In late October, Vincom Retail divested its entire 99.99% stake in Vincom NCT Real Estate Company, the owner of the Vincom Center Nguyen Chi Thanh shopping mall project, to Bao Quan Trading Investment and Services LLC. Following the completion of this transaction, valued at over VND 3,630 billion, Vincom NCT ceased to be a subsidiary of Vincom Retail.

In a recent report, Mirae Asset Securities forecasts that this divestment will yield pre-tax profits of approximately USD 68 million (VND 1,900 billion) in Q4 2025. Rather than viewing this as a one-off gain, analysts interpret it as part of VRE’s broader asset portfolio restructuring strategy.

More significantly, the sale of a “mature” asset liberates capital, enabling the company to reallocate resources toward projects with higher long-term yields. While the divestment profit enhances reported earnings, its positive impact on free cash flow (FCF) is particularly noteworthy—the inflow helps offset the VND 3,209 billion net debt increase in 3Q25 and bolsters financial flexibility for projects like Ocean City, Royal Island, and Wonder City.

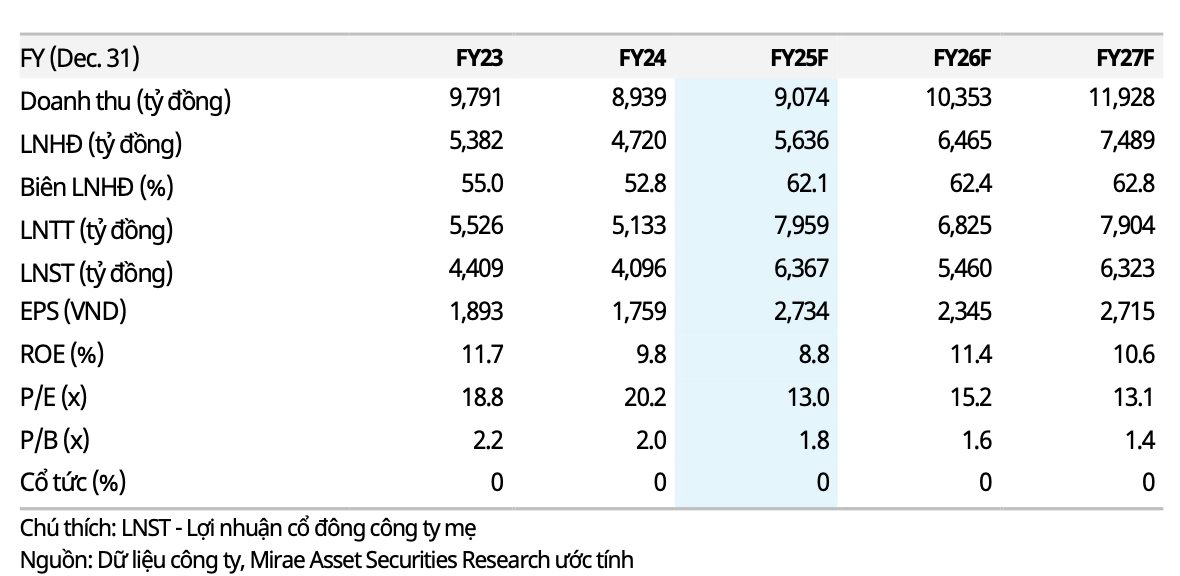

Post-transaction, Mirae Asset revised its 2025 net profit forecast upward by 55% to VND 6,367 billion, marking the highest profit in the company’s history.

Profits are expected to normalize in 2026, absent the extraordinary gain. Revenue is projected at VND 10,353 billion (+14% YoY), driven by stable leasing income and additional shophouse sales. Net profit for 2026 is forecast to remain flat at VND 5,460 billion (-14% YoY).

The positive outlook hinges primarily on divestment profits and additional revenue from the Vinhomes Green Paradise shophouse project, partially offsetting the impact of the VND 3,209 billion net debt increase in 3Q25.

Operational performance remains robust, with occupancy rates reaching 87% in 3Q25 and potentially nearing 90% as existing projects continue to attract new brands. New supply—100,800 m² from VMM Royal Island and VMM Ocean City, plus 19,000 m² from VCP Vinh—will fully contribute in 2026. Shophouse projects in Vu Yen and Quang Ninh are expected to generate over VND 10,000 billion in revenue from 2026 onward.

What Impact Does the Heat of Capital Withdrawal Have on Stocks?

The VN-Index extended its gains today (December 2nd). Amid a market lacking clear catalysts, several divestment stocks heated up, notably Giày Thượng Đình and VTC Telecom, both surging to their 10th consecutive upper limit session.

What Insights Can We Gain from the Surge in Corporate Divestment?

Numerous state-owned corporations, enterprises, and even banks are divesting from various units. According to experts, this divestment stems from businesses reevaluating their strategies, with many non-core investments, prolonged projects, or underperforming assets being addressed.