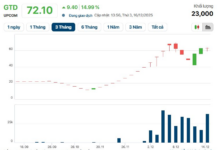

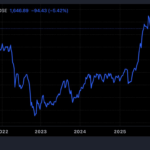

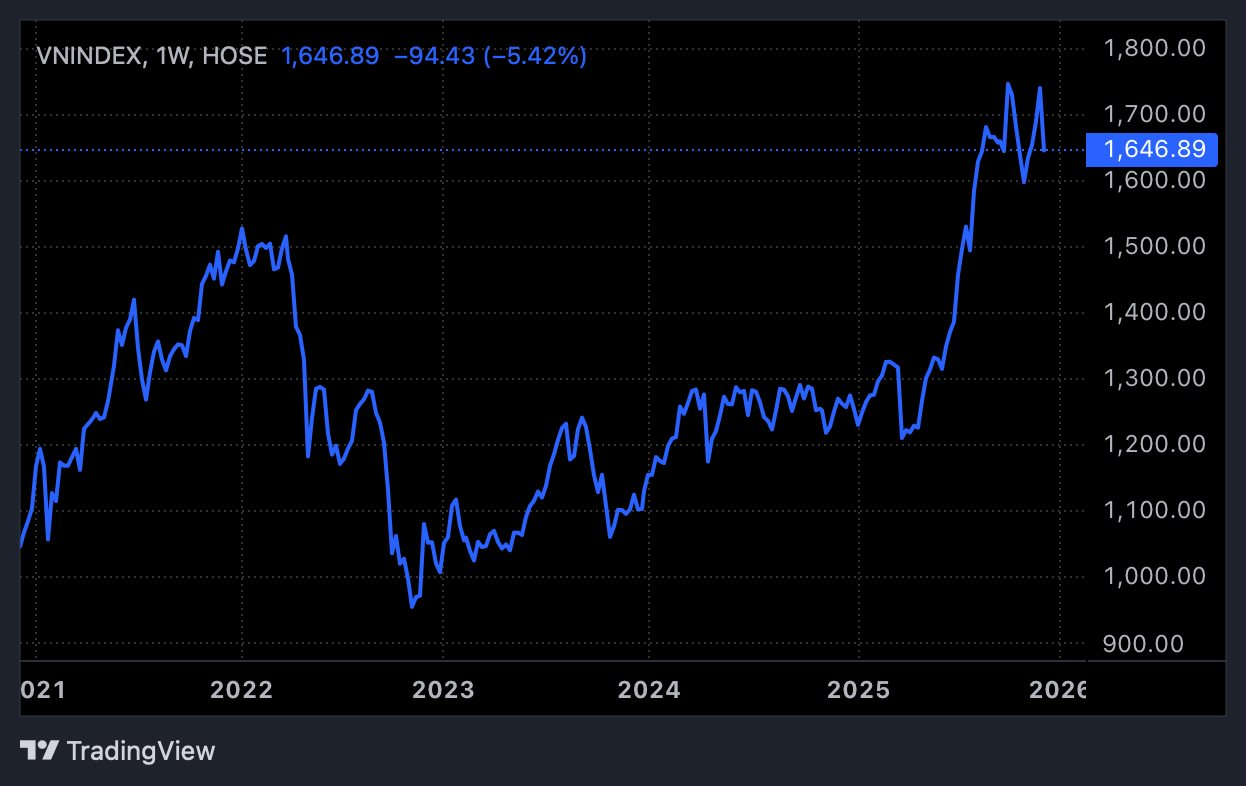

The VN-Index concluded a volatile trading session with a significant drop of approximately 100 points, marking the sharpest decline since April. Notably, this trend starkly contrasts with the global stock market’s performance, where the Dow Jones and S&P 500 have consistently reached new historical highs.

According to Mr. Nghiêm Xuân Nam, a Market Strategy Expert at VFS Securities, the recent sharp decline was not triggered by any specific negative macroeconomic news or a “black swan” event. Instead, it was primarily driven by the fragile sentiment of individual investors, who had grown weary after a prolonged period of market stagnation and sustained negative account performance. In reality, many stocks had already fallen by 5–30% in the preceding weeks, significantly eroding investor patience.

Despite the market’s deep decline, liquidity remained moderate at around 22 trillion VND on HoSE, attributed to systemic liquidity shortages and mounting pressure from rising interest rates. The OMO interest rate increased from 4% to 4.5%, elevating banks’ capital costs, while overnight rates peaked at 7.5%, the highest in several years. In this context, substantial capital remains on the sidelines, hesitant to invest at current price levels.

Interest Rate Hikes Are Temporary

Mr. Nam explains that stock market upcycles typically align with monetary policy easing, while downcycles often begin when policies shift from accommodative to restrictive. Currently, the government prioritizes economic growth and maintains low interest rates to support the economy, making a policy reversal highly unlikely.

Recent interest rate increases are largely situational, driven by year-end credit demand outpacing deposit growth, forcing banks to adjust rates to meet economic needs. Additionally, high USD interest rates earlier in the year led to capital outflows, reducing money circulation in the system. However, the Fed has cut rates three times in the second half of 2025 and is expected to continue easing in 2026. As the VND-USD interest rate differential narrows, capital outflows may diminish.

Domestic interest rates may rise slightly compared to previous periods but are unlikely to surge enough to drive investors from stocks to deposits. Thus, concerns that rising rates will “drain” stock market liquidity are premature.

Stock markets are cyclical, closely tied to economic prospects. The 2026–2030 period is expected to be a robust growth phase for Vietnam’s economy, potentially reaching double-digit expansion. Growth expectations, coupled with policies promoting the private sector, will continue to drive the market long-term, with current adjustments offering entry opportunities for new investors.

Attractive Valuation Levels

However, Mr. Nam notes that this caution does not imply a prolonged freefall risk. With the market already shedding nearly 100 points in four sessions and the 2026 projected P/E ratio retreating to attractive levels below regional averages, further downside potential is limited.

Current selling pressure stems mainly from psychological and technical factors, including margin calls, rather than fundamental corporate weaknesses. A V-shaped bottom formation remains plausible, with the equilibrium zone for renewed accumulation nearing.

Technically, after breaching the 1,650-point mark, the VN-Index is likely to test the critical 1,580–1,622 support zone. This is a pivotal buffer before the market faces a worse scenario, potentially revisiting the previous peak around 1,531 points.

To confirm a halt in the decline and a shift to accumulation rather than further bottom-fishing, the VN-Index must avoid forming a new lower low on the weekly chart, specifically by not decisively breaking below 1,580.

Currently, many blue-chip stocks and fundamentally strong companies have retreated to robust support levels, with P/E ratios becoming attractive. A reversal signal will be confirmed once margin selling pressure subsides within 1–2 sessions and proactive buying absorbs floor-priced stocks, stabilizing the index above 1,580.

Not Yet Safe to “Bottom-Fish”

According to Mr. Nam, despite the market’s sharp drop on December 12 resembling a “sale,” it is not yet safe to bottom-fish. A defensive stance remains prudent, as bottom-fishing capital remains indifferent. Without significant buying, seemingly “cheap” stocks could become “cheaper” due to downward momentum and continued margin pressure expected in the coming sessions.

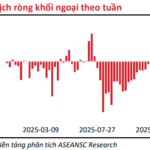

Foreign investors continue to net sell, adding to market sentiment pressure. Opportunities will arise only when capital shows clear consensus in supporting the index. “Catching a falling knife” amid weak liquidity and high panic is extremely risky. Investors should patiently await a new equilibrium zone.

For investors who have cut losses and hold cash, Mr. Nam advises maintaining liquidity and observing without rushing to re-enter. Instead, this is an opportune time to develop action plans and reallocate capital.

Deep market declines highlight the distinction between “gold” and “dross.” Investors should monitor stocks that maintain prices well, avoid breakdowns, or exhibit clear support even in panic. These are likely to lead the upcoming recovery, especially as the 2026 growth narrative becomes more compelling than 2025.

Safe entry points will emerge only when the market stabilizes and substantial capital returns to confirm the trend. In such volatile periods, capital preservation outweighs the pursuit of risky bottom-fishing profits.

Should Investors ‘Buy the Dip’ After the VN-Index Turmoil?

The VN-Index just endured a shocking week, plummeting over 94 points and erasing much of the gains accumulated over the previous month. As we enter the final trading weeks of the year, the market is anticipated to experience a technical rebound. Investors holding significant cash reserves are advised to consider gradual deployments during market fluctuations.

Phú Thọ Targets 11% GRDP Growth by 2026

Phú Thọ province aims to achieve a Gross Regional Domestic Product (GRDP) growth rate of approximately 11% by 2026, surpassing the government’s projected target of over 10%. This ambitious growth scenario underscores the province’s strong political commitment, despite ongoing global and domestic economic uncertainties.