On December 15th, the central exchange rate was listed by the State Bank of Vietnam at 25,144 VND/USD, a decrease of 4 VND compared to the end of the previous week, maintaining a downward trend since the beginning of the month.

The USD price at commercial banks such as Vietcombank, BIDV, and Agribank was traded at around 26,121 VND/USD for buying and 26,401 VND/USD for selling, a drop of 4 VND compared to the end of the previous week.

Meanwhile, the free USD price this morning was reported by some trading points in Ho Chi Minh City at 27,242 VND/USD for buying and 27,372 VND/USD for selling, a decrease of about 10 VND compared to the end of the previous week.

Since the beginning of December, the free USD price has lost more than 300 VND. Compared to the peak of 28,000 VND in mid-November, the free USD price has decreased by approximately 600 VND.

Free USD price drops by approximately 2.5% from the peak reached in mid-November.

The exchange rate in Vietnam has eased pressure as the international USD remains at a low level. The USD index (DXY) this morning on the international market was traded at 98.37 points – the lowest level in about 2 months. The USD weakened after the US Federal Reserve (FED) cut interest rates for the third time this year, by an additional 0.25% at last week’s policy meeting. The current US base interest rate is around 3.5% – 3.75%, the lowest since November 2022.

The USD/VND exchange rate has decreased by about 0.3% from its peak, narrowing the increase since the beginning of the year to about 3.5%, while the free market rate has lost up to 2.5% from its peak.

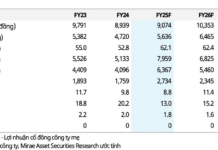

According to experts from MBS Securities Company, with the forecast of a weakening USD, the USD supply in Vietnam will be more abundant by the end of the year due to exports and remittances, helping to reduce pressure on the exchange rate.

Experts from Maybank Securities Company also believe that the FED’s interest rate cut to a lower level and the continuation of monetary policy easing will help narrow the USD-VND interest rate gap. This will reduce pressure on the exchange rate in Vietnam and create favorable conditions for the State Bank to rebuild foreign exchange reserves, providing more room for interest rate management.

Free USD price cools down.

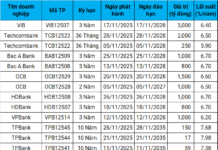

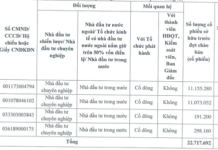

Central Bank Narrows Net Injection Scale

During the week of December 8–15, 2025, the State Bank of Vietnam (SBV) continued its net injection streak for the ninth consecutive week to support system liquidity. However, the scale of net injection significantly narrowed, dropping over 87% compared to the previous week and marking the lowest level in the past six weeks.

USD Free Market Rates Plummet Dramatically

The free-floating USD rate has plummeted in recent days, with forecasts indicating a continued downward trend as pressure on Vietnam’s exchange rate eases.

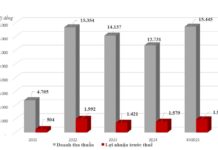

Vietcap Warns of Notable Risk for Stock Market in December

This development has made investors more cautious about allocating capital to the stock market in the final month of the year, particularly as foreign investors continue their net selling trend.