The Board of Directors of PCT has approved the implementation of a private placement of shares, as per the resolution passed by the Extraordinary General Meeting of Shareholders in 2025.

PCT plans to issue 30 million shares, equivalent to 59.96% of the current outstanding shares. The offering price is set at the par value of 10,000 VND per share, matching the current market price, and is expected to raise 300 billion VND. The newly issued shares will be subject to a one-year transfer restriction.

The entire proceeds will be used to repay bank loans. The majority of the funds, approximately 248 billion VND, will be allocated to settle debts with the Military Commercial Joint Stock Bank – Ho Chi Minh City Branch. The remaining amount will be used to pay off loans at the Orient Commercial Joint Stock Bank – Tan Binh Branch. The transaction is scheduled to be completed in 2026.

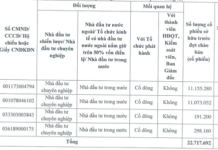

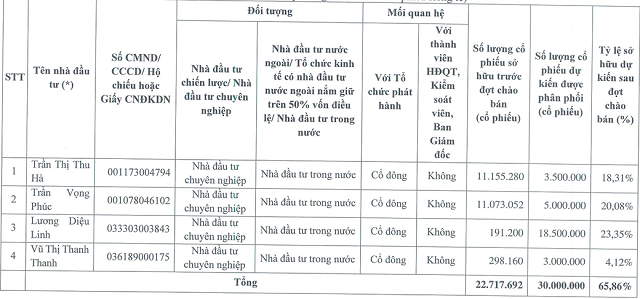

Four individual investors, all existing long-term shareholders of PCT, will participate in the private placement.

Among them, Mrs. Luong Dieu Linh intends to purchase 18.5 million shares, amounting to 185 billion VND. Post-transaction, her ownership in PCT will surge from less than 1% to 23.35%, becoming the largest individual shareholder. Previously, Mrs. Linh had lent the company 110 billion VND for working capital.

Mrs. Tran Thi Thu Ha will acquire an additional 3.5 million shares, Mr. Tran Vong Phuc plans to buy 5 million shares, and Mrs. Vu Thi Thanh Thanh will participate with 3 million shares. Post-issuance, these four shareholders will collectively hold 65.86% of PCT‘s charter capital.

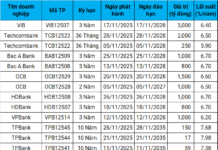

List of 4 shareholders participating in PCT‘s private placement. Source: PCT

|

Prior to the offering, PCT‘s shareholder structure was already concentrated. Mrs. Tran Thi Thu Ha holds 22.29%, Mr. Tran Vong Phuc owns 22.13%, Mr. Dang Nguyen Dang holds 21.57%, and Mr. Cao Duc Son possesses 23.56% of the company’s capital.

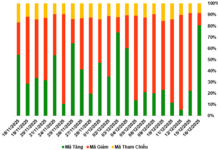

The capital increase comes amid mounting financial pressure on PCT. In the first nine months of 2025, interest expenses reached 82 billion VND, a 60% increase year-over-year, significantly impacting the gross profit from core operations of 139 billion VND.

Long-term debt at the end of Q3 exceeded 1.7 trillion VND, nearly double the beginning of the year. Most of the new loans were incurred to support the company’s vessel acquisition and investment plans. During the year, the value of fixed assets in transportation vehicles increased by 635 billion VND, bringing the total to over 2.3 trillion VND.

The cash flow pressure is also reflected in the company’s dividend policy. According to the resolution passed by the General Meeting of Shareholders, PCT‘s management decided to postpone the payment of 2024 stock dividends at a rate of 10% until the end of Q2/2026. The company stated that this adjustment aims to prioritize resources for the private placement and supplement cash flow for investment plans.

Upon completion of the offering, PCT‘s charter capital will increase from 500 billion VND to over 800 billion VND. This marks the company’s second largest capital increase in three years. The previous private placement in 2023 nearly doubled PCT‘s charter capital.

In terms of business operations, the maritime transportation segment remains the primary growth driver. In the first nine months of the year, revenue from this segment reached 503 billion VND, a 44% increase compared to the same period last year. Conversely, the ship management and consulting services segment experienced a decline.

PCT, formerly known as Cuu Long Petroleum Transportation and Services Joint Stock Company, was established in 2007 with the participation of PV Gas, PVTrans, and PV Gas South. The company has been listed on the HNX since 2011. After PVTrans divested its entire stake in 2018, PCT officially exited the road transportation sector, shifting its focus to maritime transportation and ship management.

| PCT‘s interest expenses surged in the first nine months of 2025 |

– 11:33 16/12/2025

Spring Mai Corp’s Leadership Resigns Amid Change in Ownership

A wave of resignations from the Chairman of the Board of Directors and key leaders at Xuan Mai Investment and Construction Joint Stock Company (Xuan Mai Corp, UPCoM: XMC) coincides with a major shareholder’s divestment. Meanwhile, a new group of shareholders is steadily consolidating its controlling position.

Tianlong (TLG) Announces Dividend Payment Date: Chairman Co Gia Tho’s Family Group Set to Receive 5.15 Million New Shares and VND 51.5 Billion in Cash

Thiên Long Group has officially approved its 2024 dividend plan and an advance dividend for 2025. Given their substantial ownership stake, the shareholder group associated with Chairman Cô Gia Thọ is poised to receive millions of new shares and tens of billions of Vietnamese dong.