flight with APEC” seminar was held in Sunset Town (An Thoi, Phu Quoc), attracting leading international experts in economics, tourism, policy research, and urban planning. This event is anticipated to unlock new opportunities for the Pearl Island to soar to greater heights in the upcoming era.