Mobile World Investment Corporation (stock code: MWG) has recently announced its treasury stock transaction report. From November 19 to December 12, MWG successfully purchased 10 million treasury shares via order matching at an average price of VND 80,969 per share, totaling over VND 800 billion.

According to regulations, MWG will cancel these shares post-transaction, reducing its chartered capital to VND 14,775 billion, equivalent to 1.477 billion outstanding shares.

On the stock market, MWG shares are currently trading at VND 77,700 per share, down 9% from mid-October’s peak but still 29% higher year-to-date. The market capitalization stands at approximately VND 115 trillion.

MWG Stock Performance Chart

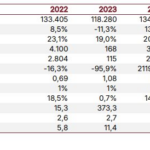

For the first ten months of 2025, MWG reported revenue of VND 128,289 billion, a 15% increase year-on-year, achieving 86% of its annual target. While MWG does not disclose monthly profits, its Q3 financial report revealed record-high post-tax profits of nearly VND 5 trillion, up 73% from the same period in 2024.

As of October 2025, Nguyen Duc Tai’s retail empire operates nearly 6,000 stores nationwide, including 1,012 The Gioi Di Dong stores, 2,017 Dien May Xanh stores, 2,370 Bach Hoa Xanh stores, 356 An Khang pharmacies, 72 AvaKids stores, and 158 EraBlue stores.

In related news, MWG recently approved a plan allowing Dien May Xanh Joint Stock Company (DMX) to conduct an initial public offering (IPO) and list its shares on the stock market. Scheduled for 2026, this move marks a strategic milestone in MWG’s ecosystem restructuring and optimization.

Positioning DMX as an independent public company is a pivotal strategy, ushering in a new growth phase for the company. MWG anticipates sustaining double-digit profit growth in the medium to long term. Beyond capital raising, the IPO is seen as a critical tool for DMX to enhance transparency and standardize governance and operations to meet listed company standards.

Moving forward, DMX will focus on deep-rooted growth, prioritizing quality, expanding value-added products and services, leveraging its Super App platform, and scaling operations in Indonesia. MWG emphasizes that DMX remains a core strategic component of its retail ecosystem.

Between 2026 and 2030, DMX is expected to significantly contribute to MWG’s consolidated revenue and profits. Its independent listing is projected to yield long-term strategic, financial, and governance benefits, while broadening growth opportunities for the entire MWG ecosystem.

Breaking: MWG Set to IPO Dien May Xanh by 2026

Elevating Điện Máy Xanh into an independent public company marks a pivotal strategic shift, unlocking a new era of growth for the enterprise. This move is poised to sustain double-digit profit growth in both the medium and long term.

SSI Securities Upgrades Forecast for The Gioi Di Dong, Q4 Profit Expected to Double to VND 1.7 Trillion

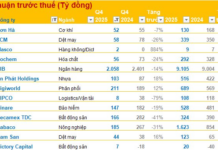

Following a record-breaking net profit in Q3/2025, SSI Research has revised its full-year 2025 net profit forecast upward to VND 6,700 billion.