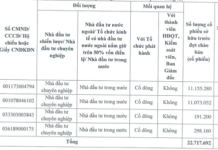

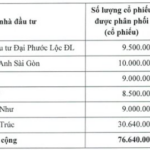

Mrs. Trúc is one of 11 professional investors allocated shares in BMS’s private placement of up to 125 million shares. The remaining 94.36 million shares were evenly distributed among 10 investors, with volumes ranging from 8.5 million to 10 million shares, without creating additional major shareholders.

Following the offering, BMS increased its share count from over 78.9 million to more than 203.9 million, raising its charter capital from over 789 billion VND to over 2,039 billion VND.

At a sale price of 10,000 VND per share, the company raised 1,250 billion VND. Of this, 650 billion VND will fund proprietary trading activities (stocks, corporate bonds, government bonds, deposit certificates), 400 billion VND will repay debts, and 200 billion VND will support margin lending and advance payment activities. The funds will be disbursed in 2025 and 2026.

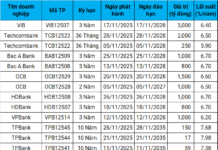

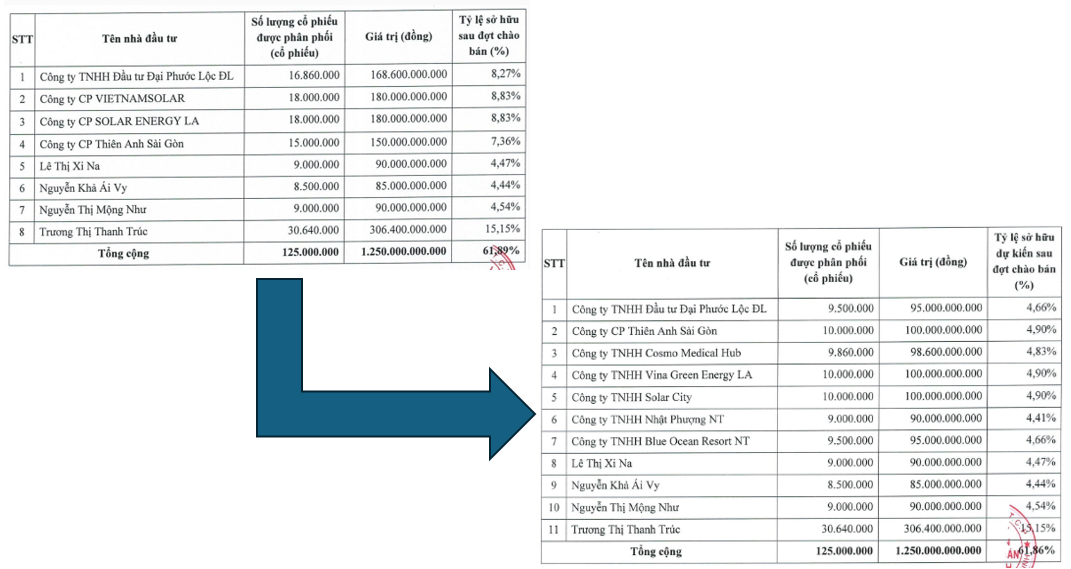

Notably, the initial list of investors approved by the Board of Directors in late July included only 8 professional investors. Comparing the new and old lists reveals significant changes among institutional investors, with a strong imprint from Hoan Cau Group.

Revised list of private placement investors – Source: BMS, compiled by the author

|

Upcoming leadership changes and continued HOSE listing plans

BMS plans to hold an extraordinary shareholders’ meeting on January 10, 2026, in Ho Chi Minh City to address several key matters.

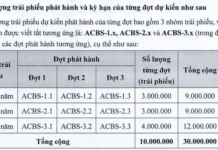

The Board of Directors will report on the use of proceeds from the BMS12501 private bond issuance, totaling 200 billion VND. The bonds, issued on September 9, 2025, have a 5-year maturity and a fixed interest rate of 8.5% per annum.

According to the proposal, the funds were used as planned to repay principal and interest debts at Vietbank.

The meeting will also approve the resignation of independent board member Mr. Đỗ Văn Hạ and two Control Board members, Mrs. Mộc Thị Lan Uyên and Mrs. Trương Thị Bích Ngân, effective November 13. Replacements will be elected for the remainder of the 2023-2028 term.

Another key agenda item is the continued pursuit of listing on the Ho Chi Minh City Stock Exchange (HOSE), as approved by the annual shareholders’ meeting in April 2025.

“Preparations and coordination with relevant units are ongoing. Some procedures are being finalized and will be reported at subsequent meetings,” stated the BMS Board of Directors.

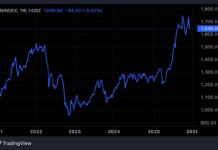

Before a potential HOSE listing, BMS shares on the UPCoM market have corrected from above 15,000 VND per share in late August, following a strong rally since late April. As of December 15, BMS closed at 12,600 VND per share, up 27% year-to-date, with average liquidity of over 345,000 shares.

| BMS shares correct after strong rally |

– 5:49 PM, December 15, 2025

What’s Halting Bitcoin’s Rally in Today’s Crypto Market, December 11?

Market experts suggest that the current lack of momentum, weak buying pressure, and divided investor sentiment significantly diminish the likelihood of a substantial Bitcoin rally in the near future.

Five Individuals Poised to Acquire Nearly 162 Million Individual Shares of VPS Securities

VPS Securities is set to offer 161.85 million individual shares, with an anticipated price range between 50,000 VND and 65,000 VND per share.