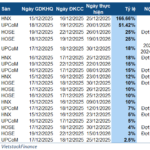

Hai Phong Pharmaceutical JSC (Stock Code: DPH) announced that January 6th will be the final registration date for shareholders to receive the 2025 cash dividend. The payment is scheduled for January 20, 2026. With a payout ratio of 20% per share (equivalent to VND 2,000 per share), the company is estimated to allocate approximately VND 6 billion for this dividend distribution.

This interim dividend aligns with the plan approved by the 2025 Annual General Meeting of Shareholders and marks the highest payout ratio in Hai Phong Pharmaceutical’s operating history.

Notably, DPH has consistently paid cash dividends to shareholders from 2017 to 2025. In the past two years, DPH distributed dividends at a 17% rate, following 15% payouts in 2020, 2022, and 2023.

In the stock market, DPH shares closed unchanged at VND 43,100 on December 15th with no trading activity. This level represents a one-year low for DPH. Compared to its historical peak of VND 66,000 in July 2025, the share price has declined by 35% over five months.

DPH’s liquidity has also been consistently low, reflecting its concentrated shareholder structure.

The largest shareholders are Mr. Tran Van Huyen, CEO and Deputy Chairman of the Board, holding 57.72% of the charter capital, followed by Hai Phong Pharmaceutical LLC with 11.67%, and Mr. Le Ngoc Duc with 6.48%.

Expert Insight: Equilibrium Point Imminent as Two Stock Groups Enter “Oversold” Territory

Anticipating next week’s market trends, most experts agree that prices have entered an attractive range following a significant correction. However, investors should remain cautious, closely monitoring developments and only committing funds once the index establishes a new equilibrium zone.

Surprise Power Injects Hundreds of Billions to Scoop Up Vietnamese Stocks Amid Market Plunge in Final Week’s Session

Proprietary trading desks at securities companies executed a net buy of VND 341 billion on the Ho Chi Minh City Stock Exchange (HOSE).