According to the Hanoi Stock Exchange (HNX), Vietnam Technological and Commercial Joint Stock Bank (Techcombank) has announced the results of its bond issuance.

On December 10, 2025, Techcombank successfully issued 2,000 TCB12525 bonds to the domestic market. With a face value of VND 1 billion per bond, the total issuance value reached VND 2,000 billion. The bonds have a 36-month term and are expected to mature on December 10, 2028.

Details regarding bondholders, collateral, and issuance purposes were not disclosed. However, HNX records indicate an annual interest rate of 6.5% for this bond series.

Illustrative image

Earlier, on December 3, 2025, Techcombank also issued TCB12524 bonds with a total value of VND 2,000 billion, a 36-month term, and a fixed annual interest rate of 6.5%, including a buyback clause. The bonds are set to mature on December 3, 2028.

HNX reports reveal that in November 2025, the bank issued two bond series: TCB12523, valued at VND 2,000 billion on November 28, 2025, and TCB12522, valued at VND 250 billion on November 5, 2025, both with 36-month terms.

Conversely, on November 27, 2025, Techcombank repurchased the entire TCBL2427016 bond series two years ahead of its scheduled maturity. The actual repurchase value was VND 1.05 per bond, totaling VND 3,885 billion for the series.

The TCBL2427016 bond series, issued on November 27, 2024, comprised 3,700 bonds with a face value of VND 1 billion each, totaling VND 3,700 billion. The original maturity date was set for November 27, 2027.

Additionally, Techcombank plans to repurchase bonds ahead of schedule in December 2025. The bank intends to repurchase the TCBL2326010 bond series, valued at VND 2,000 billion, on December 22, 2025.

Funds for the repurchase will be sourced from principal and interest collections from lending activities, other bank income, and legal capital mobilization from the economy.

The TCBL2326010 bond series, issued on December 22, 2023, consists of 2,000 bonds with a face value of VND 1 billion each, totaling VND 2,000 billion. The series is set to mature on December 22, 2026.

ACBS Plans to Issue VND 3 Trillion in Public Bonds

ACBS is set to launch a public offering of non-convertible, unsecured bonds without warrants, totaling 3.000 billion VND.

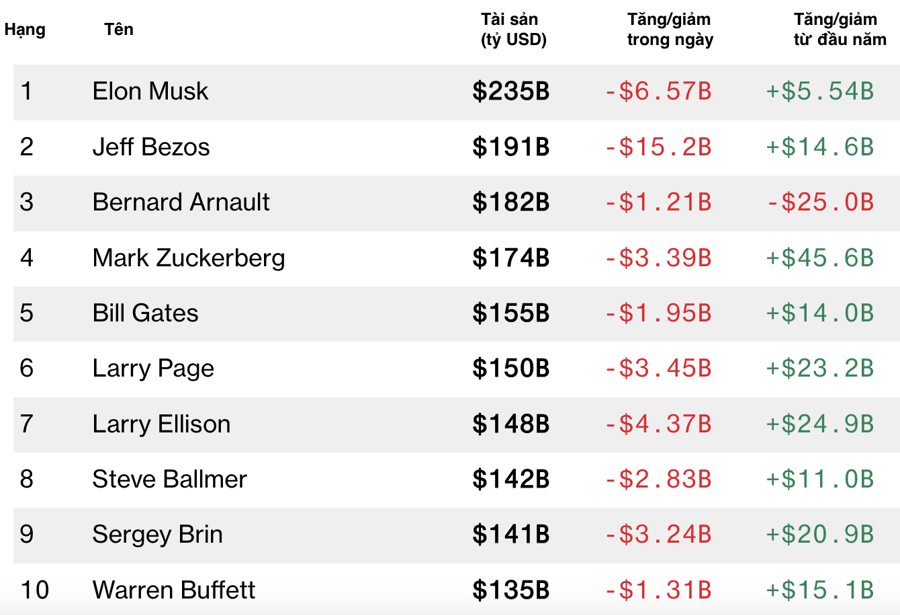

2025’s Most Notable M&A Deals: Foreign Capital Takes the Lead

Foreign capital dominates high-profile deals across healthcare, consumer goods, and industrial technology sectors. Meanwhile, domestic buyers demonstrate their strength primarily in the real estate market.