Techno Commercial Joint Stock Securities Company (TCBS, stock code: TCX, listed on HoSE) has announced a shareholder consultation on several critical matters. The shareholder list was finalized on December 5, 2025, with the consultation period running from December 12 to 25, 2025.

TCBS proposes issuing 275,475 shares under its Employee Stock Ownership Plan (ESOP) at a price of VND 10,000 per share. These ESOP shares will have a one-year transfer restriction, with issuance expected in Q1-Q2/2026. Upon completion, TCBS’s chartered capital will increase by VND 2.75 billion to VND 23,115.8 billion.

Additionally, TCBS seeks shareholder approval to borrow USD 50 million from DEG for a five-year term at an annual interest rate of 2.25%, unsecured. The lender has the option to convert the debt into TCBS’s common shares. If exercised, TCBS will issue private shares for the conversion. The loan drawdown is scheduled for Q4/2025 or Q1/2026.

Shareholders will also review amendments to the company’s charter, board of directors’ regulations, and supervisory board’s regulations, among other matters.

In related developments, TCBS has approved a capital contribution plan with affiliated entities. TCBS will invest VND 165 billion in TokenBay Investment and Technology Joint Stock Company by acquiring convertible dividend preference shares and/or convertible dividend preference share warrants issued by TokenBay.

TokenBay currently has a chartered capital of VND 1 billion. Post-investment, TCBS will hold an 11% stake in TokenBay. The transaction is expected to be completed in Q4/2025 or Q1/2026.

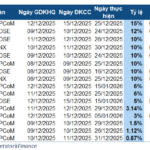

In November 2025, TCBS shareholders approved a 25% dividend payout for 2024 via written consent, including a 5% cash dividend (VND 500 per share). The cash dividend will be sourced from undistributed after-tax profits as of December 31, 2024.

Following its IPO, TCBS has over 2.3 billion shares outstanding, equivalent to a chartered capital of VND 23,133.08 billion. The cash dividend distribution is estimated at VND 1,155.6 billion.

The remaining 20% dividend will be paid in shares, totaling 462.2 million new shares. The issuance ratio is 5:1, with shareholders receiving one new share for every five held. These dividend shares will be unrestricted for transfer.

The dividend distribution is scheduled before June 30, 2026. Upon completion, TCBS’s chartered capital is projected to exceed VND 27,735 billion.

An Binh Securities Aims to Raise Capital Beyond 3.000 Billion VND

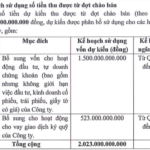

An Binh Securities has proposed two share issuance plans to its shareholders, totaling 207.3 million shares, aimed at increasing its chartered capital to over 3,000 billion VND.

Phat Dat to Issue 18 Million Shares to 177 Employees

Phát Đạt plans to issue 18 million ESOP shares to 177 employees. Among them, Board Member and CEO Bùi Quang Anh Vũ will receive the largest allocation.