Mobile World Investment Corporation (stock code: MWG) has officially approved the plan to allow Dien May Xanh Joint Stock Company (DMX) to conduct an initial public offering (IPO) and list its shares on the stock market. DMX is currently responsible for MWG’s retail segment in consumer electronics, home appliances, mobile phones, and technology devices (ICT/CE).

In a sense, DMX is the brainchild of Mr. Nguyen Duc Tai. From its first store on Nguyen Dinh Chieu Street, Ho Chi Minh City, in 2004, the chain has risen to become a leader in the ICT/CE retail sector, capturing approximately 50-60% of the market share. Historically, DMX contributed up to 95% of MWG’s revenue.

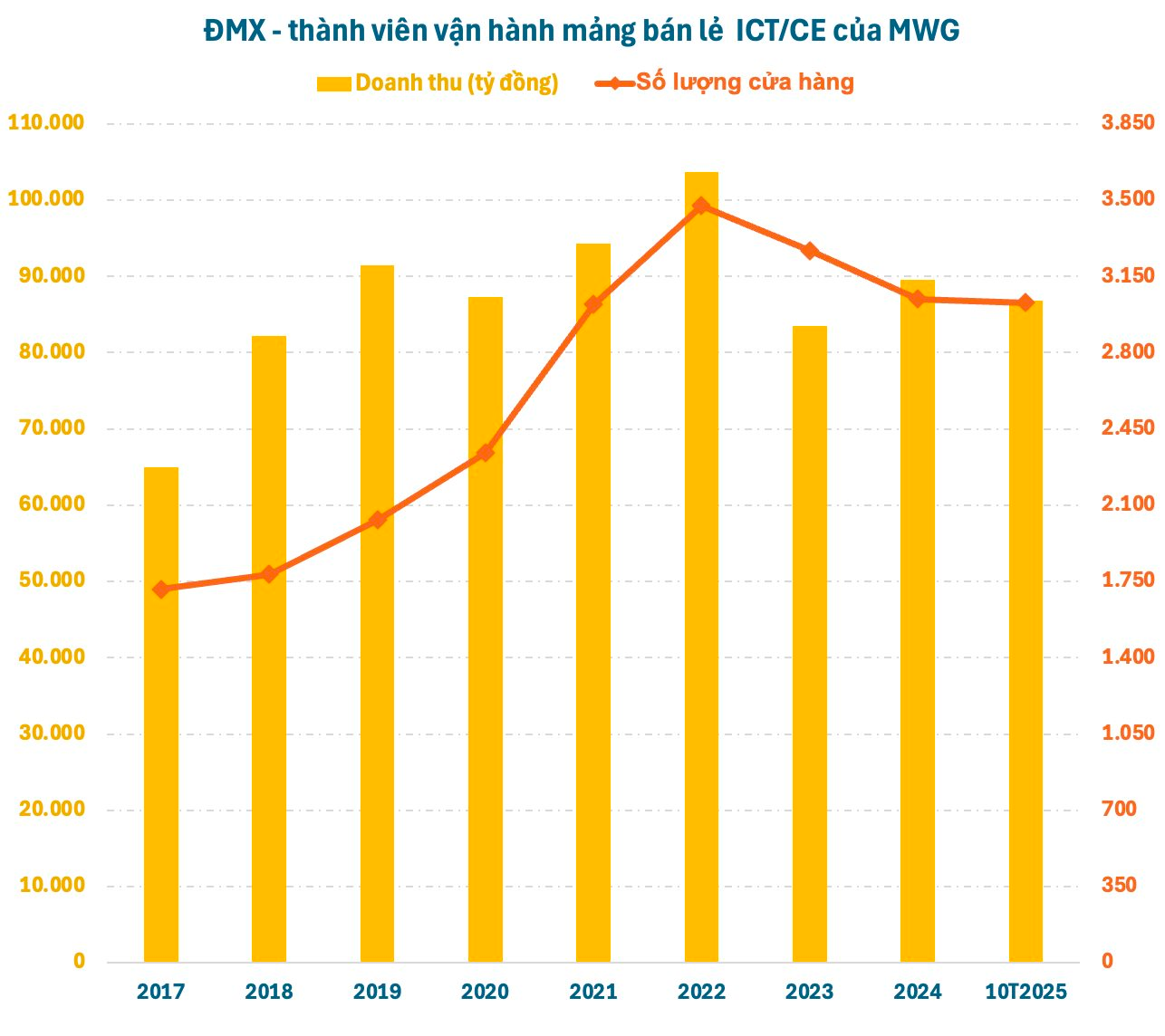

DMX’s growth can be divided into two main phases. Before 2023, the chain rapidly expanded its store network, transforming the ICT/CE retail landscape. By the end of 2022, DMX operated nearly 3,500 stores, including The Gioi Di Dong (TGDĐ) and Dien May Xanh (DMX) outlets.

During this period, DMX occasionally adjusted its model, converting some TGDĐ stores to DMX or launching new chains like “Super Cheap Phones.” However, MWG’s primary strategy for the ICT/CE segment was volume-driven growth. As the network matured, MWG shifted its focus to quality, restructuring DMX by closing underperforming stores and enhancing service speed, experience, and quality.

By October 2025, the network had streamlined to over 3,000 stores, yet the first 10 months’ revenue reached an impressive 87 trillion VND, nearly matching the previous year’s total. With the year-end shopping season, DMX is poised to potentially surpass its 2022 revenue record.

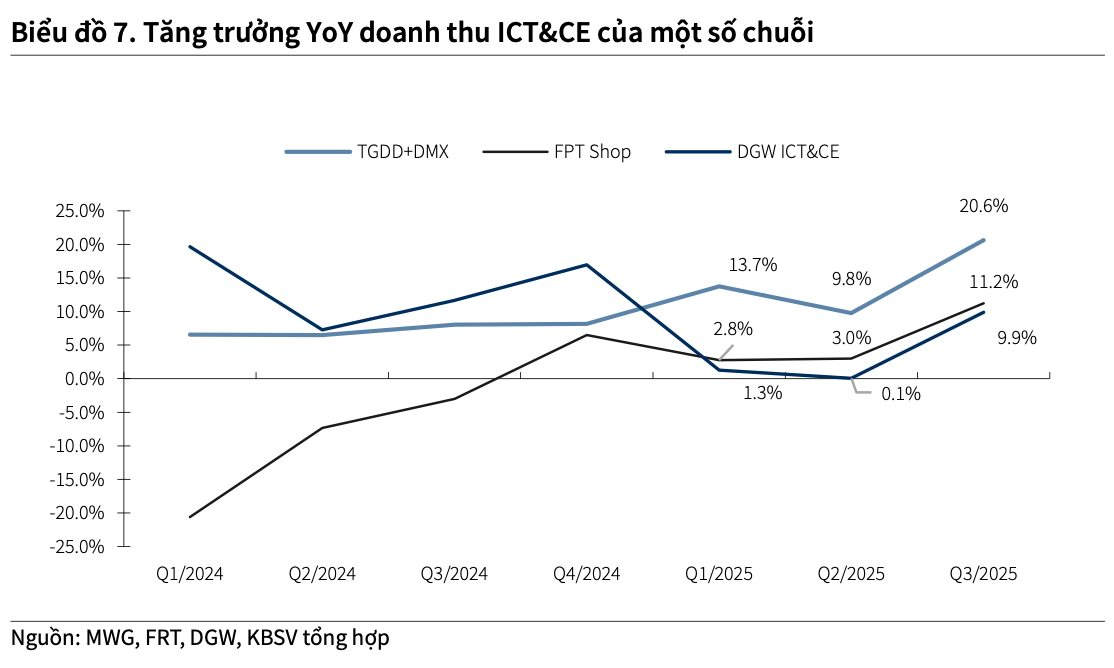

In a recent analysis, KBSV highlighted that MWG’s ICT/CE business strategy is well-defined, driven by stable growth in existing stores and seasonal consumer demand. Retailers intensify marketing efforts during this period to boost sales and clear inventory. KBSV projects DMX to achieve 102 trillion VND in 2025 sales, a 14.2% increase year-over-year.

In 2026, the ICT/CE segment is forecast to grow by 12% due to recovering purchasing power (new personal income tax policies) and a shift toward modern retail as the business environment becomes more transparent (e-invoicing, tighter e-commerce regulations). KBSV believes MWG’s market leadership positions it to capitalize on these macro trends.

MWG has chosen 2026 as the year to IPO and list DMX. This move marks a strategic pivot, ushering in a new growth phase for DMX, with expectations of sustained double-digit profit growth in the medium to long term. It also signifies a critical step in MWG’s ecosystem restructuring and optimization.

Aligned with its 2030 vision, MWG sees this as the ideal time to build on DMX’s legacy, driving new growth while expanding into Southeast Asia. DMX aims to double its 2025 profit by 2030, maintaining a 15%+ annual growth rate.

The IPO serves not only to raise capital but also to enhance transparency and standardize governance and operations to meet listed company requirements. Going forward, DMX will focus on deep growth, prioritizing quality, expanding value-added products and services, leveraging its Super App platform, and scaling operations in Indonesia.

Vietnam’s Largest Coffee Chain Hits Record Profits as Philippine Tycoon Secures 60% Stake

Highlands Coffee launched in 1999 as a premium packaged coffee brand, offering high-quality roasted and ground coffee. Over time, the brand expanded through strategic partnerships, notably collaborating with the Philippine-based Jollibee group.

How Does Becamex IDC Secure Funding Without Selling Shares?

Becamex IDC sought to publicly offer 150 million BCM shares, but the proposal failed to gain shareholder approval. The company has consistently turned to bond issuance as a means to secure capital.