On December 12, 2025, the MarketVector Vietnam Local Index (referenced by VanEck Vectors Vietnam ETF) announced its new index composition. December 19, 2025, is expected to be the completion date for the full rebalancing of the ETF’s portfolio in line with this index.

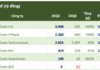

During this rebalancing, the MarketVector Vietnam Local Index added only one new stock, TCX (TCBS), without removing any existing ones. The total number of stocks in the index increased to 52. As of December 12, the ETF’s assets under management (AUM) stood at approximately $551 million (14.5 trillion VND).

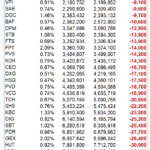

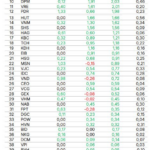

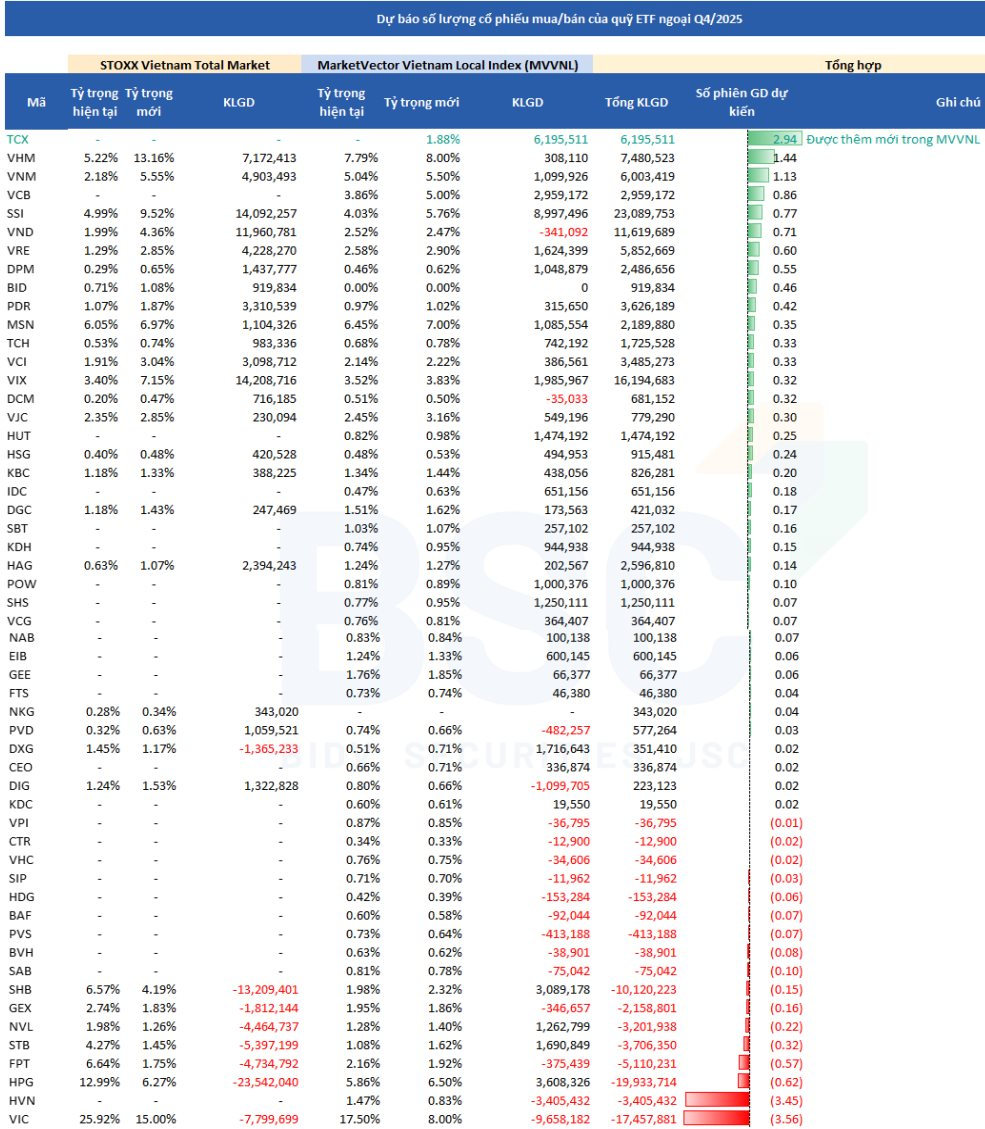

In a recent report, BSC Securities (BSC Research) forecasted that VanEck Vectors Vietnam ETF could purchase nearly 6.2 million shares of TCX, representing a 1.88% weighting. Other stocks expected to see significant buying include SSI (9 million shares), SHB (3.1 million shares), and HPG (3.6 million shares). Conversely, the ETF may sell off VIC (9.7 million shares), HVN (3.4 million shares), and DIG (1 million shares), among others.

For the STOXX Vietnam Total Market Liquid Index (referenced by Xtrackers Vietnam Swap UCITS ETF), BSC predicts strong buying in three brokerage stocks: SSI (14 million shares), VIX (14.2 million shares), and VND (12 million shares). In contrast, the ETF may sell SHB (13.2 million shares), HPG (23.5 million shares), and VIC (7.8 million shares), among others.

Currently, Xtrackers Vietnam Swap UCITS ETF has an AUM of approximately $353 million, equivalent to 9.3 trillion VND.

Summary of Q4 2025 buy/sell forecasts for VanEck Vectors Vietnam ETF and Xtrackers Vietnam Swap UCITS ETF:

For the FTSE Vietnam 30 Index (referenced by Fubon ETF), BSC Research notes that the 10% capitalization weighting cap per stock is unlikely to be triggered in December. However, Fubon ETF may proactively adjust its portfolio, as observed in the past, potentially impacting stocks with significant weightings.

It’s also worth noting that Fubon ETF has experienced substantial outflows in December 2025, contrary to the trend seen in most other ETFs in the market.

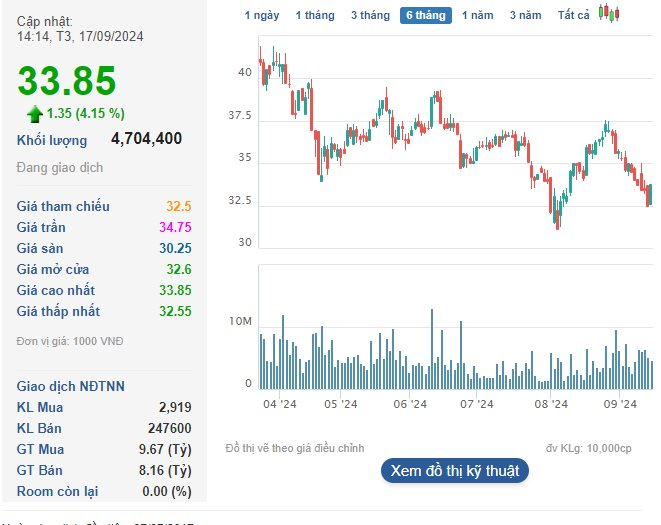

According to Bloomberg data as of December 12, 2025, VIC holds a 21.19% weighting (the only stock exceeding the 10% threshold), with approximately 16.55 million shares. This includes the recent corporate action where shareholders received bonus shares at a 1:1 ratio, with the record date on December 5, 2025.

Foreign ETFs Continue Net Selling as VN-Index Surpasses 1,700, VIC Weighting Rises to Nearly 17%

During the period from November 28 to December 5, 2025, as the VN-Index officially surpassed the 1,700-point milestone, the VanEck Vectors Vietnam ETF (VNM ETF) continued its net selling activity across all stocks within its portfolio.

Year-End ETF Restructuring Forecast: Will Brokerage Stocks Face Heavy Selling Pressure?

The VIX, VIC, VND, and VCI stocks are poised for significant sell-offs, potentially facing millions of shares being offloaded during the ETF portfolio rebalancing in Q4 2025.